Entries by Michael Bigger (152)

American Apparel: This Wart Looks So Perfect

This post should be complemented by all the research we have performed on the company since April 2011.

Back in 2011 when we first started writing about American Apparel ($APP), the stock was trading just below $1. The company had just received rescue financing of $15mm to avoid bankruptcy. The company could not re-negotiate its debt agreements, sales were stagnant, and the situation was highly distressed. We believed that the chance for the company to refinance was high because we thought sales were about to start expanding and there were enough inefficiencies in the operations for meaningful EBITDA improvements even without major sales growth. We also expected the company to reduce inventory decreasing the amount of working capital needed. At the time we hypothesized that over a 2 to 4 years period these improvements could allow them to pay down a good chunk of their debt, reducing interest expense substantially.

In addition, we saw the potential of EBITDA margin expanding to a 15 to 20% boundary condition (Source: Charney TV interviews) as it benefits from harvesting its lighter capital sales channels and with sales increasing to $800 million or higher, it allows the company to leverage its fixed cost asset (manufacturing) on a larger number of units.

In 2012 sales improved to $616mm and adjusted EBITDA reached $36.6mm for a 6% EBITDA Margin. In early 2013 the company refinanced its high cost debt. The stock took off and traded as high as $2.40.

The company implemented two important strategic initiatives in 2013:

- Elimination of the inventory room at the store level to increase sale space and reduce cost.

- Implementation of a new state of the art distribution center (DC) at LaMirada, Los Angeles to support its three business lines efficiently.

In addition, the company completed its roll-out of the RFID system and its implementation of the Oracle ATG Web Commerce Customer Service application for its e-commerce platform in 2013.

The implementation of these strategic initiatives has had a depressing effect on the 2013 baseline EBITDA forecast. At the end of Q2 2013, management’s EBITDA forecast was reduced to $46 to $51mm from $47 to $54 million because of a $4.3mm cost impact from the transition to the new DC. We can’t quantify the impact of the RFID implementation nor the backroom elimination. Therefore a normal adjusted EBITDA for 2013 baseline remains at $47 to $54 million on sales of $655mm for an EBITDA Margin of 7.8%.

In late 2013, the company was hit on two fronts. First, the distribution center going live proved to be harder than expected for the company. It just did not work as planned and as a result the company could not deliver merchandise to the stores on time. The result was lost sales and a negative delta impact of $13 million on EBITDA year-to-date 9/31/2013. The company cancelled its guidance for the rest of 2013 which stood at $46 million to $51 million as of Q2 2013.

In addition, the youth retail segment has been challenged recently which has dragged sales further down.

On December 13, the company filed a shelf for 50,000,000 common shares. To this date the company has not issued shares. On February 10, Sapna Maheswari published this interview of Charney that led us to lower our probability of a meaningful (>= $25 million) equity raise taking place.

On February 4, 2014 the stock plunged to $.85.

On February 20, some news outlets reported that some American Apparel’s creditors hired legal counsel to represent them in a restructuring of the company. It was also reported that American Apparel hired Skadden, Arps, Slate, Meagher & Flom LLP to represent them in such negotiation. Charney denied that report, saying in an interview that Skadden has been the company’s outside counsel for years and it’s a “mischaracterization that they have been engaged as a restructuring firm.” The firm is currently in a quiet period and it can’t say more than this. Skadden has been American Apparel legal firm for a long time. The 2012 shareholder meeting was held at Skadden offices in New York city.

On this news the stock plummeted to $.55. At this level, the stock was currently trading at two time normalized EBITDA. The market is according a high probability that the company will seek bankruptcy soon. We believe that the maximum leverage ratio (Adjusted EBITDA as denominator) of the credit line covenant is problematic at the moment. The company will be reporting 4th quarter 2013 results within a few weeks. We are therefore in the dark as to what the numbers look like for basically a five month period. As of 9/30/13, the leverage ratio was between 5.75x and 6.0x, and it is likely it will shake out in that range for the quarter ended 12/31/13. Unless EBITDA grows significantly in the current quarter ending 3/31/14, the leverage trigger will be a problem at the end of this quarter but we believe the company will get a waiver.

