Written by Michael Bigger. Follow me on Twitter.

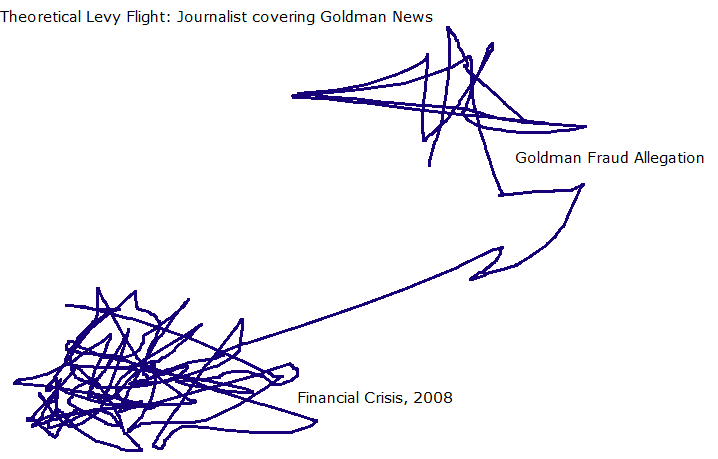

It did not take long after I wrote the post Levy Flight Path in Algorithmic Trading to get a fraud scandal erupting that was worthy of a Levy analysis. The Goldman Sachs (GS) allegations have already attracted many truffle diggers (journalists and politicians) sending the frequency of Internet news messages to the moon.

It did not take long after I wrote the post Levy Flight Path in Algorithmic Trading to get a fraud scandal erupting that was worthy of a Levy analysis. The Goldman Sachs (GS) allegations have already attracted many truffle diggers (journalists and politicians) sending the frequency of Internet news messages to the moon.

Here is what two of the diggers are saying:

This is how we think things will play out using the Levy Flight model:

- GS entered a dense news cluster.

- The cluster will persist for months.

- The cluster will attract more truffle diggers. For that reason, more negative news about GS and other financial companies will surface.

- We expect GS stock to remain under pressure and volatile until the tension is released.

- It might be of interest to short the large dealers if they rally. The Citigroup stock price gap up, which is up after today's earning release, is a good example of this trade.

- The diggers will eventually get bored and move on to the next story. "This too shall pass".

- The decrease in the frequency of news messages will be a good indication of when we are about to exit the cluster.

- A trader might want to initiate a long position at that time.

We have decided to add GS to one of our algorithmic trading strategies. We believe GS will be a great trading vehicle for agile traders. We can't wait to see how things play out and whether the Levy Flight model holds its own.

How do you think this will play out?