Investment Thesis: COSI

Price: $2

Enterprise Value: $63mm

Debt: $6.1mm

Cash: $23mm

EBITDA: -$12MM

Summary

● We project $15.3mm in EBITDA based on improved revenues and gross margins.

● We believe COSI has medium-term upside to $5.10 with our best case-case scenario calling for a stock price of $7.28 using the Hearthstone metrics for the overall system.

Background

We have been closely following Cosi ($COSI) since RJ Dourney took over as CEO in March of 2014. Dourney is a successful COSI franchisee, making profits at 13 locations in and around Boston. This is quite an accomplishment since COSI has accumulated more than $300mm in net negative earnings over its lifetime, a testimony to poor management of the parent company over that time period.

I first spoke to RJ back in June and in one conversation, I had confidence that he is the right guy to turn around COSI’s fortunes. After we met him and his team and toured some of his Boston locations on August 20, it became clear to us that RJ has a formula for success in the fast casual arena. His locations are clean, efficient, and profitable.

RJ Dourney began his relationship with COSI as a franchisee in 2005. At that time he chose COSI because he believed there is a unique brand essence, with fresh baked bread and healthy menu options. He and his corporate entity, Hearthstone, opened 5 stores in Boston and grew to 13 locations by 2014. All of the Hearthstone locations are operating successfully and profitably. In March of last year, Dourney became the new CEO of the company.

Dourney is wasting no time integrating his successful strategy into the company-owned locations. He mixes together fresh ingredients, clean and organized locations, and an efficient labor force to bake up profits. Long-term, if RJ and team are successful, COSI’s growth trajectory could match the growth of Chipotle ($CMG) and Panera ($PNRA). This situation has strong potential.

RJ hit the ground running with his turnaround plan for COSI corporate. In just a few short months, he hired a new VP of HR, an operations expert, and an IT manager. He began to implement the operating system from the Boston locations across the company-owned stores. He is reviewing the culinary component and is happy with the results so far. He moved the corporate office from a 27,000 sqft facility outside of Chicago to a 6,000 sqft facility near Boston. He hired HILCO to help the company get out of some of it’s bad leases.

RJ’s formula for operational success at COSI involves cleaning up the stores, increasing labor efficiency, and making the brand more current in line with the Boston model.

Market

Cosi operates in the fast casual dining market. This is a great space for two reasons. First, fast casual is a growing area filling the void between low-quality fast food and higher quality restaurants that require a full hour for lunch. At Cosi (and competitors Panera and Chipolte, to name a few), customers can get a delicious lunch in just a few minutes. Second, Americans are moving toward high-quality, healthy food. Cosi makes all its bread in-store, which means the bread contains simple ingredients and tastes fresh. Most people could eat at Cosi almost 5 days a week due to the large variety of healthy menu options. Check out this video to see what we mean: youtu.be/-A0eG0s2x9Q.

Anecdotally, Cosi recently rolled out a more high-quality chicken product along with with a price increase to cover the cost. RJ said that not one single customer complained about the higher price. They noticed it, but are more than willing to pay for the uptick in quality. So clearly there is a need for high quality, fast, healthy food.

So, we establish that Cosi has a great brand with a great management team in place and a business model that is proven in Boston.

Financials

COSI currently has 66 company-owned locations (58%) and 47 franchises locations, for a total of 113 restaurants. Here is a breakdown of revenues and costs for the company-owned stores during the first half of 2014:

COSI 1H2014:

|

|

$mm |

% of revenues |

|

Revenue |

38 |

|

|

Food Costs |

9.5 |

25.00% |

|

Labor |

14.5 |

38.16% |

|

Occupancy |

14 |

36.84% |

|

|

|

|

|

Gross Profit |

0.00 |

0.00%

|

Compare that to Chipotle and Panera 1H2014:

|

|

CMG |

|

|

PNRA |

|

|

|

$mm |

% of revenues |

|

$mm |

% of revenues |

|

Revenue |

1954 |

|

|

1091 |

|

|

Food Costs |

675 |

34.54% |

|

302 |

27.68% |

|

Labor |

436 |

22.31% |

|

298 |

27.31% |

|

Occupancy |

321 |

16.43% |

|

227 |

20.81% |

|

|

|

|

|

|

|

|

Gross Profit |

522 |

26.71% |

|

264 |

24.20% |

A quick glance of the numbers shows you that Cosi's Labor and Occupancy costs are significantly above that of the competition, while food costs are significantly below. RJ and team are focused on increasing labor efficiency as a critical piece of their turnaround strategy. If they can get labor costs down to 30%, the picture looks like this:

|

COSI Target Labor Costs: |

|

|

|

|

$mm |

% of revenues |

|

Revenue |

38 |

|

|

Food Costs |

9.5 |

25.00% |

|

Labor |

11.4 |

30.00% |

|

Occupancy |

14 |

36.84% |

|

|

|

|

|

Gross Profit |

3.10 |

8.16% |

Now let's talk about Occupancy costs. COSI is spending 35% of revenues on occupancy costs, this should be closer to 25%. Now, occupancy costs are at least partially a fixed cost, so the problem can be broken out into (a) revenues per restaurant are too low, and (b) lease costs are too high. RJ and team are clearly aware of both issues. Let's start with revenues.

COSI operates 63 restaurants and has an additional 47 franchise restaurants. If RJ and team can successfully bring the Hearthstone (RJ’s corporate entity) AUV numbers to the entire organization, AUV would go from $1.1mm to $1.75mm system-wide. That means $110mm in annual top-line revenues, plus another $4.1mm in franchise revenue, for a total of $114mm in revenues. This is a 48% increase over the $77mm in annualized revenue based on the nine months ended September of this year. Even if AUV increases to $1.6mm / store, that means $100mm in annualized revenues.

Now, to address (b), they hired a real estate workout company to help them terminate and / or renegotiate some leases and there is likely some wiggle room. Between increasing revenues per store and renegotiating leases, management believes a long-term run rate for occupancy cost should be closer to 25% of revenues:

|

|

COSI Target Occupancy Costs |

|

|

|

$mm |

% of revenues |

|

Revenue |

100 |

|

|

Food Costs |

25 |

25.00% |

|

Labor |

30 |

30.00% |

|

Occupancy |

25 |

25.00% |

|

|

|

|

|

Gross Profit |

20 |

20.00% |

|

G&A |

10 |

10.00% |

|

EBITDA |

10 |

10.00% |

Now, how does this compare to the numbers Hearthstone is generating? According to the Hearthstone numbers disclosed in the S-1 for the rights offering:

Hearthstone financials, $mm

|

$mm |

|

9mo through 9/30/2014 |

12mo through 12/31/2013 |

|

Revenue |

|

$12.6 |

$16.6 |

|

EBITDA |

|

$0.5 |

$0.9 |

|

Franchise Fees |

6% |

$0.76 |

$1.0 |

|

Pre-Opening Expenses |

|

$0.08 |

|

|

Legal Fees |

|

$0.065 |

|

|

Pro Forma Contribution to Company EBITDA, 13 Stores |

|

$1.4 |

$1.9 |

|

EBITDA Margin |

|

11% |

12% |

So 11% to 12% EBITDA margin is where RJ is with Hearthstone. Our target of 10% EBITDA margin for COSI corporate is reasonable.

When Dourney took over Au Bon pain in 2000 the AUV was $1.1mm and 5 years later it reached $1.7million. We expect a similar trajectory for current Cosi restaurants.

Additional Metrics

Here are some metrics that management has shared with our group. The High Street Boston location has an average peak transaction of 500 transactions an hour compared to 300 for the whole Hearthstone. The rest of COSI does a peak of 185-200 transactions an hour. A rock and rolling Chipotle peaks of 260 transactions per hour.

