Source: American Apparel Website.

Source: American Apparel Website.On March 14, 2012 American Apparel released the following guidance for fiscal 2012 results:

Initial 2012 Outlook

For 2012, the Company is initially projecting adjusted EBITDA to be in the range of $32 million to $40 million. The outlook assumes net sales between $552 million and $559 million and a gross profit rate between 54.5% and 55.8%. Raw material costs are estimated at current prices and foreign currency exchange rates are estimated to remain at current levels. Capital expenditures are estimated at $15.9 million for the year with a modest number of new store openings.

The company's outlook assumes a sales growth rate of about 2%.

Management Upgrades EBITDA forecast in August 2012.

The Company is raising its adjusted EBITDA guidance for 2012 to between $36 to $44 million from the prior estimate of $32 to $40 million.

For the month of August, the Company expects that comparable store sales will increase in the upper teen to low twenty percent range.

Twenty percent, you heard that right! And that is not all...

The process to build a new distribution center infrastructure is underway and will improve the speed and accuracy of shipments to stores and will also significantly reduce operating expenses. Completion of this project is expected by early 2013.

This information combined with the fact that the company is starting to open stores aggressively tells me that management is confident that growth will persist and that operation must be improved and expanded in order to increase capacity to meet demand. The company must also be confident that it can refinance its Lion loan at a lower interest rate in the near future, as they have discussed.

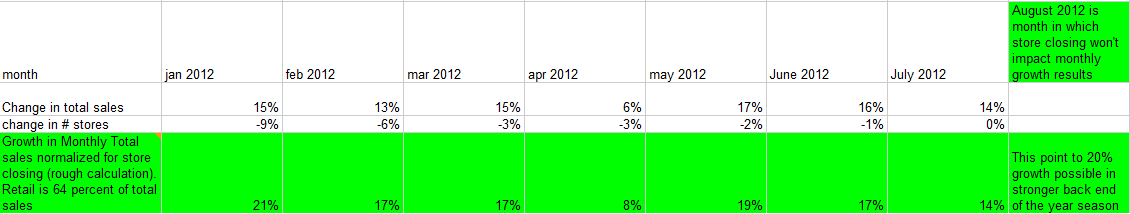

Here are the results to date in 2012. We are including a normalized growth rate (last line) which account for stores closure.

With comp sales accelerating to about 20%, store counts growing at about 4% per annum and accelerating, we're thinking that American Apparel could generate revenues closer to $625mm in 2012 and beat its EBITDA forecast by +10 million.

We believe the company could be operating at full capacity on a forward looking 12 months basis in June of 2013 with EBITDA power of about $120mm (15% of sales).

American Apparel is currently riding a massive growth wave. It either rides it and its stock responds to the massive growth in EBITDA or it wipes out (sales slow down for some unexpected reasons) and the company declares bankruptcy. This is do or die for American Apparel.

What do you think?

P.S. Please do your research before you trade the stock. This is a highly risky situation and it is not suitable for the majority of investors. The purpose of the post is to write down how I think about this and share it with you. I am currently long APP.

Source: American Apparel Website.On March 14, 2012 American Apparel released the following guidance for fiscal 2012 results:

Source: American Apparel Website.On March 14, 2012 American Apparel released the following guidance for fiscal 2012 results:

Monday, August 20, 2012 at 8:24AM

Monday, August 20, 2012 at 8:24AM

Reader Comments (1)

Internal discussion that I want noted for future reference:

[11:22:02 AM] Michael Bigger: if my numbers are correct

[11:22:14 AM] Michael Bigger: on APP you know the stock is going to 10

[11:22:17 AM] Michael Bigger: right

[11:27:30 AM] Jennifer Galperin: that would be great

[11:27:57 AM] Michael Bigger: but why is no one saying you are full of sh*t or you are right?

[11:28:18 AM] Michael Bigger: not one person is arguing

[11:28:29 AM] Michael Bigger: everyone should say cmon dude or this is awesome

[11:28:59 AM] Michael Bigger: is it because they don't make connection between ebitda pay back debt and earning power

[11:42:26 AM] Jennifer Galperin: No clue. They don't care?

[11:43:33 AM] Michael Bigger: the darnest mystery