|

Period |

|

Ratio |

|

Closing Date through March 31, 2013 |

7.35 to 1.00 |

|

|

April 1, 2013 through June 30, 2013 |

6.50 to 1.00 |

|

|

July 1, 2013 through September 30, 2013 |

6.25 to 1.00 |

|

|

October 1, 2013 through December 31, 2013 |

6.00 to 1.00 |

|

|

January 1, 2014 through March 31, 2014 |

5.75 to 1.00 |

|

|

April 1, 2014 through June 30, 2014 |

5.50 to 1.00 |

|

|

July 1, 2014 through December 31, 2014 |

5.25 to 1.00 |

|

|

January 1, 2015 through March 31, 2015 |

5.00 to 1.00 |

|

|

April 1, 2015 through June 30, 2015 |

4.75 to 1.00 |

|

|

July 1, 2015 and thereafter |

4.50 to 1.00 |

The bond's covenant calls for no more than 4.5x leverage (debt - cash) / EBITDA. We believe the company failed to meet the covenant as of 12/31/13, the interest increased by 2% PIK. It goes without saying that there is much upside to reduce this burden once the business stabilizes.

Putting aside the credit issue for a moment…

American Apparel major strategic initiatives, which were highly disruptive in 2013, have been completed. While the operational risks still exist, we think a lot of the challenges of these integrations are now behind the company, yet the benefits of these initiatives and the reduced operational risk are not reflected in the current stock price. So if you look beyond the fog and include the benefits of these initiatives into your assessment of the business, the thesis becomes much more compelling now than it was in April 2011.

Here is why in detail:

- Despite the fulfillment issues, 2013 total sales increased 3% to $634 million and the company also stated that the negative impact of the distribution center issues should not affect 2014 results.

- Although integration of the new center did not go as smoothly as management forecasted, the new facility is now in place and should allow the company to reduce inventory while leveraging more effectively the advantage of local manufacturing and vertical integration. We believe it should save the company about $5 million in cost a year.

- The cost savings from the backroom elimination in the stores are estimated to be $10 million in 2014. (based on our assumption: Elimination of two employees per store, $20m per employee on a 250 store count basis)

- The savings from the new RFID system is expected to be $1 to $2 million.

- These efforts will result in about $13 to $17 million (conservative estimate) in annual EBITDA improvement starting in sometime in 2014 over the 2013 forecast baseline.

Our baseline 2014 EBITDA Forecast stands at $57 million to $71 million for an EBITDA margin of 8.9%. Annual Interest Expense should come in at around $36 Million in cash. We believe Capex will come in at $17 million. This forecast assumes little sales growth over initial 2013 sales forecast and no benefit from increased sales resulting from the additional selling space at the store level.

How will American Apparel look in 2014 and beyond?

During this interview Dov Charney admits that the company is in a retrenching mode after experiencing the issues in 2013. Charney plans on polishing and fine tuning its operations in 2014. He does not expect as much growth for the next 1 to 2 years. We appreciate the fact that Charney admitted that he is his worst own enemy. We welcome the candor and we are convinced Charney remains a manic about engineering a differentiated apparel business model that will carry this brand forward for years to come. Most of the pieces are coming together.

Here we are in 2014 with American Apparel stock trading at $0.70 – basically a level 30% lower than our cost basis which we have accumulated since April 2011. But so much has been accomplished by the company in these last 2 years. If the company can manage its debt issue, we believe management would be in a great position to focus on fine tuning the model, connecting with its customers, experimenting and paying down debt.

Assuming a fully diluted share count of 160 million, the company could generate 38 cents of EBITDA per share in 2014. The stock is currently trading at 2 times this level. We believe this stock could trade at up to 10 times (boundary condition) this level in two to 3 years as investors gain conviction that the worst is over for the company. A while back I wrote a blog post about distressed apparel companies. In that post, I observed that when a recovery is realized, top brand apparel companies can trade up to 10x to 15x EBITDA.

We believe American Apparel is a top of the mind brand in its youth target market. This video provides a clue as to why we believe so.

During Sapna Maheshwari interview of Charney, he said:

Our 247 stores could be 20% more productive with the right tweaks, the online business could double, wholesale could grow by 20% to 30%. We could even develop a $100 million third-party retail business, selling items like American Apparel nail polish at drugstores or having hooded sweatshirt blowout sales at Costco.

Using this delta over the 2013 sales baseline, American Apparel could generate between $800 million to $900 million in sales in 2017.

At $800mm in sales and EBITDA margins reaching 15% to 20%, we could see the stock price reach $7.