The Hearthstone average unit volume (AUV) is $1.75mm a year. the rest of COSI does $1.1mm.

The industry average employee turnover is 150% while Hearthstone has a turnover of 38%. The industry average management turnover is 35% while the Hearthstone turnover is 11%.

Cash and Capitalization

One of the biggest issues facing turnaround candidate companies is cash flow. Change costs money, and companies with negative cash flow are typically tight on cash. RJ views these capital expenditures as an investment in the future of the company, but he needed to get capital from somewhere. In 2014, the team (led by CFO Scott Carlock) successfully raised over $25mm in debt and equity capital.

● On May 20, the company placed a $2.5mm note with AB Opportunity Fund and AB Value Partners.

● On August 19, COSI issued equity in a $4.5mm private placement transaction to Janus and an existing shareholder.

● On December 12, the company completed a rights offering that raised $19.7mm from existing shareholders.

When we wrote our original thesis we believed that sufficient capital was needed for COSI to clean up its act outside Boston. Clearly management agreed.

Balance Sheet

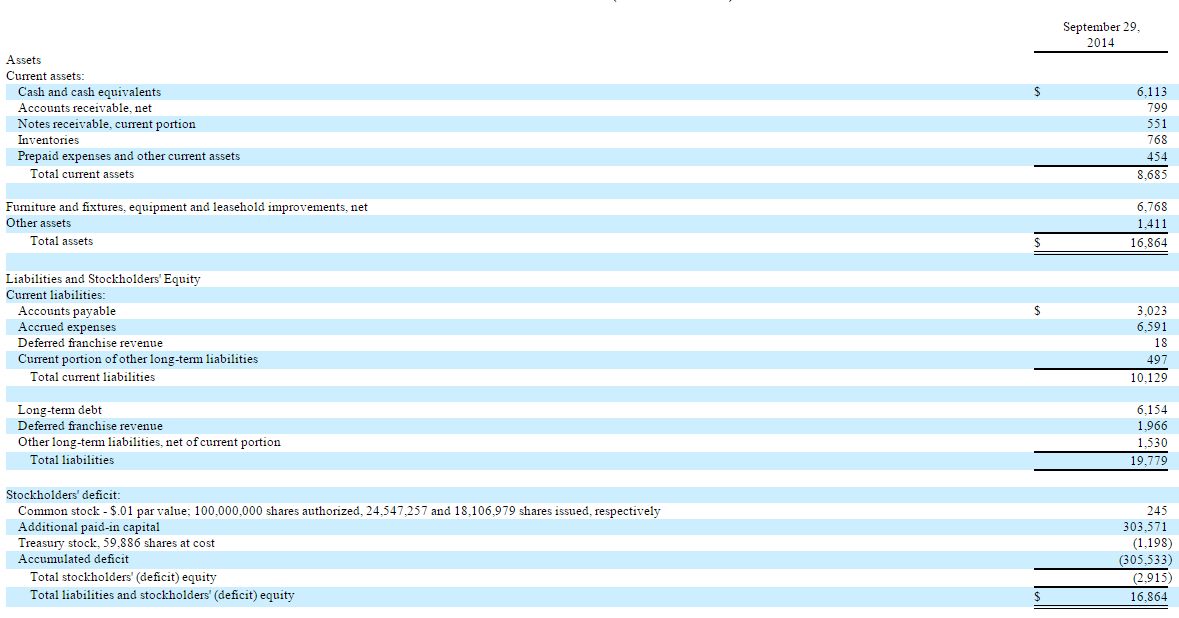

As of the 9/30/14 B/S, the company had $6.1mm in cash on the balance sheet and $6.1mm in debt. Given proceeds of $20mm from the rights offering and an estimated quarterly cash burn of $3mm, they should have about $23mm in cash on the balance sheet at year end. Here is the 9/30 balance sheet.

