A Dendritic Cell Cancer Vaccine Shines Brighter for Glioblastoma Patients

A Dendritic Cell Cancer Vac... by on Scribd

Northwest Biotherapeutics’ Annual Shareholder Meeting Key Takeaways

Feb 6th 2019, $NWBO, $0.24, $128M market capitalization

The well-attended Annual Shareholder Meeting (ASM) on Feb 2nd 2019 strengthened my conviction for NWBO. All of the board’s recommendations were approved and there was a sizable turn-out in person or proxy. While I believe that the initiation of analyst coverage could immediately help NWBO realize a more appropriate value as a Phase III clinical asset in the hot immuno-oncology space, the key takeaways from the ASM are focused on fundamental value:

- The company is laser-focused on the series of steps that they identified to get to top-line data, which will be the major value-inflection point.

- I have extreme confidence in their ability to execute the steps

- I get the sense that they have enough capital to execute the steps, particularly with the remaining 17 acres in the UK that can be monetized, if needed.

- The steps are each multi-month processes and there is some overlap where there can be parallel processing. I'm guessing this means 6 months of work, but we are 2-3 months into the work, so I'm guessing top-line data could be available at the end of May. Notably, ASCO is May 31st - June 4th - The company is compelled to unveil at ASCO because it is the main event for revealing clinical oncology advances. On the other hand, some have guessed top-line data will be available at the end of the year. February 12th is the deadline to retain the opportunity to submit an abstract to ASCO 2019.

- They have stated that they are submitting the Statistical Analysis Plan to four distinct geographical/market regions - This gives them four independent chances at regulatory success and four chances at commercialization/revenue. i.e. the probability of regulatory success in at least one of the four markets is better than the probability of regulatory success if they were to submit to only one market.

- If top-line data is compelling, then the valuation could reach $10-20B based on the CAR-T valuations and with the understanding that DCVax represents a platform that can be applied more readily to a larger set of indications (i.e. each CAR-T drug that addresses a new target must go through the drug development process and each first-generation CAR-T prep for each patient requires a genetic engineering step, which is not required for DCVax). To be clear, DCVax is easier to produce than first-generation CAR-Ts.

- I was reminded that their facility has the capacity for 10,000 patients per year, which is large enough to drive it to the valuations cited above.

- The general feel was that the board has greater confidence, optimism, and unity than ever before.

Along with the key takeaways above, I have a growing sense that the company intends to inflict maximum value at the most advantageous moment for shareholders. A crescendo, with a vengeance.

Disclosures

Impact of Drug Delivery Services on MRI Interventions Valuation

A friend of mine just sent me this analysis. Enjoy! Michael Bigger.

$MRIC $VYGR Value Impact Analysis by biggercapital on Scribd

MRI Interventions Fresh Insights

It's been a while since we wrote about MRI Interventions (MRIC). We want to share with you two pieces that will enhance your understanding of its potential.

Kris Tuttle at SoundView Technology Group has updated his research piece on MRIC, and the entire work is exceptional. You can find the presentation below.

Last week, Voyager Therapeutics (VYGR) posted its April 2018 Corporate presentation to its site. The presentation, which is included at the bottom of this post, highlights the importance of MRIC's ClearPoint system for the delivery of the Voyager Parkinson Payload to the brain. Slides 25-52 contain commentaries on the phase one trial and the posterior approach to delivery. In addition, on page 97, VYGR discusses its goal "to deliver a one-time administration of a 'vectored' monoclonal antibody directed against Tau to potentially treat primary and secondary tauopathies including Alzheimer's disease".

To think that the MRIC ClearPoint system might be the delivery method for some of the therapeutics developed as part of the VYGR-AbbVie collaboration is really exciting.

MRIC will be presenting at the MicroCap Conference being held in New York City on April 9th and 10th. The conference is free for qualified investors. You can find more at https://microcapconf.com/.

