Friday

Feb262010

Crocs, $crox

Story: Crocs reported fourth quarter earnings last night. The results beat analysts’ forecast both on the top line and the bottom line. The company issued first quarter 2010 guidance which are above analysts’ consensus.

Story: Crocs reported fourth quarter earnings last night. The results beat analysts’ forecast both on the top line and the bottom line. The company issued first quarter 2010 guidance which are above analysts’ consensus.In addition, short term turnaround specialist John Duerden, who was appointed CEO of Crocs in February 2009, will retire from the company and John McCarvel, the company chief operating officer, will become Crocs’ CEO.

The stock plunged 14% on the news. Should investors worried about this situation? Could there be a canary in the coal mine? It is time to reassess our investment thesis about Crocs.

Background: No introduction to this company is needed. People either like Crocs or they don’t, but either way, they talk about them. Being talked about is great when the barriers to getting brand attention are so high.

Last summer, if you typed “crocs” into Twitter’s search box, you identified the following criticisms about the company:

1. Crocs are coyote ugly.

2. Knockoffs are cheaper; there is no need to buy Crocs.

3. Crocs are a short-term fad.

4. The company is mismanaged.

5. The company is doomed. The Washington Post reports that Crocs is on its way to bankruptcy (July, 2009).

Fast forward six months and a different view of the company emerges:

1. Crocs’ newest styles are stylish. Check for yourself on the Crocs website.

2. From Amazon.com’s "Best of 2009" list of shoes and handbags: the Crocs Cayman Sandal.

3. Crocs had up to six shoes among the top ten bestsellers in men’s shoes throughout the year on Amazon.com.

4. I just came back from India and the Dominican Republic, and I can attest that Crocs are everywhere. Crocs are not a fad.

5. John Duerden, short term turnaround specialist and appointed CEO of Crocs in February 2009, did an amazing job stabilizing the company.

6. As of December 31, 2009, Crocs’ cash increased to $77 million, despite fully repaying outstanding debt.

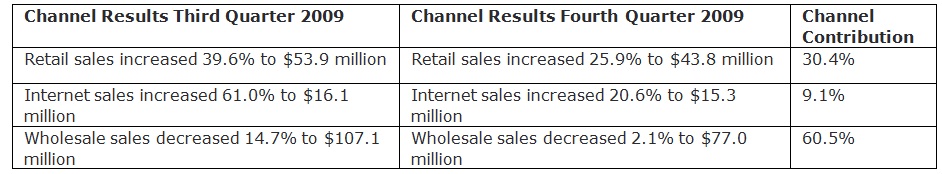

7. Wholesale, which had been a drag on the business, had flat comps for the fourth quarter.

8. Wholesale spring and summer pre-bookings trends are +30% Europe, +60% America, +130% Total Americas, +61% Asia, and +50% globally.

9. U.S. wholesale fall and winter pre-bookings trend is +70%.

10. The CEO gave a presentation (slideshow) at the ICR Conference on January 13, 2010. He sounded very upbeat and forecasted a return to profitability for 2010.

The numbers: With 3,700 employees and sales of $650 million, Crocs has a market cap of $636 million, giving it a price/sales value of 1. This hardly qualifies as a bargain, especially considering the company lost about $.49 a share for 2009. During its heyday, Crocs’ net profit margin topped at an unsustainable 20%. It seems reasonable and conservative to assume an industry average net margin of about 7% for Crocs for analytical purposes. On that basis, the stock trades at a P/E of 14 (E being defined as conservative earning power). The company has about $1 to $1.50 per share of excess working capital.

The thesis: Looking at the table above, it becomes obvious that wholesale has stabilized. If you look at the wholesale pre-bookings metrics displayed in bullet #8 and #9 above, one can assume this business is coming back with a vengeance (and fourth quarter is the seasonally slow quarter). I don’t know about you, but I do get excited by sales growth rates way above 20%, as the numbers above indicate. They are all pointing positive and strong for 2010.

With regards to John McCarvel, we just don’t know enough about him at this stage to make an assessment. We are monitoring.

For us at Bigger Capital, an investment in Crocs is a very long-term bet that the company will strongly expand its market share on a global basis over the next ten to twenty years. For Crocs fans, the satisfaction of wearing these shoes is as intense as the enjoyment of Coca Cola fans drinking their favorite beverage, Tempur-Pedic fans sleeping on a very comfortable bed, or Tylenol fans relieving their muscle pain. (Try a pair of the new “Almost Barefoot” ABF Flips and let me know what you think.)

Risks:

1. John Duerden’s departure could be disruptive.

2. As Crocs opens more stores on a global basis, its capital-heavy balance sheet becomes riskier.

3. The cat gets out of the bag and more competition enters the molded shoe business.

4. The stock has rallied about ten times over the last year from a base of $.79. The stock could experience another sharp pullback.

Written by Michael Bigger. Follow me on Twitter.

Update on Wednesday, March 10, 2010 at 6:31AM by

Michael Bigger

Michael Bigger

Michael Bigger

Michael Bigger