The Mighty Constant

On August 19, a respected market analyst added Crocs (CROX) to his top stock pick recommendation list. In his research report, he noted that Crocs is a different company today than it was during its faddish days. I buy this argument but…

It is also true that CROX is similar in one very important way. Since its inception, Crocs has always been in the business of providing foot comfort. That is what CROX does day in, day out. This is the reason why people buy its ugly styles. Yes, the outer shell of the business is different but the essence is still the same. And by the way there is much more to Crocs offering than the few ugly shoes.

For CROX, comfort is the mighty constant.

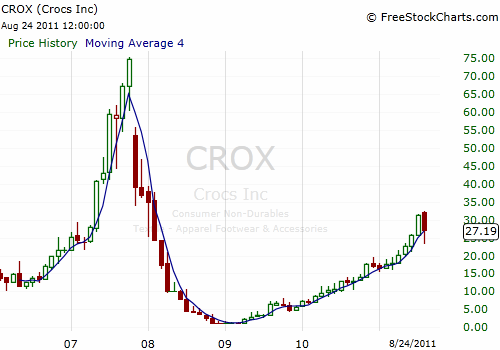

This post is not about Crocs however. This post is about the importance of the mighty constant in our speculative activities. The CROX example illustrates very well how a stock price and the crowd’s perception of a company can vary wildly while the core essence remains constant. $CROX was in the business of providing foot comfort when it was trading at $70 and it was still in the business of providing foot comfort when it was trading at $5 and lower. Now that it is trading at $27, the same constant is there, unwavering.

In a fast-changing situation such as the $CROX stock price trajectory, your ability to extract energy (money) out of a system depends on your ability to identify the mighty constants and manage your speculative thesis around them. If you manage your thesis to what is changing and not to what remains constant, you will compound return negatively. Many investors will buy when the media screams BUY, only to sell when the stock price collapses.

Managing to what remains constant creates a profit beacon. The path leading to the beacon is a compounding machine.

Jeff Bezos said this about change: “It is important to focus on what’s not going to change in the next five to ten years.” Amazon customers want lower prices, increased selection, and fast and free shipping. This will never change.

Ask yourself what’s not going to change in your speculation. Build your strategy around that.

A list of my favorite constants follows:

- Overreaction to news already factored in. Investors and traders overreact.

- Stocks fluctuate: they are volatile.

- Ibbotson’s Law of One Price: “two investments with the same payoff in every state of nature must have the same current value.”

- If you see a roach in the cupboard, you will find many more: Cockroach Theory.

- Stocks are manipulated.

- In aggregate, diversified portfolios track the market return minus some.

- In aggregate, if a stock move after an analyst makes a recommendation, the move should be faded.

- In a Levy flight news cluster, most sharp moves are erroneous.

- Intrinsic value has a much lower volatility than its corresponding stock price.

- Traders, when trading, behave like animals.

- Efficient market hypothesis: the market is information efficient. EMH does not mean securities are priced right.

- Positive information about a security takes more time to be reflected in stock price than negative information.

- Shelby Davis's Law: “A purchaser of common stocks makes most of his money in a bear market; he does not know it yet.”

- Corollary to Shelby Davis's Law: A seller of common stocks creates most of his value in a bull market, but he does not know it yet.

- Customers are more truthful than management.

- When opinions are diverse, stock prices reflect fair value.

- When opinions are similar, stock prices diverge from fair value.

- Investors are fickle when they lose money.

- The purpose of media is to sell advertising.

- And so forth…

Anything else I should be thinking about?

Written by Michael Bigger, author of How Traders Achieve Creative Flow and In Praise of Speculation!

Follow me on Twitter and StockTwits.

Tuesday, August 30, 2011 at 1:54PM

Tuesday, August 30, 2011 at 1:54PM

Reader Comments (1)

Breaking out the ol Monthly Chart I see.

Timely... Now back to the weekly and smaller time frames.

Thanks