- This is an updated American Apparel (APP) investment thesis post re-financing.

- It examines the events that have brought American Apparel down on its knees.

- We explore the reasons why we decided to get invested in the company in 2011 and why we decided to increase our position to 3.27mm shares by buying 2mm shares in the last round of equity funding and 100,000 shares in recent days.

- Then we examine the impact of the last equity raise on the ownership structure of the company and after talking to APP’s largest investors and its management we will discuss additional insights we have gathered about American Apparel during the past few weeks.

- This post includes many elements from previous posts.

History

Throughout its brief history, American Apparel ($APP) has been spewing negative catalysts. First, it started with the hiring of thousands of illegal immigrants which had to be fired after the company got caught by the INS. The company paid a dear price for this value destroying action.

The company’s balance sheet got decimated as it tried to recover from this situation by firing thousands of employees and having to interview 12,000 candidates to replenish the lost stock. In addition, the financial crisis created a great recession for retailers and APP sales collapsed in the process.

All of this brought the company down the precipice. The stock traded down from $17 in 2008 (13% EBITDA margin) to $.55 in 2011.

Back in 2011 when we first started writing about American Apparel ($APP), the stock was trading just below $1. The company had just received rescue financing of $15mm to avoid bankruptcy. The company could not re-negotiate its debt agreements, sales were stagnant, and the situation was highly distressed. We believed that the chance for the company to refinance was high because we thought sales were about to start expanding and there were enough inefficiencies in the operations for meaningful EBITDA improvements even without major sales growth. We also expected the company to reduce inventory and henceforth decreasing the amount of working capital needed. At the time we hypothesized that over a 2 to 4 years period these improvements could allow them to pay down a good chunk of their debt, reducing interest expense substantially.

In addition, we saw the potential of EBITDA margin expanding to a 15 to 20% boundary condition (Source: Management) as it benefits from harvesting its lighter capital sales channels and with sales increasing to $800 million or higher, it allows the company to leverage its fixed cost asset (manufacturing) on a larger number of units.

In 2012 sales improved to $616mm and adjusted EBITDA reached $36.6mm for a 6% EBITDA Margin. In early 2013 the company refinanced its high cost debt. The stock took off and traded as high as $2.40.

Then came 2013 when the company implemented two important strategic initiatives:

- Elimination of the inventory room at the store level to increase sale space and reduce cost.

- Implementation of a new state of the art distribution center (DC) at LaMirada, Los Angeles to support its three business lines efficiently.

In addition, the company completed its roll-out of the RFID system and its implementation of the Oracle ATG Web Commerce Customer Service application for its e-commerce platform in 2013.

These initiatives show the strategic resolve by management to build a first class vertically integrated global apparel platform.

The implementation of these strategic initiatives has had a depressing effect on the 2013 baseline EBITDA forecast. At the end of Q2 2013, management’s EBITDA forecast was reduced to $46 to $51mm from $47 to $54 million because of a $4.3mm cost impact from the transition to the new DC. We can’t quantify the impact of the RFID implementation nor the backroom elimination. Therefore a normal adjusted EBITDA for 2013 baseline remains at $47 to $54 million on sales of $655mm for an EBITDA Margin of 7.8%.

In late 2013, the company was hit on four fronts. First, the distribution center going live proved to be harder than expected for the company. It just did not work as planned and as a result the company could not deliver merchandise to the stores on time. The result was lost sales and a negative delta impact of $13 million on EBITDA year-to-date 9/31/2013. The company cancelled its guidance for the rest of 2013 which stood at $46 million to $51 million as of Q2 2013.

In addition, the youth retail segment has been challenged recently which has dragged sales further down. If that was not enough, management’s diverted attention away from merchandising to fixing the issues at the DC, and bad weather in the American Northeast in late 2013 and early 2014 forced the company to face catastrophe once again.

So for most of its public life, American Apparel stock has been driven down by the following negative catalysts:

- Immigration issues.

- Bizarre behavior from the CEO of the company (Source: Media).

- A very ugly Balance Sheet.

- Strong dilution favoring management, and in particular the CEO.

- Distribution Center (DC) Issues.

- Management focus diverted to fixing DC issues instead of running the business.

- Bad weather and weak trends in key markets in late 2013 and early 2014

All these factors contributed to the company needing to raise money to pay for an April debt payment. The company received about $30mm in equity funding in late March and paid its April 15th debt coupon.

American Apparel is as ugly as you can get.

