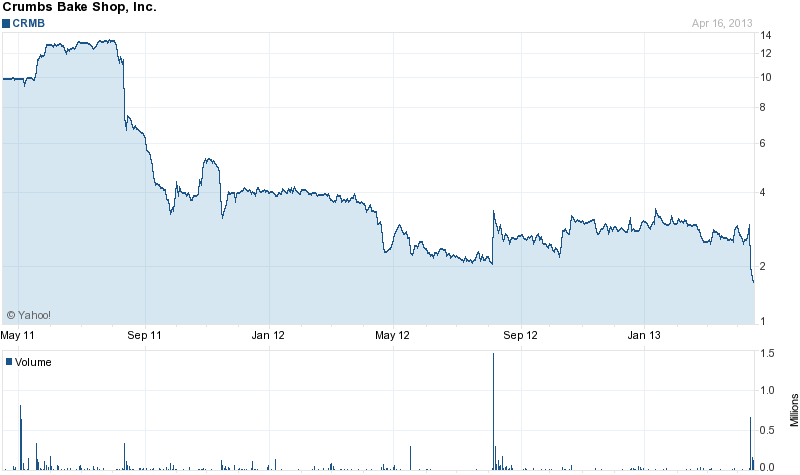

Michael and I are analyzing a special situation with Crumbs Bake Shop ($CRMB). Here is a chart of the stock, where you can see that it fell from a high of over $13 in 2011 to it’s current $1.40. Most recently the fall from over $3 to below $2 due to disappointing earnings in the fourth quarter of 2012 and a pending deal with regards to the convertible bond:

$CRMB grew its store count rapidly, however, when growth failed to achieve expectations, the stock price began it’s decline. Most recently, 4Q2012 earnings came in below expectations. To finance future expansion and the change in strategy from street-level stores to mall kiosks, the company announced on April 11, 2013, a private arrangement with Canadian investor Michael Serruya. Under the terms, Serruya will purchase $10mm in senior unsecured convertible notes with a 5 year term and a $2.50 conversion price, with interest rates at 7% (cash) or 10% (stock). Serruya will also be on the board of Crumbs.

Michael Serruya was the same “rescue investor” who called attention to our recent investment in American Apparel ($APP). The name and the strike price on the convert tell us it is worth investigating this situation.

Here is what we know:

-

Serruya will have converts covering 4mm shares (40% of the shares outstanding).

-

Sales increased on a Y/Y basis (2012/2011), although 4Q sales declined (partially due to Hurricane Sandy). Gross margins decreased as well, on a Y/Y and Q/Q basis.

-

Operating Loss also widened on a Y/Y basis.

-

The company has no long-term debt.

-

To turn around sales, the company is focused on it’s change in strategy to mall-based kiosks and away from street-level retail stores.

-

The cupcake business is very competitive, however sweets are a constant in the American diet.

We currently have a very small position. We will be monitoring the situation closely to see if it makes sense as a larger investment.

Written by Jennifer Galperin. Follow me on Twitter and StockTwits