Tesco PLC: How Spread and Ratio Trading Helped Me Unwind A Position Months Before the Stock Crash

Whenever we talk to people about spread trading, most of them think it is something related to statistical-arbitrage, mean-reversion and pairs trading. While this is true, for me there’s more to spread trading than stat-arbitrage. For me it is also a valuable tool for measuring the relative value of a stock against another stock.

Let me give a recent real-life example here.

The first chart you see below is the ratio of Tesco PLC/Sainsbury’s PLC. These two supermarket giants are headquartered in the UK.

Around February-March 2011, you can see from the chart that TSCO.L was looking very cheap compared to SBRY.L. I decided to purchase shares of TSCO.L at £3.79/share on the 17th of March 2011.

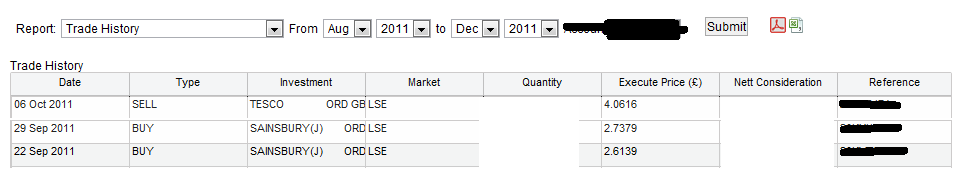

After a few months, I checked the ratio again. TSCO.L was looking expensive relative to SBRY.L as if it was telling us to get out of TSCO.L and Buy SBRY.L. I trusted the Math here. I decided to Buy some SBRY.L shares at average price of £2.68/share in late September and unwind all my TSCO.L position in early October at £4.06/share for a 7% return.

Today the share price of TSCO.L is hovering around £3.13/share. It crashed nearly 19% in three days after the company reported a sluggish Christmas Trading. £5 Billion was wiped off the value of Tesco Plc. I must say I got very lucky for getting out in October thanks to the ratio chart. Otherwise my Large-Cap Portfolio would have been treading water.

I've been using the ratio tool and the spread analyzer to compare other equities that operates in similar market or sector especially before the earnings season. There's plenty of names out there ORCL/MSFT, AMZN/AAPL, GOOG/BIDU, NFLX/BIDU, CROX/SKX etc. You'll be surprised what this tool will reveal!

When the ratio reaches the bottom blue line on the first chart, I’ll add TSCO.L in my medium term portfolio. Michael Bigger termed this area as “Fat Margin of Safety”.

Michael Bigger illustrated this in his book “In Praise of Speculation”.

“..let’s plot the trajectory of Stock1 and Stock2 versus time (Figure 1). Let’s assume both stocks have an identical intrinsic value term structure. According to Figure 1, a trader who uses a value framework for making investment decisions would buy Stock2 and sell Stock1 at time t1. .”

Statistical-Arbitrage Comparison (Dollar-Neutral)

The second chart below is the spread +10 * TSCO.L - 13 * SBRY.L. In our book, when we spread two securities, we also measure the standard deviation from the mean of the spread. A 2 standard deviation below the mean is considered an oversold spread i.e. TSCO.L is cheap relative to SBRY.L. A 2 standard deviation above the mean is considered an overbought spread i.e. TSCO.L is expensive relative to SBRY.L. Standard deviations are shown in the third chart.

We can map the spread and their equivalent standard deviations at time t as can be seen below:

-1000pts ~ 2 Standard Deviations below the mean of the spread at t = March 2011

200pts ~ 2 Standard Deviations above the mean of the spread at t = September 2011

Now around March the spread was trading at 2 standard deviations below the mean. If one bought the spread here: Long 10 * Shares of TESCO/Short 13 Shares of Sainsbury's at -1000pts and got out in September at 2 standard deviations above the mean at +200pts, the profit would be +200 - (-1000) = 1200pts per spread.

Written by Aris David. Follow me on Twitter and StockTwits.

Sunday, January 15, 2012 at 11:14AM

Sunday, January 15, 2012 at 11:14AM

Reader Comments