Of interest: 100 to 1 - MRI Interventions, Inc.

Enjoy!

Michael Bigger. Follow me on Twitter and StockTwits.

MRI Interventions SoundView Note Published Mar 2018 by Research2Zero on Scribd

Voyager Corporate Presentation April 2018 by biggercapital on Scribd

Alzheimer's,

Alzheimer's,  biotech,

biotech,  mric,

mric,  parkinson

parkinson  #genetherapies,

#genetherapies,  #mri,

#mri,  #parkinsons,

#parkinsons,  #voyageur

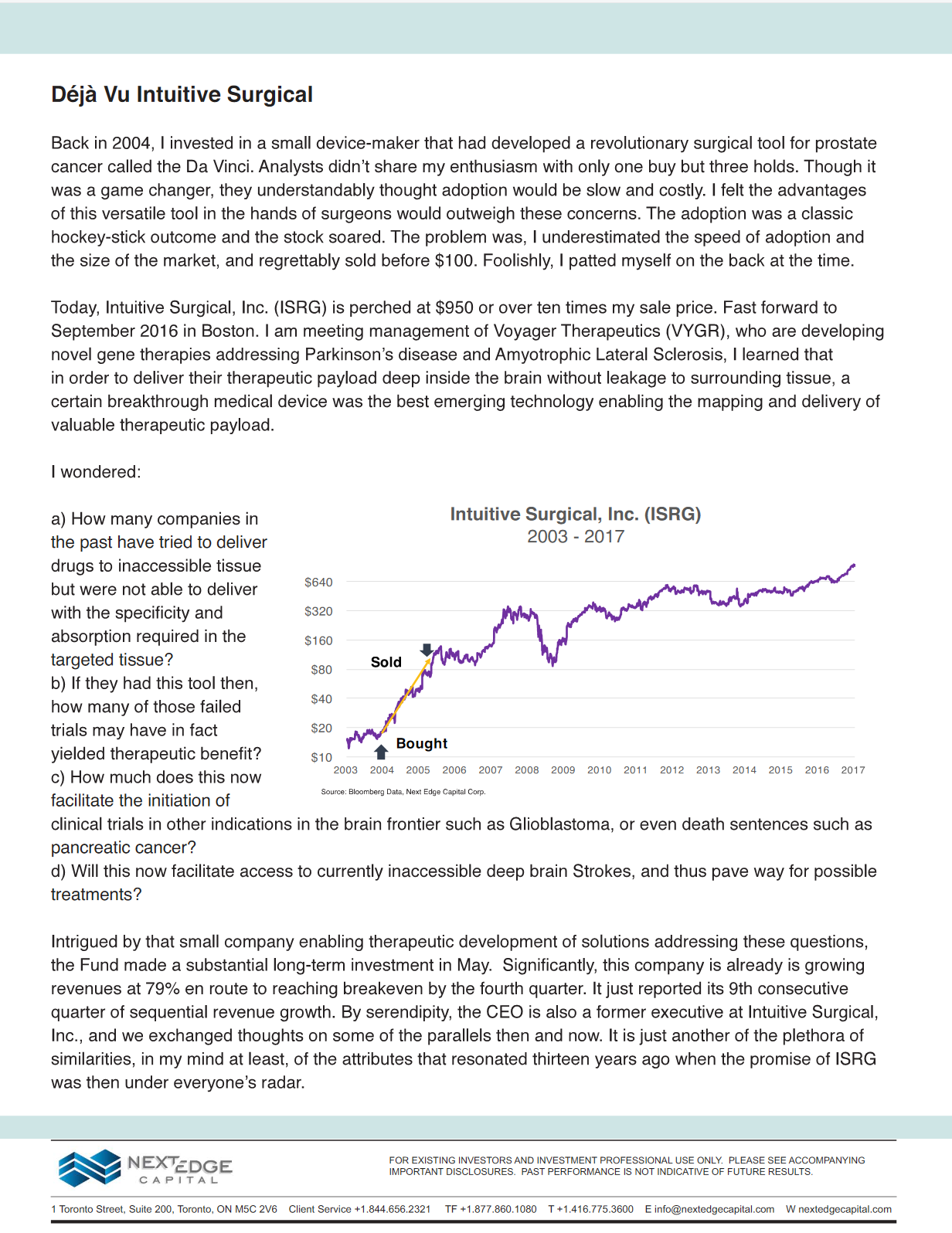

#voyageur Deja Vu Intuitive Surgical

- MRI Interventions to Present at the 2017 MicroCap Conference on October 5 $MRIC bit.ly/2xhqxS2

- 100 to 1 - MRI Interventions, Inc.

#alzheimers,

#alzheimers,  #biotech,

#biotech,  #parkinsons,

#parkinsons,  #prostatecancer,

#prostatecancer,  $ISRG,

$ISRG,  $MRIC

$MRIC 100 to 1 - MRI Interventions, Inc.

- MRI Interventions, Inc.(MRIC), a medical device company with a $13 million enterprise value trading at 2 times revenues which are growing at 79% and standing on the doorstep of profitability, represents a compelling opportunity to investigate for investors searching for potential returns of 10 times and much more.

- While the current revenue generating side of MRIC supports a 10 times potential and much more, it’s the hidden and explosive side of the business that gets us even more excited for a 100 to 1 outcome.

Stock Chart

Financial Metrics (6/30/2017)

Author’s Note

This post was completed just before this Voyager Therapeutics (VYGR) news hit the tape.

This post explores the potential in MRIC. It is not a stock recommendation nor does it come with price targets nor stock price trajectory. It is not a buy or sell recommendation. We are just trying to answer How big can this become? We are trying to determine its size boundary at a very long-time scale. It’s certainly not intended for traders living in the now.

Please do not rely on our views to make an investment decision, instead use the information as a jumping off point to begin your own independent due diligence into MRIC potential. It is best to start analyzing MRIC by reading the latest company presentation (link). If you like what you read, then get to know management via 1 on 1 meetings, by attending one of many company’s presentations at investing conferences, and listen to their many webcasts. This post only highlights how we think about the business potential and it’s far from being complete.