We think that if the company raises a token amount under the shelf to help it through the seasonally slower first half of 2014, the fog will lift rapidly and investors will start focusing on the bright future ahead.

We also believe that given all the cash management can squeeze out of operation, the company will get a waiver on its credit line if it needs to.

Written by Michael Bigger with the help of Jennifer Galperin.

Many thanks to my friends who have provided feedback on this post.

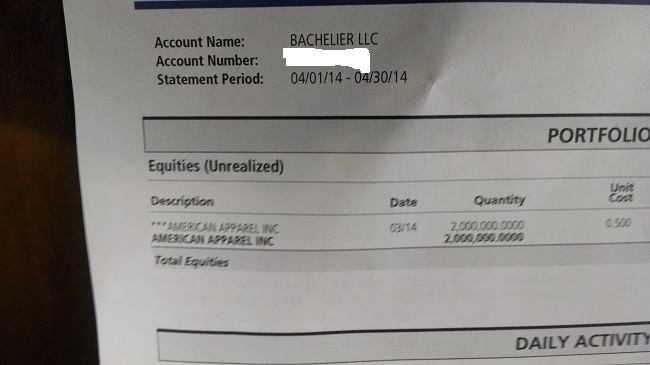

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family own more than 1 million shares in American Apparel. We intend to increase our position opportunistically.

American Apparel is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal. In other words, the probability of losing all your investment in this situation is very high.

We have been purchasing American Apparel since May of 2011 and we have nothing to show for it. Take our opinions with a grain of salt and do your homework.

Blogging American Apparel

We wrote our first post about American Apparel ($APP) on May 6, 2011. We view blogging as embracing entropy. By this I mean, the activity is more like throwing a handful of seeds in the air and see what takes hold overtime. When we go into it we have no assumption about what is about to take place. We have no clue really, but we embrace the pursuit of throwing seeds in the air. You just never know.

I often push the exercise further by reminding our trading group that we know nothing as a group and in order to discover profitable ideas we start with experimentation with no pre-conceived notion about the situation at hand. That is the upside of studying Physics -- Learning you know nothing very fast.

We just don't know, like we didn't know what would happen with the American Apparel series of posts. But yesterday, I got rewarded handsomely for all the hard work we put into the American Apparel ($APP) situation.

I was approached by an analyst at a firm that has a significant position in the name. I can't say more than this about who it is. He wanted to talk to us about American Apparel ($APP) after he read all our material on the company.

Our conversation was one of the most enlightening conversation I have had in ages. He knows the company inside out and it showed he had put a lot of work into it. Actually, much more than we did. You see, I don't get turned on about how stock prices move or how a chart looks like or what have you. I crave talking about the business, the customers, the products, the strategy, and so forth.

I like talking about its valuation and how big can this company be in 10 year, 20 years down the road. I like to mentally imagine the trajectory of the business at very long time scale.

Yesterday, I was like a kid in a candy store. I could have talked about the business for days. I could have listened to this analyst talk about the business for days. It was that exciting. Having this type of conversation helps me validate my investment ideas and get confidence to go in big when it makes sense.

All the blogging we do helps us connect with other individuals. Sometimes it takes a while to get the reward for the work, but it is usually worth it.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Physics - Note to Self

The most important thing I learned studying Physics at University is that I know nothing and therefore I gotta experiment.

Plug Power Cracks the Hydrogen Code

Bruno Forget of Air Liquide gave one of the most insightful presentation at the Plug Power ($PLUG) Analyst Conference held on December 4th in Albany, NY.

He described the fuell cell hydrogen business as being a research experiment for most of the nineties until about 2009. Back then, there was no commercial opportunities to extend a single project into a viable recurring commercial opportunity.

He proclaimed that it was Plug Power that cracked the commercial fuel cell opportunity when it won a deal to implement its Gen-Drive solution at a new Wal-Mart ($WMT) distribution center in Canada.

Then he said:

$WMT is about data and return on investment. It measures everything.

Forget knew then that this was a big deal that was about to change the whole business dynamics. He was so excited about it that he thought that Air Liquide should invest in this company. He got rejected from the get-go. Air Liquide is a big company. It does not move that quickly.

$WMT added the $PLUG solution to an existing facility in Balzac, Ontario. It replaced its existing lead battery solution with $PLUG's GenDrive solution.

