Cool Financial Tools

1. Interactive Brokers’ Accumulate/Distribute and Scale Trader features: If you want to take advantage of short-term fluctuations and provide liquidity in stocks, options, and futures, you should have a look at Interactive Brokers’ Scale Trader or Accumulate/Distribute algorithms. "The Scale Trader algorithm originates from the notion of buying into a declining market by averaging down at ever-lower prices, or on the opposite side, selling into a rising market to scale out of a long position. But you can use the algorithm for much more, including liquidity-providing strategies that take advantage of profit-taking strategies. Accumulate/Distribute is a flexible and powerful algorithm designed to let you execute almost any complex strategy you can think of. High frequency traders can ramp up the power of the algorithm by running multiple instances of it at once on the same symbol. But this is just the tip of the iceberg of what you can accomplish using Accumulate/Distribute". For more information, including pre-recorded webinars, in-depth algorithm descriptions, and more, go to the Algorithms page on the Interactive Brokers (IB) website: www.interactivebrokers.com/algos.

There are other advantages to dealing with IB:

1. IB’s trading cost is among the lowest in the industry.

2. IB’s technology is powerful and reliable.

3. IB’s application programming interfaces (API) are extensive and cutting edge.

4. IB offers continuing education via webinars.

5. IB introduces new features frequently.

6. IB’s credit is strong.

2. Google Reader: Build a financial listening station with Google Reader. This software helps you see how people on the web think about you, your company, your investments, and your strategy, and you can also select companies to monitor and anything else of interest to you. To set up a Google Reader account, first open up a Gmail account at www.gmail.com. Then go to www.google.com/alert and perform a search on a subject you want to monitor. On my alert page, after inputting a search term, I set the type to “comprehensive,” with a frequency of “as it happens” to be delivered to “feed.” Google will relay the results to my Google Reader in real time. To monitor the output, open www.google.com/reader on your browser. In addition, Google Reader will update your favorite blogs and websites in your reader by using the RSS (Really Simple Syndication) Feed function. To set up a feed from blogs and websites, look for the little RSS orange button. If this button is available, right click it and select copy link. Go to the Reader and click the “add a subscription” button. Copy the link into the box and click the “add” button. Once added, updates to these websites will be automatically delivered to your reader.

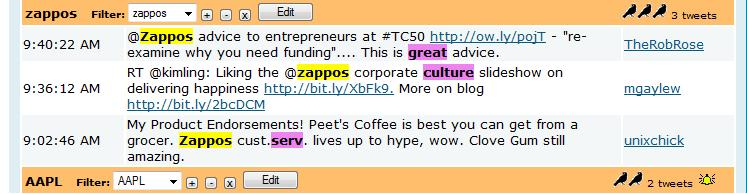

3. Twitter: Expand your financial listening station using Twitter and its API. Twitter is a broadcast station: Twitter often broadcasts breaking news ahead of other news venues. At Bigger Capital, we monitor what goes on Twitter using our filter algorithm. We connect to Twitter via its APIs. You can either do the coding yourself or hire a firm to build a customized Twitter application that meets your needs. Or you can hire the firm that did the work for us. Send me an e-mail at biggercapital@gmail.com and I will be happy to introduce you.

The image below displays the output of our Twitter application on the Zappos filter. Zappos was recently acquired by Amazon.com.

4. Google Docs: Bookmarking links works well for investment and trading research, but I find it messy and cumbersome. When I come across a topic worth storing for future reference, sometimes I prefer to copy and paste the article and its link into a Google document that I name specifically reflecting that topic. When I want to find the document later, Google’s search engine helps me retrieve it quickly. Since the documents are stored in the cloud (in this instance on Google’s servers), you can access them from any computer, anywhere. Make Google Docs your investment and research database.

5. Kindle DX: For investors who read 10-Qs, 10-Ks, and other financial reports in abundance, the Kindle DX is a no-brainer. The Kindle DX’s Auto-Rotation feature allows you to read financial reports in landscape mode, and the rendering is excellent. I love how I can download or send PDF copies of anything I find interesting on the web to my Kindle for on-the-go reading.

There are other benefits as well, including:

• If you print about twenty-seven pages of financial material on a daily basis, you will break even on your Kindle investment within a year by saving on paper and toner costs alone.

• Ever since it introduced Kindle, Amazon has offered free books to Kindle users. I have calculated that the annual savings to me in free books exceeds $200 per annum.

• The tyranny of lugging around piles of work material ends.

• Your fingers are free of newspaper ink.

• There’s no need to fetch the Wall Street Journal before you go to work.

• You can have most of your material at your fingertips since the Kindle DX’s memory can store 3,500 books.

• You will have access to your favorite business publications via your Kindle when you take an overseas business trip.

• The Text to Speech (TTS) feature will come in handy when your eyes get tired.

Based on these features, the Kindle DX is a wise investment for the savvy investor.

In the next few weeks, I will discuss more cool financial tools. Don’t forget to subscribe to this blog and receive automatic updates. The RSS button is located in the top right-hand corner of this page. Also, if you know of any other cool financial tools, I would like to learn about them. Please add your comments and tell me which application you find the most useful and why.

Monday, September 21, 2009 at 5:16AM

Monday, September 21, 2009 at 5:16AM

Reader Comments