Therefore, very few eyeballs are following the stock. No one cares, and we think this creates an amazing opportunity and here are the reasons why.

The Platform Attributes

First, throughout its history, American Apparel has built tremendous global brand equity. Whether you like or hate American Apparel for its polarizing actions, the fact remains that most people around the globe -especially in urban centers- know the company. In a world in which information is abundant, almost free and near perfect, gaining attention is expensive and difficult. American Apparel has attention and this is very valuable. The company is followed by millions of people on different social media platforms.

Second, throughout its history, Dov Charney has obsessed over creating a differentiated apparel business platform. This is evidenced by its irreverent marketing campaign, its vertically integrated platform, its ability to fulfill orders (Internet, retail, wholesale, flash sales) on a global basis from the newly minted distribution center, the elimination of inventory backroom at the store level which requires just in time inventory delivery, the implementation of its RFID system, and its focus to develop a strong global Internet platform (work in progress). This is an asset that is next to impossible to replicate.

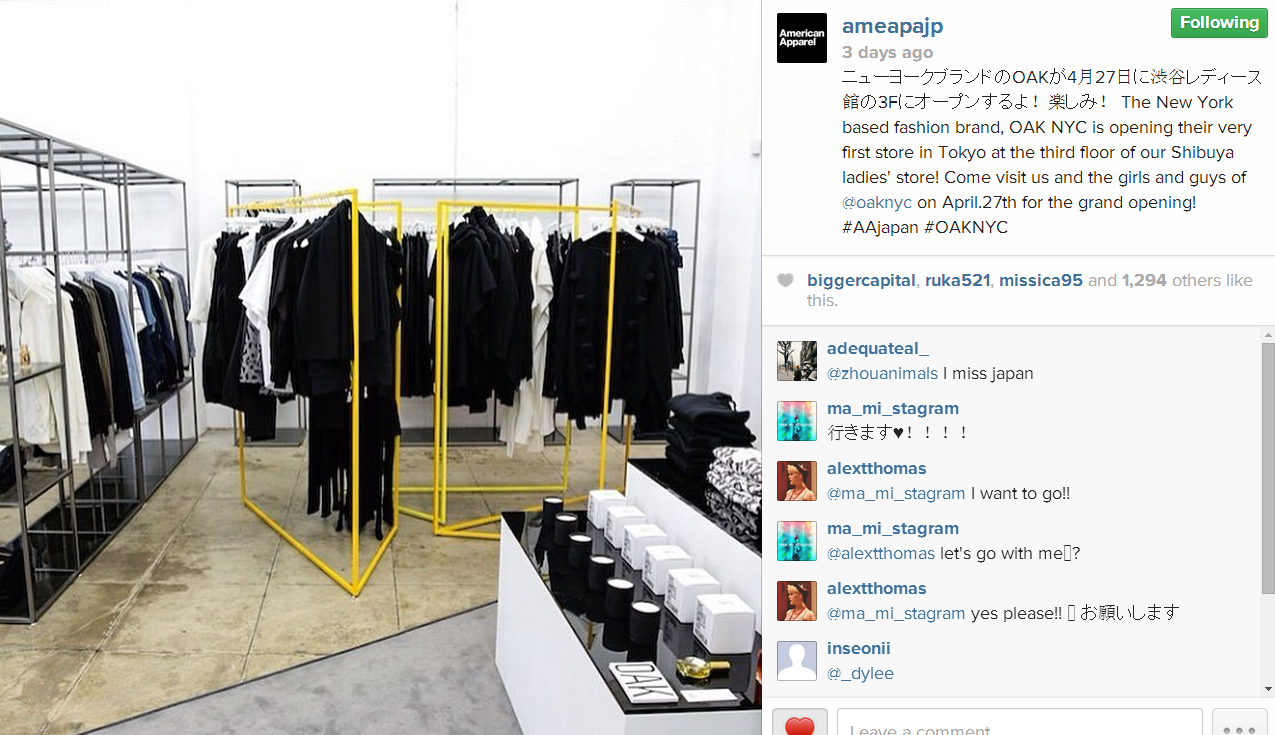

Third, the company has developed a culture of experimentation as witnessed by its acquisition of Warriors of Radness and OAK NYC, and the development of a Made in the USA shoe business. American Apparel will leverage these brands using its global distribution platform. It could do the same with its in-house Cali Sun & Fun. In a few years from now, APP could have 4 to 6 customer facing brands supported by a global apparel logistic system.