Then $PLUG proceeded to win more $WMT distribution centers business in the USA. Then it won a bunch of business from the like of Kroger ($KR), FedEx ($FDX), BMW, Mercedes Benz and so forth. You can find the more comprehensive list here. Forget grew more excited than ever and he kept on pushing.

That lead Forget to conclude:

$PLUG IS THE LEADING HYDROGEN SYSTEM INTEGRATOR IN THE WORLD. NO ONE COMES CLOSE

That is when I almost fell of my chair listening to Forget.

Now you know why Air Liquide decided to invest when the company faced liquidity issues in early 2013, after a botched financing attempt during which shortsellers front ran the stock.

Consider this: Who will get a big chunk of this $20 billion opportunity in the USA alone? That is just forklift and it does not include all the adjacent markets....tuggers, TRUS, range extenders, and so forth.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family hold millions of shares of Plug Power. We intend to increase our position if the company's results track our benchmark.

Plug Power is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal.

Note to Self - Insights

Focus on the rare and massive insights (Information Entropy). Everything else is noise (Noise).

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Plug Power Conference Call - The Breakout Picture

On November 14, Plug Power (PLUG) reported its Q3 results and held its Q3 2013 earnings call. Andy Marsh, PLUG's CEO, surprised Wall Street by announcing $14 million of new booking since October 8. I want to point out the major insights I uncovered while reading the release and listening to the call.

- The big driver for the increase in booking was an order from Kroger for 201 GenDrive units with a service component attached to it. If we assume two third of the booking since October 8 is from this order than Kroger did a $9 million deal with PLUG. That works to about $46,000 per Gen-Drive unit. We know that on average a Gen-Drive unit costs about $16,000. Service becomes a very large portion of this contract. This bodes well for PLUG, because the service addition gives us confidence that PLUG is in a position to see revenues swell above the break even mark of about $55 million in 2014. In addition, this is the second Kroger distribution center win for PLUG. Kroger is sold on the PLUG solution and there is no reason why PLUG can't win a significant chunk of all of its 34 distribution centers conversion if Kroger decide to go all in. The total Kroger Distribution Center opportunity is about $300 million recurring over a 5 to 6 years period. If you doubt the importance of fuel cells for Kroger check out page 43 of the Kroger Factbook.

- Bridgestone was the second customer of PLUG Power Gen Drive solution. They have used Gen Drive for over 6 years in their automated ground vehicles (AGV). These units run 24/7 and can lift up to 40,000 pounds for 21-plus hours a day. They have decided to renew this fleet with a Gen-Drive solution. This is another testimony of the superiority of the PLUG solution. This is something PLUG can bring on the road to win more contracts and win new customers.

- Marsh said: I'm expecting a blowout number of orders in the fourth quarter as we start to close some of these multi-site deals and gain new customers win. When Philip Shen of Roth Capital asked: You've already had a really nice Q4 for booking. How much better can it get? Marsh responded:It easily could be 2 to 3 times higher. Shen exlcaimed: WOW!

On December 4th, PLUG will hold an Analyst meeting in Latham, NY to update analysts on these deals and new customers wins. I will be attending the meeting and can't wait to give you an update.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family hold millions of shares of Plug Power. We intend to increase our position if the company's results track our benchmark.

Plug Power is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal.

American Apparel Memorandum

MEMORANDUM

To: Board of Directors of American Apparel, Inc.

From: Michael Bigger, CEO of Bigger Capital, LLC, Cold Spring Harbor, NY 11724

Attn: Glenn A. Weinman, Executive Vice President, General Counsel and Secretary

747 Warehouse Street, Los Angeles, CA 90021

Distr: Dov Charney, Alberto Chehebar, David Danziger, Robert Greene, Marvin Igelman, Allan Mayer, and William Mauer

As a significant holder of American Apparel shares, I want to take this opportunity to remind the Board of American Apparel of its fiduciary duty towards all the shareholders of American Apparel.

Given the recent setbacks experienced by the company as evidenced by the October 10 press release, Bigger Capital strongly opposes any action by the Board to extend the maturity of the Charney Anti-Dilution Provision as it did in 2013.

The current stock price represents an opportunity for Mr. Charney to make open market purchases with his own money in order to negate the dilution created by the funds that were raised in 2011, should he so desire.

Kind Regards,

Michael Bigger

CEO, Bigger Capital, LLC

Saturday, March 15, 2014 at 10:19AM

Saturday, March 15, 2014 at 10:19AM