Written by Michael Bigger. Follow me on Twitter.

Seth Godin wrote a fabulous blog post about a cool mathematical concept called the Levy Flight that shows up in nature (Wikipedia: Levy Flight Description).

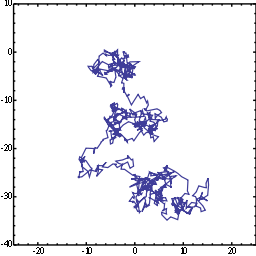

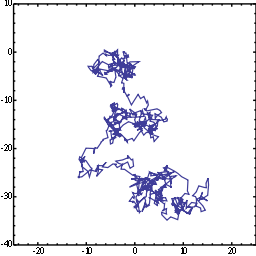

Here's how a Levy Flight might play out in the media. A journalist finds an interesting story to write Source: Wikipedia about. For example, think about Merck's scandal involving the drug Vioxx. That was big business news, and it stirred up emotions. Many people took a stance on both sides of the issues related to this event. Writing about Vioxx generated good readership and sold advertising. Eventually, readers got bored with the story and moved on. Our journalist had to find other news. The journalist’s path follows a Levy Flight as depicted in the image, from one random walk to a cluster, followed by the same process over and over again.

Source: Wikipedia about. For example, think about Merck's scandal involving the drug Vioxx. That was big business news, and it stirred up emotions. Many people took a stance on both sides of the issues related to this event. Writing about Vioxx generated good readership and sold advertising. Eventually, readers got bored with the story and moved on. Our journalist had to find other news. The journalist’s path follows a Levy Flight as depicted in the image, from one random walk to a cluster, followed by the same process over and over again.

Source: Wikipedia about. For example, think about Merck's scandal involving the drug Vioxx. That was big business news, and it stirred up emotions. Many people took a stance on both sides of the issues related to this event. Writing about Vioxx generated good readership and sold advertising. Eventually, readers got bored with the story and moved on. Our journalist had to find other news. The journalist’s path follows a Levy Flight as depicted in the image, from one random walk to a cluster, followed by the same process over and over again.

Source: Wikipedia about. For example, think about Merck's scandal involving the drug Vioxx. That was big business news, and it stirred up emotions. Many people took a stance on both sides of the issues related to this event. Writing about Vioxx generated good readership and sold advertising. Eventually, readers got bored with the story and moved on. Our journalist had to find other news. The journalist’s path follows a Levy Flight as depicted in the image, from one random walk to a cluster, followed by the same process over and over again.The Levy Flight also shows up in finance. Just think about how Merck (MRK) reacted on the Vioxx news and how it stabilized after journalists migrated to a different story.

For algorithmic traders or investors, a few things are of interest here:

1. What is the relationship between a cluster and volatility?

2. As journalists migrate from one story to the next, is tension being released on the system? Is that a form of catalyst (value trading and volatility trading)?

3. What are the roles of traders or investors in these situations? Do they also become news amplifiers within the cluster? Do they contribute to the catalyst after the cluster disintegrates?

4. When a news cluster starts forming, could monitoring social media, finance groups, or other venues help predict entry into a cluster or exit from it?

5. If so, could we analyze Internet messages to incorporate the jump function into a Brownian process?

The Levy Flight is worthy of further analysis. I can see a few ways to incorporate this concept into our algorithms right now.

When the next Vioxx crisis erupts, I will remember that journalists will eventually walk away and let it go. The news will subside as it always does. Benjamin Graham once said this: “This too shall pass.”