Written by Michael Bigger. Follow me on Twitter.

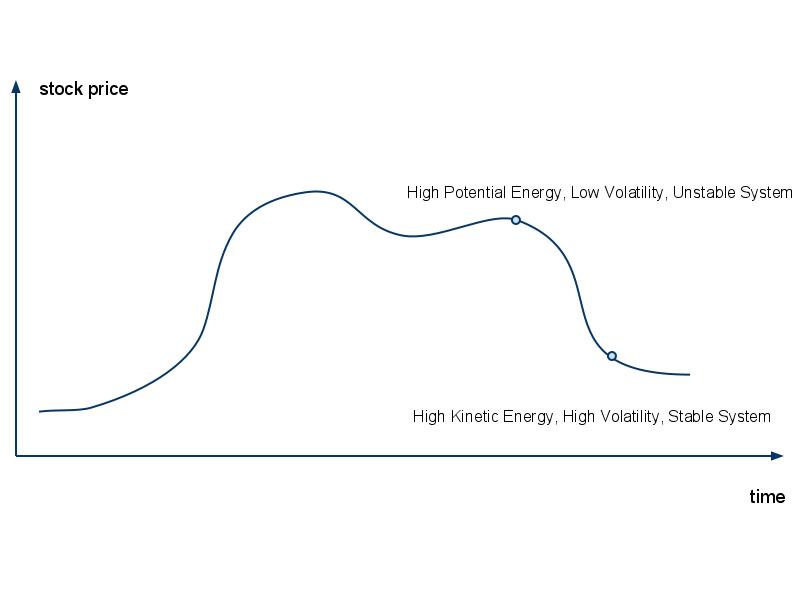

The stock market is a great optical illusion. When prices march much higher, volatility decreases but instability in the system increases. The opposite is true after a big fall. Volatility is high but stability increases.

These statements lead us to state the following dualities:

- Perceived instability is stable.

- Perceived stability is unstable.

What are some of the signs we believe indicate instability?

- Low implied volatility.

- A P/E ratio much higher than historical levels.

- Lower than typical implied options correlation.

- A decline in dividend yield.

- Your cab driver is talking about stocks.

What are some of the signs indicating a stable market?

- High implied volatility.

- P/E ratios comparable to or lower than historical levels.

- High implied options correlation.

- An increase in dividend yield.

- Panic in the market.

We have been fooled many times by Mr. Market. Have you?