A while back, Seth Godin wrote a fabulous blog post about a cool mathematical concept called the Levy flight that shows up in nature (Wikipedia: Levy Flight Description).

It also shows up in finance.

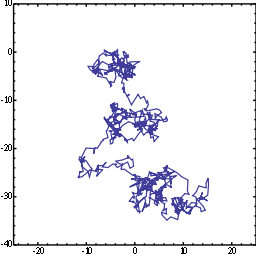

A journalist finds an interesting story to write about. Think about Merck and Vioxx. That was big business news, and it stirred up emotions. Many people took a stance onboth side of the issues related to this event. Writing about Vioxx generated good readership and sold advertising. Eventually, readers got bored with the story and moved on. Our journalist had to find other news. The journalist’s path follows a Levy flight from one random walk to a cluster, followed by the same process over and over again, as depicted in the image (Source: Wikipedia).

Or you can think about it this way: the path between each cluster is a stochastic directional vector and the cluster is a manifestation of the cockroach theory. This theory states that if you find a roach in the cupboard, others are usually crawling in the same location. Using Godin’s example, once an animal finds food along its random walk, the animal will rummage in the same area because the likelihood of finding more food is elevated.

The Steve Jobs news has already attracted many truffle diggers (journalists), sending the frequency of Internet messages about Apple to the moon.

If Apple had just entered a typical Levy Flight news cluster, this is how we think things would play out:

- The cluster will persist for months.

- The cluster will attract more truffle diggers. For that reason, more news about the health of Steve Jobs will surface.

- Expect AAPL stock to remain under pressure and volatile until the tension is released.

- The diggers will eventually get bored and move on to the next story. "This too shall pass."

- The decrease in the frequency of news messages will be a good indication of when we are about to exit the cluster.

- A trader might want to initiate a long position at that time.

However, Apple will report earnings tonight, and that will add another dimension to the situation. With everything going on with the stock today, we are going to focus on the options maturing at the end of this week. These options offer a large amount of gamma.

I wrote a similar post about Goldman Sachs in April.

Michael Bigger. Follow me on Twitter and StockTwits.