Fourth, the stock is darn cheap and it does not reflect the intrinsic value of the platform as you will learn below.

In a nutshell these are the reasons why we decided to participate in the last round of funding led by Roth Capital. We think the worst is over for the company which will allow the platform to shine in the next few years.

Financials

The funding should allow the company to end 2014 with close to $50 million of cash on its balance sheet (B/S). This is how we derive this amount (caveat: We don’t have the 2014 1st quarter numbers yet).

Assuming $5mm of cash on the (B/S) as of 3/26/2014

Equity Raise assuming over allotment options is exercised= +$30 million (about)

2014 EBITDA guidance = +$45 million

2 times bond cash interest payments of $13.7 million (Source Here) = -$27.4 million

Cash interest payment on ABL = -$3 million

Capital Expenditures (Source: Preliminary 2013 annual results) = -$12 million

Decrease in Inventory (Source: Management) = +$12 million

Total Cash as of 12/31/2014 = +$50 million (Very rough estimate)

This financial position will allow the company to fine tune the business and reduce cost in 2014 and start expanding in 2015. As investors gain confidence these numbers will be met, we believe the news flow is about to turn from negative to positive and the following catalysts are about to drive the stock much higher and investors will pay attention:

- Distribution Center Issue resolved (Source: Management).

- Cleaner Balance Sheet.

- Partial debt repayment starting in late 2015.

- Aggressive inventory reduction by 14% (Source: Management).

- Deal dilution will somewhat weaken Dov’s control over the company and insure a more balanced approach. Investors will appreciate that.

- Deal dilution will be counterbalanced by Charney’s performance package not meeting key milestones.

- A more subdued Charney with a better narrative for the company and focusing on moving the brand forward.

- The beauty of the American Apparel brand is about to become more obvious to many investors. No wonder Goldman, an APP bond holder, is playing to keep (Source Here).

A better environment will allow Charney to implement his vision. He said:

Our 247 stores could be 20% more productive with the right tweaks, the online business could double, wholesale could grow by 20% to 30%. We could even develop a $100 million third-party retail business, selling items like American Apparel nail polish at drugstores or having hooded sweatshirt blowout sales at Costco.

Current Valuation

American Apparel major strategic initiatives, which were highly disruptive in 2013, have been completed. While the operational risks still exist, we think a lot of the challenges of these integrations are now behind the company, yet the benefits of these initiatives and the reduced operational risk are not reflected in the current stock price. So if you look beyond the fog and include the benefits of these initiatives into your assessment of the business, the thesis becomes much more compelling now than it was in April 2011.

Here is why in detail:

- Despite the fulfillment issues, 2013 total sales increased 3% to $634 million and the company also stated that the negative impact of the distribution center issues should not affect 2014 results.

- Although integration of the new center did not go as smoothly as management forecasted, the new facility is now in place and should allow the company to reduce inventory while leveraging more effectively the advantage of local manufacturing and vertical integration. We believe it should save the company about $5 million in cost a year.

- The cost savings from the backroom elimination in the stores are estimated to be $10 million in 2014. (based on our assumption: Elimination of two employees per store, $20m per employee on a 250 store count basis)

- The savings from the new RFID system is expected to be $1 to $2 million.

- These efforts will result in about $13 to $17 million (conservative estimate) in annual EBITDA improvement starting sometime in 2014 over the 2013 adjusted baseline.

Our baseline 2014 EBITDA Forecast stands at $57 million to $71 million for an EBITDA margin of 8.9%. Annual Interest Expense should come in at around $33 Million in cash. We believe Capex will come in at $12 million. This forecast assumes little sales growth over initial 2013 sales forecast and no benefit from increased sales resulting from the additional selling space at the store level.

The enterprise value of American Apparel is about $330mm. It trades at near 5 times normalized EBITDA and it is operating way below capacity. That is just too cheap for this type of strategic asset. Here is an interesting read on the topic.

The Current Ownership Structure

The latest round of funding reduced Dov Charney percentage ownership in the company from 44% to 28%. We believe that Charney remains manic about realizing APP’s potential. That being said, we welcome the possibility of activism if management does not improve the performance of the company. I believe that the company has the whole of 2014 to convince investors of its ability of turning the ship around. If it does not, it wouldn’t surprise me to see a retail enterprise come in to acquire this strategic asset.

The Future: How will American Apparel look in 2015 and beyond?

