A Better Poker Hand

We can't know everything about every company. There is always something that another smart investor will know about a company that we just don't know. What we do know, though, is our thesis and their actions.

In April, 2011, a group of Canadian investors lead by Michael Serruya and Andy DeFrancesco made a significant investment in American Apparel, providing the rescue financing that the company desperately needed. At that time, we made an investment in the American Apparel brand. A brand we believe in. We increased our position when the stock went below $1 and when the actual operational results confirmed the benchmark of our original thesis.

We did this with incomplete information, but Serruya and DeFrancesco's actions served as a beacon to make ourselves comfortable with this uncertainty.

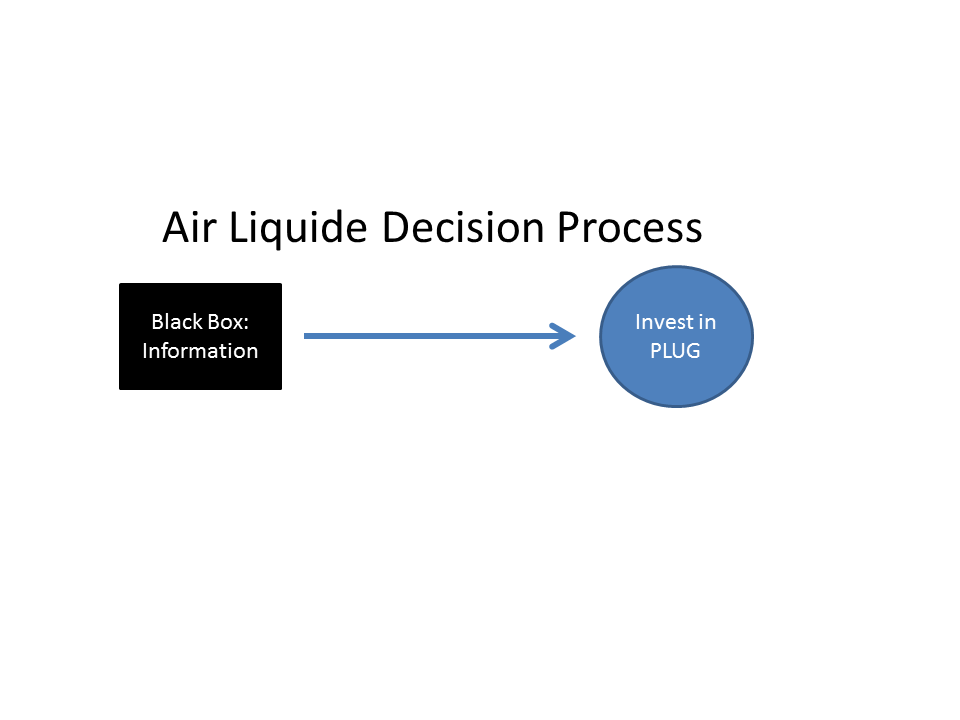

We see a similar situation right now with $PLUG. Back in early May, Air Liquide made a strategic investment in Plug Power ($PLUG). The capital provided by Air Liquide, a large public company with over $5bn in current assets, allowed $PLUG to continue operating.

At that time, our analysis pointed to tremendous strategic value in the $PLUG asset. We built a substantial position. Although we could not know everything there is to know about $PLUG, we know that Air Liquide has a much better seat at the table and a much better poker hand than we do.

We don't know what they know but we know the decision they made based on what they know. We can't see inside the black box, but we have insight based on what came out of the box.

Plug Power needs additional financing to get to cash-flow positive. The stock is under pressure, and we think this is the reason. However we are cautiously optimistic the money will come in based on our strategic assessment of the $PLUG asset.

What do you think? Will they get the money they need?

Disclaimer: We are long $PLUG and $APP. Both stocks are very risky and are not suitable for the majority of investors. There is a high likelihood of losing your entire investment in both situation.

Written by Jennifer Galperin. Follow me on Twitter and StockTwits.

With the collaboration of Michael Bigger. Follow me on Twitter and StockTwits.

Wednesday, July 3, 2013 at 10:41AM

Wednesday, July 3, 2013 at 10:41AM

Reader Comments