A Thousandfold Return on Investment

Written by Michael Bigger. Follow me on Twitter.

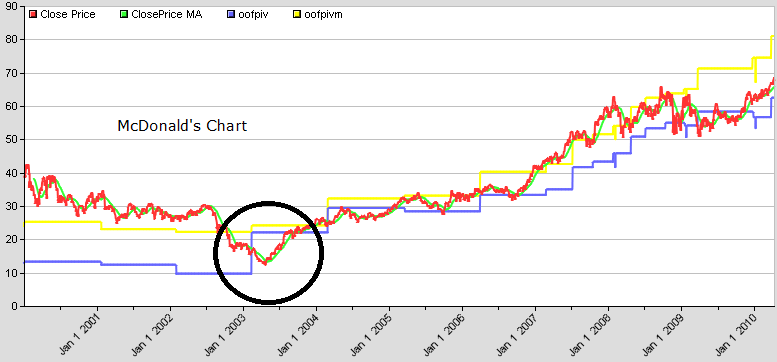

A good friend of mine, a talented research analyst, covered McDonald's (MCD) in the sixties. One of his field reports is posted below. My friend liked the company and bought the stock at a price of $.06 (post split). He still holds a major portion of his original stake. The investment has returned more than one thousand times.

The lesson of this story is that you will most likely stumble upon one or two great companies like MCD in your lifetime. If that happens and your insight leads you to buy the stock, hold on to it for a long period of time. Don't get shaken out of your position.

Recommended reading: The Big Money: Seven Steps to Picking Great Stocks and Finding Financial Security (Amazon Affiliate Link).

A Few Reasons Why I Am Shorting Barnes and Noble $BKS

Written by Michael Bigger. Follow me on Twitter.

Here they are:

- Barnes and Noble (BKS) does not have the balance sheet to win a price war with Amazon.com.

- BKS is fighting the Kindle and the iPad. Put yourself in BKS's shoes. Is that a war you can win? Imagine how much more intense this battle becomes if Google enters the market.

- The Kindle has been social-media enabled. It seems like the big innovations on the e-reader front are not coming from BKS. I don't expect that to change.

- My post Barnes and Noble's Pathetic Online Results was prescient. My short position has worked, and it should continue to do so.

- With books going digital, BKS stock price should follow the same trajectory others followed in such predicaments: for example, Polaroid, Eastman Kodak, Blockbuster, etc. You get the idea.

- If BKS decides to unwind stores, it would do so in a difficult real estate market.

- Many e-books are free. Digital publishing will put pressure on e-books prices and more pressure on printed books. This trend is just starting. The margins won't sustain the old model.

- The business model is broken.

Caveat: BKS will not go away so easily. It has a minimal amount of debt and it could very well find more capital to fight this battle. I keep my short positions small since I never know what is lurking on the blind side.

Do you know of anything BKS could do to change my mind?

Are Dark Clouds Gathering on the Apple Sunny Sky Horizon? $AAPL

#FollowFriday Investment @specialsin @harmongreg @werner

Written by Michael Bigger. Follow me on Twitter.

@specialsin: Asif Suria writes a great investment newsletter. Check out his latest post on the Ipad.

@harmongreg: I enjoy reading Greg Harmon's comments on his technical charts. More often than not he is right!

@werner: CTO - Amazon.com. Blazing new trails in cloud computing. Must read for $amzn investors.

@....whatever company you own in your portfolio: Learn about your portfolio companies by watching how they interact with customers on twitter

Why our Investment Blog is Boring

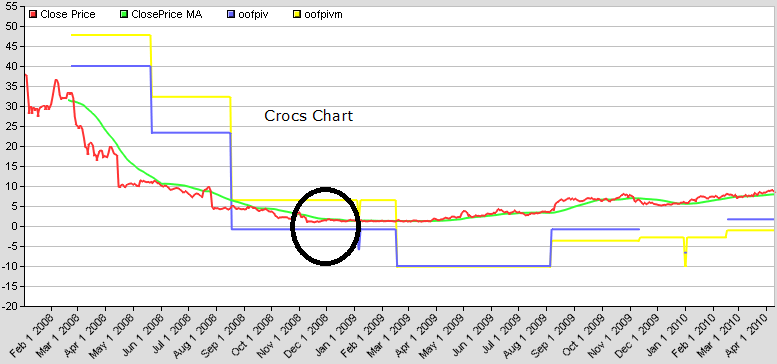

What Do Stock Price Targets of $0, $10, $20 and $30 Mean for Crocs? $CROX

Written by Michael Bigger. Follow me on Twitter.

I posted this on Twitter this morning: Trying to explain why $crox is a $20 stock on my blog. Cant find the proper words. Hard to be a French Canadian writing an English blog post.

I recently explained my investment thesis on Crocs in this POST. I did not provide a fair value or a price target for the stock because it is too difficult to do so.

