Amazon Showrooms are Everywhere

We have heard recently about Best Buy's ($BBY) poor performance due to the fact that consumers use $BBY retail stores as showrooms for ordering on Amazon.com ($AMZN).

That is true and it affects many more companies than Best Buy. Not just brick-and-mortar retail chains, but online retail is also a virtual showroom for Amazon.com.

When I buy Crocs ($CROX) shoes, I always check the shoes on its site but I order on $AMZN because Amazon.com offers free shipping and it is fast; crocs.com shipping is much slower and you pay for it.

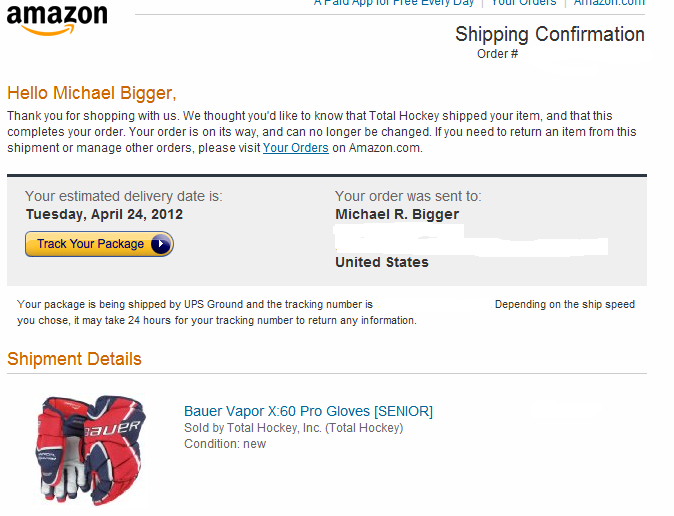

It seems these days that retailers need to work with Amazon to make sales. I just bought some hockey gloves from Amazon.com after doing research on the gloves at totalhockey.com. I paid with some points I had on my Amazon.com credit card. But remember, Amazon does not warehouse and sell all of it's products, most of the time you are actually buying from a third party seller using Amazon like a virtual mall. The hockey gloves were sold by Total Hockey operating as a third party seller on Amazon.com, for the same price as they sell them directly. Cool, isn't it?

The Amazon.com showroom is omnipresent and it is not only affecting BBY. If you think about the market share $AMZN has in online retailing, it is staggaring. And there is much more to come according to Josh Tarasoff. Tarasoff wrote in Greenlea Lane Capital Partners' write up about Amazon.com's Lollapalooza:

One company that may jump to mind as a lollapalooza retailer is Walmart. Indeed, it is the largest retailer in the world, and one of the greatest wealth generators in history, with over $400 billion in revenue and an enterprise value of approximately $250 billion. The company has admirably executed a virtuous circle strategy of leveraging its scale to drive down prices, which attracts more customers, which adds yet more scale, and so on. Conveniently, Walmart is nearly ubiquitous: there is one within 15 miles of 90% of Americans.

I believe that there is another lollapalooza in the early stages of unfolding in the retail industry, and that this one will create more wealth than even Walmart. This lollapalooza is Amazon.com. The fundamental difference between AMZN’s business model and that of traditional retailing is that by selling over the internet, AMZN replaces labor and real estate with technology. This tradeoff presents at least six large benefits to AMZN:...

Tarasoff's piece is a must read. It is the best research piece I have read about $AMZN.

Michael Bigger. Follow me on Twitter and StockTwits.

Tuesday, April 17, 2012 at 8:13AM

Tuesday, April 17, 2012 at 8:13AM

Reader Comments