On September 9 we came across this Research Piece written by Soundview Research. It's a must read for anyone contemplating an MRIC investment.

You can meet management at the 2017 MicroCap Conference on October 5 in New York $MRIC bit.ly/2xhqxS2.

Company’s Technology

MRIC is the leader in MRI-guided therapies with its ClearPoint Neuro-Navigation system. MRIC’s technology grew out of the Advanced MR department at Johns Hopkins. The company has an extensive intellectual property portfolio (IP) including 70+ issued US patents, 45 international patents. According to the company, the IP portfolio would block anyone intent on replicating its MRI guided approach.

To date stereotactic procedures own most of the market share for central nervous system (CNS) surgical procedures. For this conventional stereotactic procedure, the head of the patient is immobilized in a metal frame and the surgery is performed blind with the patient awake. Some have called this procedure barbaric. But more importantly, the images used to guide those procedures are two-dimensional, low resolution, not real time (usually images from earlier in the day or week are used) and not continuous.

The ClearPoint Neuro-Navigation system is the next step in the trend of image guided procedures which have become a mainstay in healthcare. ClearPoint makes it possible to perform MRI guided neurosurgical procedures such as placing DBS electrode, performing laser ablation and biopsy, and delivering drug to specific areas of the brain. The technology is used to address medical needs caused by Parkinson’s disease, Epilepsy, Brain tumors, Dystonia, and so forth. ClearPoint provides guidance for the procedures through real-time, high resolution, three-dimensional, and continuous images with no radiation. The highly accurate surgical procedures are minimally invasive and performed with the patient under general anesthesia.