Recall the quote of Charney:

“Our 247 stores could be 20% more productive with the right tweaks, the online business could double, wholesale could grow by 20% to 30%. We could even develop a $100 million third-party retail business, selling items like American Apparel nail polish at drugstores or having hooded sweatshirt blowout sales at Costco.”

Using this delta over the 2012 sales baseline, American Apparel could generate between $800 million to $900 million in sales in 2018. There seems to be quite a bit of confidence from some senior executives that annual sales could reach $1 billion within 4 years (Milestone could be reached in 2018). That is about $350 million of incremental revenues over 2013 sales. This represents 12% of annual growth until 2018. That is a big number and given the recent management execution issues, one should be very skeptical about the ability of management to deliver on this.

What could explain this optimism, and should we share this optimism?

In order to answer this question, I think it is important to look at the American Apparel line of business that has performed quite well recently. That line is wholesale. There is no way to move the needle to $1 billion in sales by opening 60 to 70 stores (plan) over the next 4 years.

The only way to get there is to expand wholesale from a U.S.A. centric business to a global wholesale business.

And we think that American Apparel is about to launch a massive wholesale push into Asia and other parts of the world. We are comfortable with this statement because of the activities we have uncovered on the American Apparel Japan Instagram page. We believe that APP will pursue OAK NYC and Warriors of Radness wholesale opportunities in the region after it establishes a retail foothold.

So let’s look at how the company intends to get there and determine if the expectation gap can be plugged in with a reasonable global (ex USA) wholesale. Using the information released by the company over the past year, let's see if the numbers jibes with this expectation.

Baseline Annual Sales (2012)

Retail $389mm

Wholesale $173mm

Internet $55mm

Total Sales 2012 $617mm

Retail

Management indicated in early 2013 that they could open 65 new stores over the next 3 to 5 yrs. The store base is expected to grow 26.31%. In addition, management has said current stores could improve productivity by 25%.

So in total, retail sales could increase by 58% by the end of 2018. We are assuming no comp sales growth to counterbalance the fact that new stores are not fully productive right from the get-go.

2018 Retail Sales = $588mm

Wholesale

Current wholesale sales growing by 25% over that period.

2018 Wholesale Sales = $207mm

Internet

Internet to double.

2018 Internet Sales = $110mm

Total 2018 Sales excluding new businesses = $905mm

New Businesses

To build a $100mm third party business (Example: Selling hoodies at Costco).The company has already started this effort via Wal-Mart and Ross Stores (Source: twitter).

2018 Sales = $100mm

To build a global wholesale business

2018 Sales = $100 mm (our reasonable and conservative scenario)

Total 2018 Sales including new businesses = $1105 mm

The company's goal is to increase EBITDA margin to 15% over that period which we think is reasonable since APP EBITDA margin was 13% in 2008 on a much lower sales figure. Using a 200 million shares count, the company could generate $.80 per share in 2018. Using a 10% EBITDA margin, the company could generate $.55 of EBITDA per share in 2018. Even if we assume the worst of both that the company generates $800 million of revenues in 2018 at a 10% EBITDA margin we calculate at $.4 of EBITDA per share.

On the debt side, currently APP has approximately $205mm in debt outstanding at 15% interest (We are excluding ABL), total annual interest payments of about $31mm. If they reach their goal of $1Bn Revenues in 2018 and 15% EBITDA margin, that means $120 in pre-tax earnings ($0.60 / share). Even at $800mm Revenues and 10% margin, there is still $50mm in pre-tax earnings or $0.25 / share. That is without repaying a dime of debt. We think it is likely they will start to pay down debt gradually beginning as early as 2015 and refinance as early as 2017 (The bonds are callable in 2017). (Rough Calculation)

Conclusion

We believe that the 1st quarter of 2014 was the nadir for American Apparel and that its results will improve dramatically for the rest of the year. We think that the American Apparel platform will start delivering impressive growth starting in 2015 with very little investment required. This is very hard to imagine when looking at the current American Apparel wart, but if you look at the platform the company has built and the clues you can gain by following the company more closely via different information channels, it becomes more obvious that the company is on a path to generate more than $1 billion in sales and 15% to 20% EBITDA margin. Everything is in place for the company to run a strong marathon.

Written by Michael Bigger

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family own more than 3.27 million shares of American Apparel. American Apparel is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal. In other words, the probability of losing all your investment in this situation is very high. We have been purchasing American Apparel since May of 2011 and we have nothing to show for it. Take our opinions with a grain of salt and do your homework.