Written by Michael Bigger. Follow me on Twitter.

Because once every three to five years, we buy one stock. While we wait, we suffer from investment apathy. We are boring.

Why do we buy one stock every three to five years?

It is very simple. If you look at the following charts, they reveal the best investments we have ever made:

1. We bought Amazon.com in 2001 below $10.

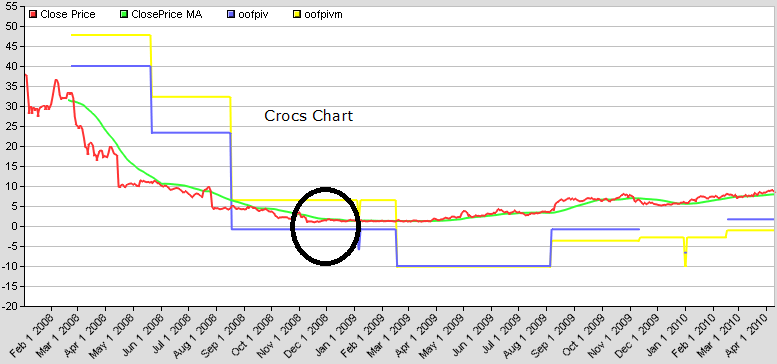

2. We started buying Crocs in July 2008 and purchased aggressively below $1.

3. We shorted Deckers in early 2005 and we covered in early 2006. We should have gone long big time then.

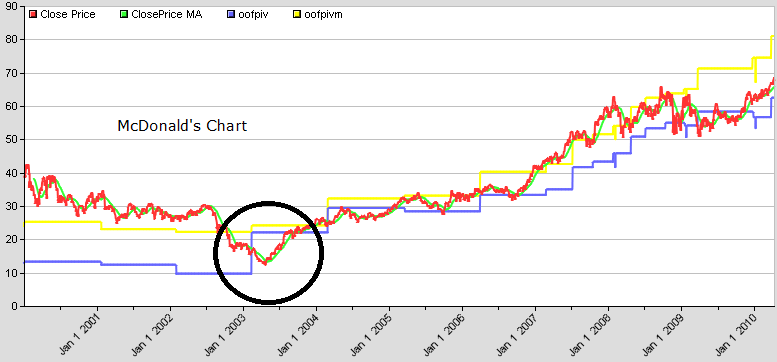

4. We bought McDonald’s in 2003 at about $13.00.

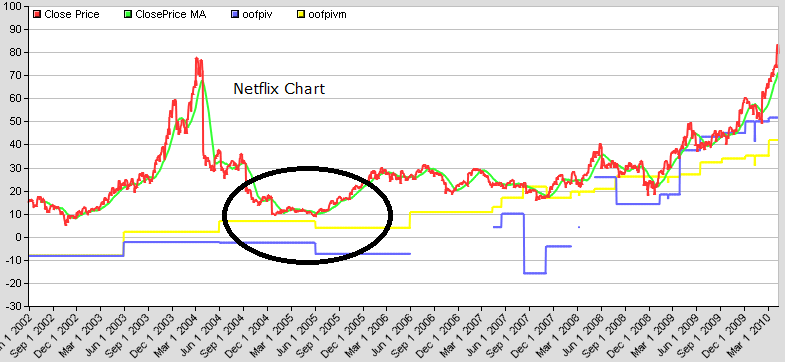

5. We bought Netflix in 2005 in the low teens.

6. We bought Priceline at about $2 (pre-reverse split of one for six).

These are all companies we know quite a bit about because we use their products. We don’t need to do extraordinary things to get very good returns. The most difficult thing for us as an investor is to be patient waiting for the simple opportunity. When we force it, we don’t do well. We have the scars to prove it.

It has been almost two years since we started purchasing Crocs. While we wait for the next opportunity, we work on crafting our trading algorithms. It fulfills our need to be busy without putting our investment assets at risk by doing stupid things. We also read a lot. This balance works well for us.

If you are into boring and profitable, stay tuned in, we will discuss cool investment topics until a mighty opportunity presents itself.