The technology leverages the MRI systems found in most hospitals which reduces the capital outlay and footprint associated with a system that would have its own dedicated visualization technology.

Competition

Medtronic (MDT) is a large supplier of Stereotactic equipment and therefore a competitor to MRIC. In addition, MDT is also a very large supplier of laser ablation products which are used in MRI Guided Ablation and stimulators used in MRI guided deep brain stimulation procedures. MDT is both a competitor and customer.

It is possible that MDT decides to build the equivalent of a ClearPoint system but the company would have to bypass MRIC patents. MRIC has invested $90 million in its business and we believe that it makes more sense for MDT to buy MRIC outright, which is already a commercial company.

For the same reasons, we believe other medical device companies won’t enter the MRI guided surgery space. That being said, other companies could develop guided technology based on other visualization platforms. We don’t see anything on the horizon at the moment but if you do, let us know.

Business

MRIC operates along 3 business segments (Image 1):

1. Functional Neurosurgery. (Commercial stage - almost 100% of current revenues))

2. Stroke and Oncology. (Pre-clinical stage)

3. Drug Delivery Market. (Clinical stage)

Image 1. (Source: August 2017 Company Presentation)

1. The Functional Neurosurgery Business derives most of MRIC current revenues, growth, and fast approaching breakeven cash flows. The total annual market opportunity is about $415 million. MRIC which should generate about $9 million in revenues in 2017 has a tiny market share and the size of this market should support a torrid growth rate for years to come. The company expects surgeons to perform about 700 procedures in 2017. The company has disclosed that it will be cash flow break even on a run rate of 1,200 to 1,400 procedures a year. MRIC is expected to reach cash flow break-even in 2018.

MRIC counts 50 hospitals and clinics as customers as of June 2017. It is adding 4 to 5 customers per quarter.

The company revenues are composed of disposable product revenues and reusable product revenues. ClearPoint Hardware/Software packages are priced at between $100,000 to $150,000 and ClearPoint disposables are priced at $7,500 per procedure with strong margins.

2. The Stroke and Oncology programs have an annual total market opportunity of $143 million. This is an early stage business and it requires the company to invest its own capital to develop it as this segment is a new procedural application of its technology. Given that this segment is in the preclinical stage and that management will tune up or down its level of investment in this segment depending on its cash position, we won’t allocate any value to this segment for the time being.

3. MRIC’s Drug Delivery Business focuses on the revenue potential from usage of its existing ClearPoint technology in new drug therapies. ClearPoint enables biotech companies to deliver drug payloads directly into an area of the brain with extreme precision. Each payload consists of a gene modifying therapeutic or cancer therapeutic that are delivered via one-time MRI guided surgical procedures. Even though no meaningful revenue is derived from this business today the potential of business if any one of those new drug and therapy developments succeeds is tremendous.

Financials

Gross margin is about 60% and should trend toward the 70% mark as disposables revenues increase as a slice of total revenues.

The 35% per annum growth in the number of new clients and the increased adoption by surgeons, bodes well for the sale of new systems and disposables.

The company burned $1.2 million of cash in Q2 2017 and this burn rate is decreasing rapidly as the company ramps up revenues. MRIC has about $13 million in cash and it’s sufficient to see it through break even.

SG&A and R&D should trend up slightly. Management is firmly committed to its cash flow break even target given how important the health of its balance sheet is to its clients especially its drug delivery customers who are investing significant resources in their clinical trials. Therefore, we believe management will push the SG&A and R&D accelerator lightly until it gains more visibility on its cash flow situation.

If we assume MRIC can grow sales of its functional neurosurgical business at 25% per annum over the next 10 years from 79% currently in this segment, the company would generate about $83 million a year at year 10 which is about a quarter of its annual market opportunity and it’s far from being unrealistic. Keeping current valuation metrics intact at year 10, the company would return slightly less than 10 times on investment. Large medical device companies trade at enterprise value of 4 to 6 times revenues and are growing revenues at much lower levels. If the company grew at its current growth rate, the company would be ten times bigger in just four years.

