Verifone Spread Gaining Momentum

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Michael Bigger

Michael Bigger

New free scan for 1/11/2013 here.

In our pursuit of stock trading profit, we view securities being connected to each other by a spring force. This force is invisible but very powerful. When one security moves, other securities are pulled in the same direction by the spring force this stock exercises on other securities at varying degrees. Because the connection is flexible like a spring, the movements are not always 100% in sync, and that is where the trading opportunities come in. When you see one security moving, you can take a position in other securities connected to it. Understanding the force that connects them together is essential to exploiting the opportunity. Because there is a lag in the pull this force is somewhat predictive. Think about it this way: You are tenth in line waiting for a traffic light to turn green. I bet you that when the first car gets going you won’t be far behind. You may even find yourself stepping off the brake when you see the light turn green, you don’t wait until all the cars have gone through the light! With the elastic force, you can anticipate market movements ahead of the crowd, and elevate your trading to the next level.

If I had one trading video to recommend, Charlie D's trading video would be it. This video was created in 1989 and it is a must watch for all traders. I want to thank the trader on Twitter who lead me to it (unfortunately I can't remember who it is).

Here is a cool example of how we applied Charlie D's advice recently. On June 28 after the market closed, this tweet from Aris David caught my attention.

FYI, Europe covered before the close FTSE last minute rally $EWU

Our signal had a super strong buy signal going into the U.S. close and we were waiting for a dip to buy. After the market closed at 4pm, the S&P futures went down 7 points and we decided to buy a bigger futures position based on our signal and Aris' information. We thought someone new something about Europe given how the FTSE closed and the S&P selloff presented an attractive opportunity. We had more conviction and we committed.

That is what spread trading is for us. Trading the relationships. Not only the statistical relationships between stocks, but information against information; a stock price against its intrinsic value; price against news. Spread trading is about exploiting two levels of potential energy and their relationship.

The next day, the market went up about 2 percent. Someone knew and we exploited it.

Do you understand why spread trading is so interesting?

Written by Michael Bigger. Follow me on Twitter and StockTwits.

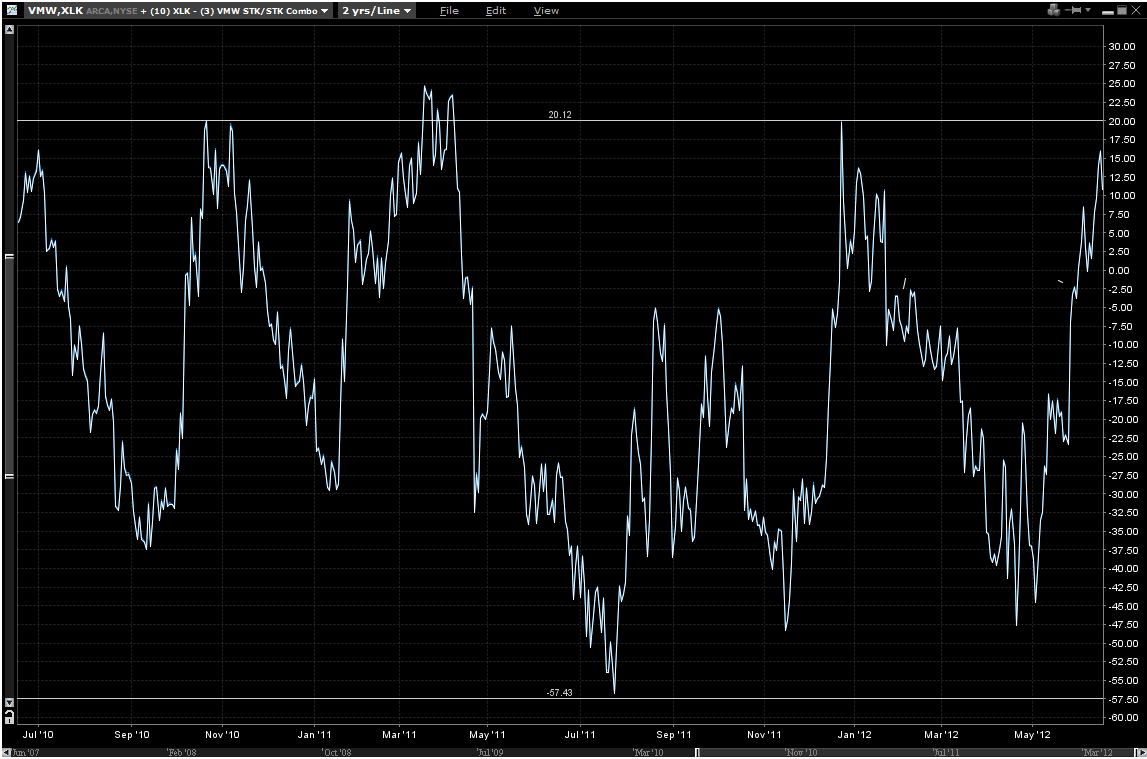

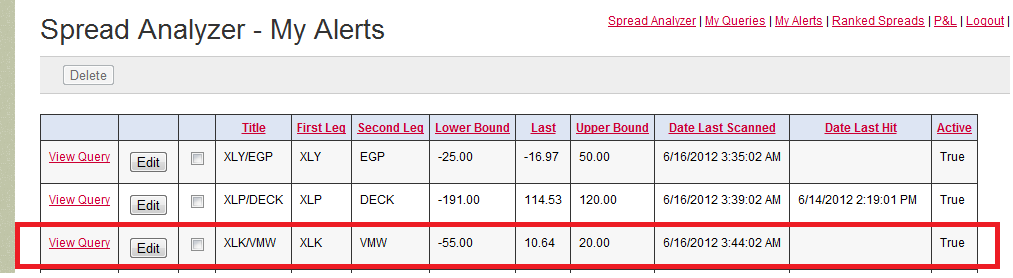

We are monitoring the $XLK $VMW $spread based on recent insider activities. We are hoping that we can get a spike in the 10 * $XLK - 3 * $VMW to the 20 level. We have used the My Alerts feature of our Spread Analyzer to monitor this $spread for us. Located below, are all the documents supporting our thesis, as the insider buying we think is bullish for VMW (bearish for the spread). If the $spread reaches the $20 level, we will be happy sellers.

Written by Aris David. Follow me on Twitter and StockTwits.