As of 12/31/14, the company will have another $20mm in cash from the rights offering, less cash burn of about $3mm. We project the balance sheet will look something like this:

|

Balance Sheet, $mm |

12/31/2013 |

9/29/2014 |

Projected 12/31/14 |

Projected 3/31/15 With Hearthstone |

|

Cash |

$6,021 |

$6,113 |

$23,113 |

$20,113 |

|

A/R |

$594 |

$799 |

$799 |

$799 |

|

Inventories |

$779 |

$768 |

$768 |

$768 |

|

Other Current |

$1,899 |

$1,005 |

$1,005 |

$1,005 |

|

Total CA |

$9,293 |

$8,685 |

$25,685 |

$22,685 |

|

|

|

|

|

|

|

FFE |

$8,195 |

$6,768 |

$6,768 |

$10,226 |

|

Other LA |

$1,115 |

$1,411 |

$1,411 |

$2,808 |

|

Total LA |

$9,310 |

$8,179 |

$8,179 |

$13,034 |

|

Total Assets |

$18,603 |

$16,864 |

$33,864 |

$35,719 |

|

|

|

|

|

|

|

A/P |

$2,462 |

$3,023 |

$3,023 |

$3,023 |

|

Accrued Exp |

$9,088 |

$6,591 |

$6,591 |

$6,591 |

|

Current Portion |

$214 |

$515 |

$515 |

$515 |

|

Total SL |

$11,764 |

$10,129 |

$10,129 |

$10,129 |

|

|

|

|

|

|

|

Long-term Debt |

$0 |

$6,154 |

$6,154 |

$16,575 |

|

Deferred Franchise Revenue |

$1,931 |

$1,966 |

$1,966 |

$1,966 |

|

Other LL |

$2,189 |

$1,530 |

$1,530 |

$1,530 |

|

Total LL |

$4,120 |

$9,650 |

$9,650 |

$20,071 |

|

|

|

|

|

|

|

Common Stock |

$181 |

$245 |

$245 |

$245 |

|

APIC |

$297,181 |

$303,571 |

$323,571 |

$323,571 |

|

Treasury Stock |

-$1,198 |

-$1,198 |

-$1,198 |

-$1,198 |

|

Retained Earnings |

-$293,445 |

-$305,533 |

-$308,533 |

-$317,099 |

|

Total E |

$2,719 |

-$2,915 |

$14,085 |

$5,519 |

|

Total L+E |

$18,603 |

$16,864 |

$33,864 |

$35,719 |

Notably, there is ample cash available for the capital improvements we know are necessary.

Hearthstone Acquisition

As part of the deal to sign RJ as CEO of COSI, an acquisition of Hearthstone was contemplated. The acquisition terms say that RJ gets 1.79mm shares of COSI in exchange for Hearthstone, plus RJ transfers anywhere between $6.9mm and $9.2mm in debt (depending on which paragraph of the S-1 you read). Hearthstone has book assets of $4.85mm. Total forecasted EBITDA of $2.3mm (pro forma for consolidation and 2 new restaurants).

To value Hearthstone, we use EV / EBITDA ratios. PNRA trades at 11x and others are around 10-15. We take a haircut to those valuations and use 7x $2.3mm EBITDA = $16mm EV. Let's say $10mm in debt, which means the equity is valued at $6mm. That corresponds to a “purchase” price for RJ of $3.40 / share. In addition, RJ will receive both time-based and performance-based shares. The time-based component consists of a total of 414,582 shares, 25% at each anniversary of his start date. The performance-based component consists of 414,582 shares, 25% at each of $2, $2.50, $3, and $4 share prices.

We believe the deal serves to align RJ’s interests with shareholders, as RJ is trading his interest in a cashflow positive private company with a smaller share in a much riskier cashflow negative COSI corporate entity. With 10 years experience with COSI as a franchisee and a long career in the chain / franchise restaurant industry, he is in a good position to evaluate the risks. His decision was to take the opportunity. This gives us comfort with our long position.

