Why We Traded Ugly J. C. Penney

Last Friday we bought J. C. Penney for our trading account. Many of you asked: Can't you find something easier to trade?

Do you want to look at the ugliest stock chart? Look at jcpenny $JCP

My answer to this question is that at times my subconscious override my rational and we will allow to do insanity trades as long as the size is reasonable.

Maybe, there is something in the back of our minds that gets aroused by high potential trading energy and high entropy situations. The ugliest charts on the block are the most interesting for us.

We will probably lose money on this situation, but overall we have done pretty well going on dates with ugly.

The chart below is a dollar neutral $XRT $JCP $spread and it gives a few clues about the Physics of the $JCP situation.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Video: Finding and Booking Spread Trades

How to Trade Spreads Manual

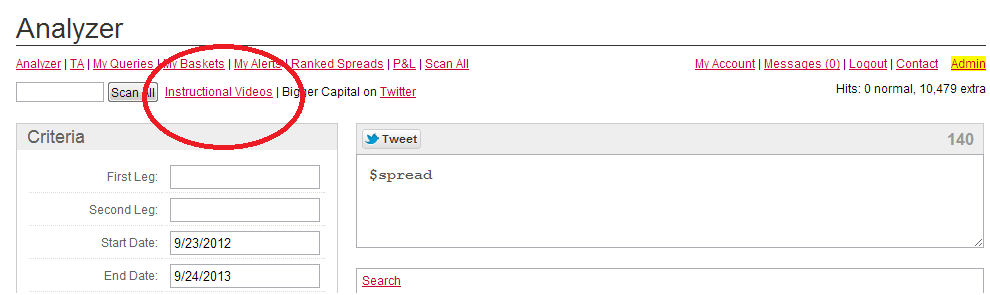

Jennifer, Aris, and I have created a short manual for the traders interested in spread trading. You can access the manual by clicking the Instructional Videos link in our Analyzer. From there you will see the How to Trade Spreads Booklet.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Analyzing a Single Stock

Experienced traders find our Analyzer extremely useful for both visualization as well as analysis of complex relationships among securities. If you have been asking yourself how you can incorporate our analysis into your trading strategy, check out this 5-minute video. You will learn how to use our free technology to augment a single stock trade or to hedge it.

Is this video or these videos useful to you?

Written and produced by Jennifer Galperin. Follow me on Twitter and StockTwits.

Mental Convexity is My Opportunity

At Bigger Capital we run many trading experiments at any point in time. As part of this process we back up with our capital fledgling traders that have unique strategies. We run one or two of these at any point in time. If the traders demonstrate to us they have something unique and profitable then we are happy to invest in a more formal way.

One of the experiments we are running right now is a strategy involving short term options. As they approach maturity these options display increasing convexity or price sensitivity to a change in price of the underlying.

The interesting thing is that the trader psyche is also affected by a change in price of the underlying. It gets worst as we approach the last few hours before the options expire. I call this state of mind; Mental Convexity.

Here is a discussion I had with a trader (Mr. A) who runs an experiment for our group.

Mr. A Please buy to close XX contracts of 167 SPY calls expiring today. Holding till close is not worth the risk. Friday closes often have a strong move in the last few minutes.

Me: One thing I am curious about is that your model exploit inefficiencies in the distribution of returns (if I get this correctly). This is the part that deals with options pricing and all that. What I am curious about is how you adjust your model for the mental convexity approaching maturity/short strike. On Friday, you made a call, saying the market was going strong in the close and we unwound the position. Is your model accounting for that?

Mr. A I made a wrong call to unwind the position. The model statistics were correct. I will adjust to trading ..........., but with the win/(max loss) size much less scary.

Mr. A A down day would be helpful today.

Me: "A down day would be helpful today." I call this mental convexity. It is totally irrelevant to the process. It either works or it does not.

There you go, Mental Convexity at work. We all should realize that Mental Convexity steals return from us. Listen to the noise on the stream when stock prices bounce around. You hear it...right?

Isn't about time we use Mental Convexity to our own advantage? How exactly should we do that?

Mental Convexity is My Opportunity

P.S. If you have an interest in participating in our trading experiments just visit our Analyzer and use the contact button on the top right hand corner to reach out to us.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Emerging Markets Builders on the Run Soon?

Killing the Momentum

The challenge in mean reversion strategies like pairs trading is to find opportunities with value that are about to mean revert. Often, relationships with significant statistical value have strong momentum in one direction. This is true in pairs trading, value investing, and many other relative value trading strategies.

The key in trading these relationships is finding the catalyst for a momentum change. In most market conditions, it is a futile exercise to trade pairs on the basis of statistical value only. One must also understand the dynamics that are in place to kill the momentum that has pushed the relationship into the area of statistical value.

Don't enter into a statistical trade unless you have strong conviction that a catalyst is evolving to kill the momentum. That is how we think about this at Bigger Capital.

What are your thoughts on this topic?

Written by Michael Bigger. Follow me on Twitter and StockTwits.

How to Calculate the Beta of Your Portfolio

In our latest analyzer release, we introduced a basket tool that has tons of potential applications. One example is in calculating the beta of a portfolio. In the video below, you'll learn exactly how to make this calculation. In my example, I used a portfolio of US large cap stocks, so the natural choice was to calculate the beta versus SPY. Depending on the composition of your portfolio, you might want to use the Q's, a sector ETF, an international ETF, or even a basket of ETF's to accurately represent your portfolio's composition. To create a basket of ETF's just use our basket creation tool.

In addition, I just posted an ETF's scan you can dowload in our Forum which you can access here. Enjoy!

Written by Jennifer Galperin. Follow me on Twitter and StockTwits.

Friday, October 4, 2013 at 12:12PM

Friday, October 4, 2013 at 12:12PM