Because of the early stage, capital requirements and unknown timing of the Stroke and Oncology programs any future contribution to revenues from this expansion of its technology falls in the surprise bucket. The company should provide clearer guidance about those programs in early 2018.

What about the future impact on revenues of the Drug Delivery Market?

We asked Frank Grillo, MRIC CEO, if there is anything material investors are missing about the company. He replied that investors don’t account for the value of the potential payout associated with the portfolio of biotech companies running cutting edge clinical trials with ClearPoint as the designated payload delivery system for their trial protocols.

To fully grasp the meaning of this, it is important to understand the FDA Approval of Interstitial Delivery of Therapeutics. By needing to specify the payload delivery system for trial protocols, ClearPoint is tied to the approval process. We believe this creates a very strong moat for MRIC. Changing device mid-clinical trial just adds a lot of variability to the program…. If the sponsor has a problem, is it from the device? The drug? In addition, the FDA approval of a therapeutic by method of Interstitial delivery would specify a real-time MRI imaging technology for the delivery as part of its commercial usage. Changing delivery method after a drug has been approved would create unnecessary complexities, delays, and costs.

The approval process anchors MRIC technology tightly to the therapeutic candidates without having to spend money on clinical trials and without having to spend money on marketing the therapeutic after the therapeutic is approved. MRIC shareholders gets the upside and none of the downside of owning exposure to a basket of early stage biotech companies with cutting edge technologies.

The following 5 companies are using ClearPoint to deliver their one-time payload to the brains as part of their clinical trials at this time:

-

Voyager (Parkinson’s disease). Market Cap: $250 million.

-

Medicenna (Glioblastoma Brain Tumors) Market Cap: $31 million

-

Oxford Biomedical (Parkinson’s disease) Market Cap: $370 million

-

Lysogene (Sanfilippo A) Market Cap: $50 million

-

International Stem Cell (Parkinson’s disease) Market Cap: $5 million

Let us take a closer look at the relationship between MRIC and Voyager Therapeutics (VYGR) to highlight the dynamic in the Drug Delivery business (VYGR Presentation):

VYGR uses MRIC technology to deliver VY-AADC01 for Advanced Parkinson’s Disease. The payload consists of a gene modifying vector payload delivered one time into the putamen of the brain. The company is currently in its Phase 1. Ph1 Cohort 1 and Cohort 2 results have been published and we are now waiting for the final data on Cohort 3 which should read in Q4 2017 and complete VY-AADC01 Phase 1 study. For Cohort 3, VYGR used a posterior of the head trajectory to deliver its payload. VYGR has stated that this modification should increase the area of coverage of the therapeutic into the putamen. Sanofi has an opt-in options on this program and a decision is due this fall.

VYGR intends to initiate its VY-ADDC01 Phase 2 study in late 2017 and run a Phase 3 study in parallel starting around the middle of 2018. This could lead to a PH3 readout in late 2019. This is two years earlier than previously expected from people following the company closely, and it creates a major catalyst for MRIC.

On September 2nd, 20016, VYGR made a strategic investment of $3.8 million for a 21.04% stake in MRIC. The investment is a testimony to the value of the MRIC technology. VYGR wanted to make sure MRIC had the capital necessary to support the supply of disposables for its trials. The quality of MRIC balance sheet is of the utmost importance to VYGR and any biotech companies embarking on expensive CNS drug trials. The June 2017 raise finally put to rest any issues with MRIC balance sheet. The company is now cashed up.

In 2016, VYGR performed 24 MRI guided procedures and we expect the number of procedures to increase to 90 in 2018. MRIC generates revenues from these procedures in line with its other neurosurgery activities. MRIC is in the enviable position of generating profitable business during the trial period and create massive trial upside potential. It rarely gets better than this.