I recently explained my investment thesis on Crocs in this POST. I did not provide a fair value or a price target for the stock because it is too difficult to do so.

This post's intention is to comment on a set of targets for CROX using the Price/Earnings ratio (P/E) and the Price/Earnings to Growth ratio (PEG).

Since CROX has been losing money for the past two years, we use an earning power of about $1 per share for our computations (POST). On the growth rate side of the equation, we use Yahoo! Finance's 5-year expected earning growth rate of 18.66%. Take these numbers with a grain of salt. The purpose of this post is about evaluating a range of possibilities and nothing else.

Let's look at different price targets:

$0: The Washington Post was right about Crocs in July 2009. But HEY! they were wrong

$10: A very conservative P/E of 10. We are basically there

$20: A PEG ratio of about 1

$30: A more aggressive growth rate forecast based on the strong pre-booking trends persisting for a few years. As an example, U.S. wholesale fall and winter pre-bookings are trending at +70%. A high growth rate would scare short sellers away. Although possible, this scenario is highly unlikely.

Gun to my head, I pick $20 as a fair value for CROX. A P/E of 20 is very reasonable considering the growth rates that are about to be reported. What is your price target on CROX?

Michael Bigger

Michael Bigger

Crocs reported earnings last Thursday afternoon. John McCarvel, Crocs' CEO, said in a conference call, "We were off to a good start in the first quarter, where our results were dramatically better than one year ago and above guidance, highlighted by diluted earnings of $0.07 per share. Improvement began at the top with sales of $167 million, up from 24 percent from last year, and above [the] high end of our forecasted range of $155 to $160 million."

Contrary to popular belief, Crocs can make money.

Then he added the following: "Importantly, our growth this quarter was driven by strength of wholesale, which was up 26 percent in the first quarter versus last year"

Wholesale was the business dragging Crocs down for the past couple of years. It has turned around and is now a significant contributor.

Then he talked about how the pipeline of products is resonating with customers: "We are very proud to say at last check yesterday, we had 6 of the top 7 best-selling styles on Amazon.com... Fall/winter pre-bookings [are] up 82 percent from a year ago. Backlog as of March 31st was up 74 percent from last year to $204 million."

Wow, these growth rates are huge. Fall/winter is the weak season for Crocs. It seems as if merchants are enthusiastic about the fall/winter styles and that Crocs will generate better results during that season.

Given these results, we are comfortable with our earning power of $1 a share and a $20 stock price as a reasonable value for Crocs. These stellar growth rates are not sustainable, but if growth rates higher than 20 percent persist for a few years, you could see Crocs reaching $30 per share a few year from now.

Giving our Crocs Shoes to Charity

- We wear the shoes and understand why people wear them

- We check the Amazon.com product ranking to see how the brand performs

- We analyze the interactions between customers and the company via social media

- We try to understand the culture of the company by analyzing what the company says and does via the internet

- Monitor the debate about the shoes and the company on the Crocs Twitter thread

Why are we giving our Crocs to charity? Some people will certainly benefit from these great shoes. In addition, we think Crocs will release some cool styles in 2010 and we must make the space available for these.

Investment Leadership Lessons From Dancing Guy

Written by Michael Bigger. Follow me on Twitter.

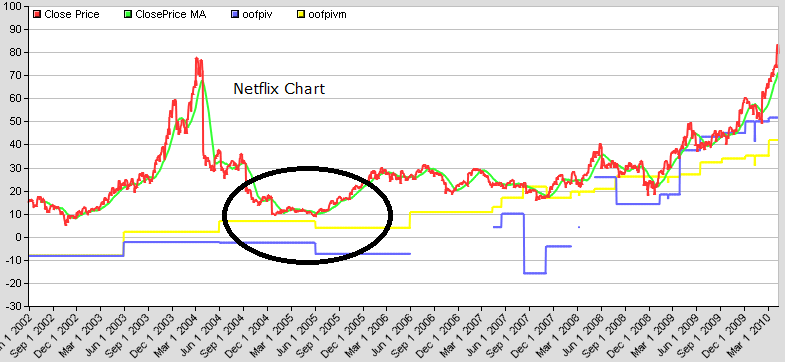

Derek Sivers wrote a great blog post entitled "Leadership Lessons from Dancing Guy". I am mentioning this post in this investment blog because an investor when acting contrary to most investors, stands alone and looks ridiculous. I certainly felt that way when;

- in 1995, I invested in Innovative Fibers.

- in 2001, I invested in Amazon.com below $10 while some analysts counted the company for dead.

- in 2008, we went all in with Crocs below $1.

If your facts are right, the investment thesis appealing, and if you are generous about discussing your investment thesis, a follower will show up. This process could turn one follower into a crowd and this crowd could enhance your catalyst.

What is your take on this video?