Valuation

Pulling it all together, we take our projected numbers:

| Restaurant Net Sales: | $100mm |

| Gross profit margin: | 20% |

| Net Profit from Company-Owned Stores: | $20mm |

| Franchise Revenue: | $3.0mm ($3.8mm less $0.8mm from Hearthstone) |

| Total Gross Profit: | $23mm |

| General & Administrative Expenses: | $10mm |

| EBIT: | $13mm |

| Corporate EBITDA: | $13mm |

| Hearthstone EBITDA: | $2.3mm |

| Total Projected EBITDA: | $15.3mm |

Competition’s EV/EBITDA multiples are at 11x for PNRA and 28x for CMG.

| EV/EBITDA multiple: | 10x |

| EV: | $153mm |

| Total debt (corporate): | $6.1mm |

| Hearthstone debt: | $10mm |

| Total debt: | $16.1mm |

| Total Cash: | $23mm |

| Market cap = EV - Debt + Cash: | $160mm. |

| NOL’s of $225mm: | $44mm (Assuming 50% haircut to valuation) |

| Total Value: | $204mm |

| Shares Outstanding: | 40mm |

Stock price of $5.10 with reasonable / conservative assumptions. And that is without expanding store count at all.

Boundary Condition Valuation:

We have made some conservative assumptions. Let’s now push it to the limit and see what the valuation looks like if RJ can get the rest of COSI to look exactly like Hearthstone in terms of AUV and EBITDA margin:

| Restaurant Net Sales @ $1.75mm AUV: | $110mm |

| EBITDA Margin: | 12% |

| EBITDA from Company-Owned Stores: | $13.2mm |

| Franchise Revenue @ $1.75mm AUV: | $4.1mm |

| Hearthstone Contribution: | $2.3mm |

| Total EBITDA: | $19.6mm |

| EV @ 10x EV/EBITDA Ratio: | $196mm |

| Total Debt (incl. Hearthstone): | $16.1mm |

| Total Cash: | $23mm |

| Market cap = EV - Debt + Cash: | $203mm |

| NOL’s of $225mm (no haircut): | $88mm |

| Total Value: | $291mm |

| Shares Outstanding: | 40mm |

| Stock Price (incl. NOL’s): | $7.28 |

So it is theoretically possible for the stock to get to $7.28 without any expansion of store count.

How Big Can Cosi Become?

Now let’s talk about growing store count. This is the fun part of the analysis because we get a glimpse into the long-term potential for the company.

Now, the first priority for RJ and team is to get the current store base in order, and get to both the revenue and EBITDA margins goals we discuss above. But in the long-term, there is huge potential for growth. Cosi has 113 stores currently with a mix of 60% company-owned / 40% franchise. Panera has 1810 locations with a mix of 50% company-owned stores and 50% franchise locations as of July 2014. RJ believes there are about 2000 potential locations nationwide. So long-term, with a profitable operating model at the store level, there is significant room for expansion in terms of store count.

Even with 5 x = 1130 total stores and the current 60/40 split between company-owned and franchise, the company could be worth multiple of our projected numbers. It is going to take time and capital to get there, but the team is already laying the groundwork for this type of success.

We think the Cosi team will focus on implementing the Boston processes throughout the organization over the next year. Once all of Cosi is ready to serve up an amazing experience, we believe RJ will press the pedal to the metal from a public relations and marketing standpoint.

Conclusion

As you can see, we believe there is tremendous opportunity in COSI if RJ and team can right the ship and get it headed in the correct direction. Based on our meetings, we feel confident in their ability to do so.

We have exercised our rights to purchase shares in the December rights offering. In addition, we plan to increase our position opportunistically.

Wednesday, January 7, 2015 at 2:37PM

Wednesday, January 7, 2015 at 2:37PM