Potential Payoff Associated with the Drug Delivery Business

Clinical programs have a 10% to 50% chance of turning into a commercial drug depending on the clinical stages they are at. If you bet on 10 clinical biotech programs or more, the probability of success on a least one program is very high.

Let’s derive a potential value for the MRIC Drug Delivery business. The trial pipeline looks like this:

Image 2. (Source: Company presentation August 2017)

Using industry data, we can derive the probability for each program to getting an FDA approval:

Image 3. (Source: BIO Industry Analysis)

Phase I to Approval: 10%

Phase II to Approval: 15%

Phase III to Approval: 50%

NDA/BLA to Approval: 85%

The company has computed that annual market opportunity for Drug Delivery business is $350 million for Parkinson’s and $208 million for Brain Tumor.

The 3 Parkinson’s trials are in Phase 1 and the probability of having 1 of 3 shots on goal hit the net is about 30%. Therefore, the expected value of the Parkinson’s annual market opportunity is $105 million.

The Brain Tumor program is in Phase 2 and its has a 15% chance of paying off. Therefore the expected value of the Brain Tumour annual market opportunity is about $31.5 million.

We assign no value to the Lysogene opportunity at the moment as we don’t have the metrics to perform such calculations. We add the Lysogene opportunity to the surprise bucket.

We assign a potential binary value for revenues of $136 million to the Drug Delivery business ($105 million + $31.5 million). This number is well below the aggregate market capitalization of the firms currently using ClearPoint in their trials. This value should increase over time as new programs join the platform.

In addition,the company knows of 3 preclinical drug delivery programs that could potentially use ClearPoint once they enter the clinic.

We believe that VYGR VY-HTT01 for the treatment Huntington Disease could be one of these preclinical candidates. (Our own due diligence)

This is what VYGR said about VY-HTT01 in its 8/8/2017 press release:

Selected VY-HTT01 as a clinical candidate for the treatment of Huntington’s disease. Huntington's disease is a fatal, inherited neurodegenerative disease that results in the progressive decline of motor and cognitive functions caused by an expansion mutation in the huntingtin, or HTT, gene. VY-HTT01 is composed of an adeno-associated virus (AAV) capsid and proprietary transgene that harnesses the RNA interference pathway to selectively silence the production of HTT. Direct delivery of VY-HTT01 to the brain with a one-time administration could potentially slow or halt the progression of this uniformly fatal disease. In preclinical models, a single administration of VY-HTT01 was well-tolerated and resulted in robust and widespread knockdown of HTT messenger RNA in disease-relevant regions of the non-human primate central nervous system. The extent of HTT mRNA suppression (greater than 50%) and high precision and efficiency of primary microRNA processing in these preclinical studies supported the selection of VY-HTT01 as our lead clinical candidate.

We assign no value to the preclinical programs for now but we are excited about the possibility for increasing the breadth of the Drug Delivery business over the next 5 years.

Management has mentioned that they want to be the equivalent of a “biotech portfolio play”, where they have 6 or 8 or 10 shots on goal. They have 5 or so now and they are working hard to add more.

Failed therapeutics

A colleague of ours met the CEO of one of the Drug Delivery businesses using MRIC technology and indicated to him that the technology was essential to their ability to safely and effectively deliver drug to the targeted site. He also said that this technology will make it possible to restart trials targeting delivery of drugs to the brain, that had previously failed. It is very early in this process but we believe that a positive outcome in one of the clinical programs could unleash a resurrection of trials for which the inability to deliver the therapeutic in the right location can be remediated using MRIC technology. This potential business also belongs into our surprise bucket.

Putting it all together

One approval is all that’s needed to create stratospheric value for the company and its shareholders, and to move the potential needle from a 10 to 1 to a 100 to 1.

