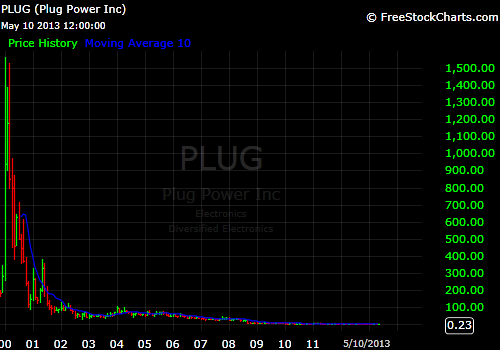

The Boulevard of Broken Dreams: Plug Power

In finance, the image located below represents the Boulevard of Broken Dreams: Dreams about a massive technological adjacent possible with unlimited potential opportunities that never becomes reality. This is the sad story of Plug Power ($PLUG) in one image.

Plug Power is an architect of modern fuel cell technology. Plug Power is revolutionizing the industry with cost-effective power solutions that increase productivity, lower operating costs and reduce carbon footprints. Long-standing relationships with industry leaders forged the path for Plug Power’s key accounts, including Walmart, Sysco, P&G and Mercedes. With more than 3,000 GenDrive units deployed to material handling customers, accumulating over 8.5 million hours of runtime, Plug Power manufactures tomorrow’s incumbent power solutions today. (Source: Plug Power website)

The company has had its fair share of problems over a span of fifteen years. The situation has been going to zero fast. Investors have been attracted to this situation based on the promise of its technology. Most have left poorer the Boulevard of Broken Dreams.

We look at $PLUG as an options on the modern fuel cell technology. Buying $PLUG buys you convexity on this market but the underlying payoff has also some convexity to the upside because of the impact of reflexivity (Soros) between the stock price and the business.

This situation has tremendous potential energy to the upside. Some will be disappointed that we are not pulling out a 180 pages Ackman presentation about this situation. Doing this would be intellectually dishonest. When dealing with the adjacent possible....We just don't know.

Management has stated they they will be EBITDA breakeven at around mid 2014 on a quarterly revenue run rate of $13.50 mm. They are doing about half of this at the current moment. The company can accomodate $200mm of business with its current facilities.

The downside is zero with a walk of shame along the Boulevard of Broken Dreams.

A few facts are favoring a positive outcome:

- Air Liquide, one of the largest industrial companies in the world, invested $6.5 million in $PLUG on May 8. This investment was strategic in nature.

- Andrew Walsh, $PLUG's CEO, stated the following in the recent earnings conference call:

The pent-up customer demand is visible to the team at Plug Power. That is why during the past 5 months, the toughest in the company's history, we have not lost the design or sales employee, except for extraordinary personal reasons, because they recognize how close we are to success. I perceive this also, and in the near future, path to success will be visible to shareholders, new investors and especially our competition. I know many will be surprised, but not us. We're building the business every day.

The next 120 days are critical to our sales effort. I expect order flow of over $20 million in that time frame, but also, we will be seeing business steps by some customers to position large orders before year's end. (Source: www.seekingalpha.com)

We speculate that these large orders before year's end will be the catalyst moving the stock higher.

We have a long speculative position in $PLUG. We will be increasing this position if $PLUG's results confirm the company's performance benchmark.

If you want to learn more about this situation you should read the earnings conference call transcript. And don't forget to let us know what you think.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

P.S. Plug Power is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal.

Wednesday, May 15, 2013 at 8:16AM

Wednesday, May 15, 2013 at 8:16AM

Reader Comments (2)

Very interesting. Do you think you could write a short post discussing how you discover and eliminate distressed ideas for consideration?

Hi Ross,

Thank you for your comment. I can't discuss that because the process is too chaotic....Designed that way on purpose.