There are spread trading opportunities with foreign stocks too.

Look at this spread of Reckitt Benckiser (RB.L) and Unilever (ULVR.L). Both companies operate in the same sector/industry and they produce almost the same type of products - cleaning products, medicines, personal hygiene etc. Both are FTSE 100 companies.

Not a while ago the spread 1 * RB.L - 1.7 * ULVR.L was trading below -400pts with a standard devaiton of 2.5 below the mean. Today the spread is at fair value fairly close to the mean.

Had you purchased the spread at -400 and took profit today, you would be up: current spread - entry = 43 - (-400) = 430pts.

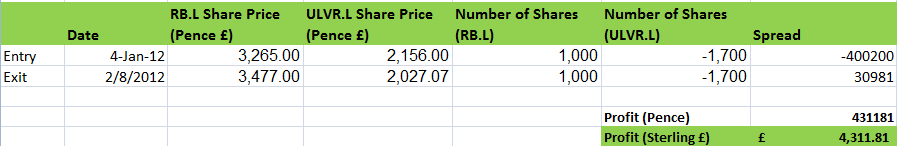

Here is a sample computation: (Note: Negative for Short-Sale)

The computation in a nutshell, if you Bought 1000 shares of RB.L/Short-sold 1700 shares of ULVR.L on 01/04/2012 and exited today (02/06/2012), you would have made a profit of £4,311.81.

You can view the spread here - http://goo.gl/50RsL

Bigger Capital is commited to developing its techology platform to make it easier for users all around the world to identify these opportunities. Stay tuned!

Written by Aris David. Follow me on Twitter and StockTwits.