The Functional business and the Drug Delivery business could generate close to $200 million of annual revenues in about 10 years. Yes, a large portion of this number is binary in nature but a healthy dose of diversification already exists in the portfolio of cutting edge biotech companies.

The potential in the surprise bucket is also very alluring.

We believe that owning MRIC gives us a good shot at a 10 to 1 upside potential and if something goes right in the other two buckets, a 100 to 1 payoff is not a crazy idea.

Tail I win, and head I just kill it!

To pay attention to on the horizon

-

Quarterly results confirming sustainability of growth

-

Funding overhang dissipating

-

Sanofi opt-in or out of the VYGR program this fall

-

Drug Delivery trials results starting this fall

-

Nasdaq Uplisting

Risk

-

Business execution

-

Disruptive technologies

-

Funding requirements

Of Interest:

- MRI Interventions to Present at the 2017 MicroCap Conference on October 5 $MRIC bit.ly/2xhqxS2

Michael Bigger. Follow me on Twitter and StockTwits.

Disclaimer: Bigger Capital Fund, LP and related entities are long 500,000 MRI Interventions, Inc. securities (stock and derivatives). MRI Interventions, Inc. is a nanocap company and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal. Take our opinions with a grain of salt. If you find yourself relying on our views to make an investment decision it means you definitely did not do your homework about this situation. Please do not rely on our views, instead use the information as a jumping off point to begin your own independent due diligence.

biotech,

biotech,  mric,

mric,  parkinson,

parkinson,  parkinsons,

parkinsons,  voyager

voyager Momentous Alzheimer’s Disease Readouts

Neurotrope (NTRP) will release its Bryostatin Phase 2b top line data this week (company’s guidance). The primary efficacy endpoint is based on Severe Impairment Battery Scale (SIB). Entry criteria was based on the MMSE score. Secondary efficacy endpoints were based on – Activities of Daily Living (ADL), Neuropsychiatric Inventory (NPI), and Mini-Mental State Exam (MMSE).

Considering 70% of all phase two drug trials fail, and even more so with Alzheimer’s Disease (AD) indications, this will be a cage fighting, raw, win or lose, zero or hero event.

We are long NTRP and we wrote about our thesis right here. We are comfortable with our position given our utility curve, our assessment of the situation, its risk and reward potential.

We have the utmost respect for investors going into the event with a short or long position based on their assessment. This is not easy; it shows conviction with a position under imperfect information.

Given the history of AD trials results, it is understandable that many label this situation as a failure from the get go. To be clear, we are handicapping the probability of success and its associated payoff much differently.

ProMIS Neurosciences (PMN.TO) is conducting a cohort study to demonstrate the prevalence of 5 strains (5 epitopes) of soluble toxic oligomers in the cerebrospinal fluid (CSF) of 100 cadavers at the University of British Columbia of patients who had been diagnosed with AD. The results of this study could confirm and present a profile of heterogeneity in AD patients. Based on these results, ProMIS monoclonal antibodies (5 mabs) could be used to create CSF diagnostics for early detection in patients at high risk of the disease.

These mabs could also be used by researchers to advance AD’s science turning PMN’s IPs and therapeutics portfolio into a platform.

The cohort study results should readout before the end of May (our expectation).

In addition, PMN is running blood based screening assays to detect these toxic oligomer strains at the molecular level (5 epitopes). If PMN can overcome the challenges posed by the hypothesis that toxic oligomers have a very short half-life in blood, the company could be in a position to provide a data readout this summer or fall.

We are long ProMIS Neurosciences and we wrote extensively about it here.

Let's Go!

Michael Bigger. Follow me on Twitter and StockTwits.

Disclaimer: We are long the securities and some of their associated derivatives. The likely outcome of an investment in early stage biotech companies is a loss of principal. Take our opinions with a grain of salt. If you find yourself relying on our views to make an investment decision it means you definitely did not do your homework about these situations. Please do not rely on our views, instead use the information as a jumping off point to begin your own independent due diligence.