Why I think Long Term Treasuries will Trade at 50 cents on the Dollar

1. My good friend Eric G. led me from a task force composed of major financial institutions to the Treasury Borrowing Advisory Committee. The graph on page 34 shows the Federal Reserve (Fed) buying all the U.S. Net Fixed Income Supply in 2009. The table on page 35 shows that the Fed is supporting the fixed income market with its action in the mortgage-backed security (MBS) market. Printed money is supporting the U.S. fixed income market. As soon as the Fed stops its action, the Treasury market will gap down. Page 35 begs the question: Who is Households? See bullet #3 below.

2. China can’t fund our current addiction. Here is what Zhu Min, deputy governor of the People's Bank of China, has to say about the U.S. current account deficit according to the Shanghai Daily: "The US current account deficit is falling as residents' savings increase, so its trade turnover is falling, which means the US is supplying fewer dollars to the rest of the world," he added. "The world does not have so much money to buy more US Treasuries."

3. Eric Sprott asks:“Is it all a just a Ponzi scheme?” In this article, he is trying to explain “Households” from bullet #1 above.

4. Fannie and Freddie: "Treasury removes cap for Fannie and Freddie aid." U.S.A. goes from cocaine junkie to heroin junkie. The addiction continues.

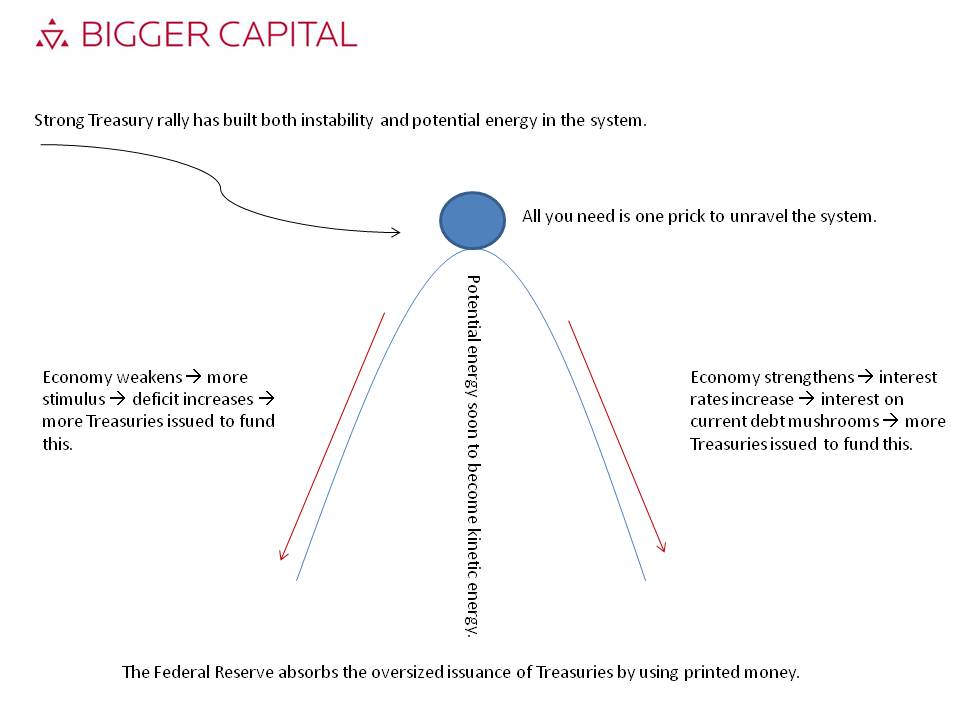

5. This leads us to my own chart: we have a very unstable system.

Thursday, December 31, 2009 at 9:29AM

Thursday, December 31, 2009 at 9:29AM

Reader Comments (2)

nice post michael- love the tbt's

Thanks Pete. Crazy stuff. I am living a nightmare.