LD Micro Invitational Conference

Many thanks to the team at LD Micro for organizing a great conference! In particular, Chris Lahiji did an amazing job bringing so many great companies and investors together. Conrad and Wade organized the 1x1 meetings and dealt with lots of changes to the schedule. In addition to connecting with companies, I was able to network with a great group of smart investors.

At the conference, I had the good fortune to connect with about 20 great companies. Of those, here are the ones I plan to keep on my radar for the near-term:

Iveda (IVDA): Market Cap $27mm.

Iveda is in the cloud-based video surveillance market. Specifically, Iveda generates monthly recurring revenues by offering customers wifi-enabled security cameras marketed through ISP’s. Initial sales successes have been through telecom companies in the Philipines and Vietnam, with Mexico coming online in the third quarter. The cameras themselves are somewhat of a commodity product (low-margin) but they are easy to deliver to the end user (drop-ship from the manufacturer) and easy for the end user to set up (wifi-enabled). The real value and money is in the software to access the video feed (and, for an additional fee, save video for pre-determined lengths of time). Note that the ISPs provide the hosting and storage, Iveda provides the software to link the cameras to the data and storage. Iveda has about $2.6mm in cash on the balance sheet, with $1mm of it restricted related to a specific purchase order from a large customer. Cash burn is currently about $275k / month, with sales successes expected to drive revenues such that cash flow will be positive by year end. In the first quarter of this year, Iveda closed a $3.1mm Series B convert with investors, including a strategic investor. We are monitoring and might get involved if the company gets a bigger strategic investment or if some US ISP’s express an interest.

Calpian (CLPI): Market Cap $25mm, Total Debt $19mm

Calpian is in the mobile payments business. Their largest subsidiary, MoneyOnMobile (72.9% owned by CLPI, with options to buy another 1.1%) operates in India. Of India’s 1.2 billion people, about half of them have no access to electronic payments or bank accounts. Calpian is building infrastructure there to enable people with no bank or smartphone to digitize cash for easier payments. Customers deposit cash at a local bodega and can digitally pay bills including phone, utilities, and TV. Previously, customers needing to pay bills would need to travel (sometimes quite far) to a centralized location where they might wait hours to pay their bills. Using MoneyOnMobile’s transaction-based bank, customers pay a fee on the order of 1% to 5% but avoid the cost and inconvenience of paying these bills with cash. MoneyOnMobile currently has about 260,000 retail locations and about 131mm cumulative unique users on the system, with about 4mm “Repeat Active” users as of April 2015. Monthly average transactions is about 7mm, with about Rs 2Bn (a little over $30mm US) processed in April 2015. Average transaction volume has been increasing, as well as transactions / user. MoneyOnMobile reported $57mm in top-line revenues in 2014, with gross margins of about 1%. We are monitoring the situation.

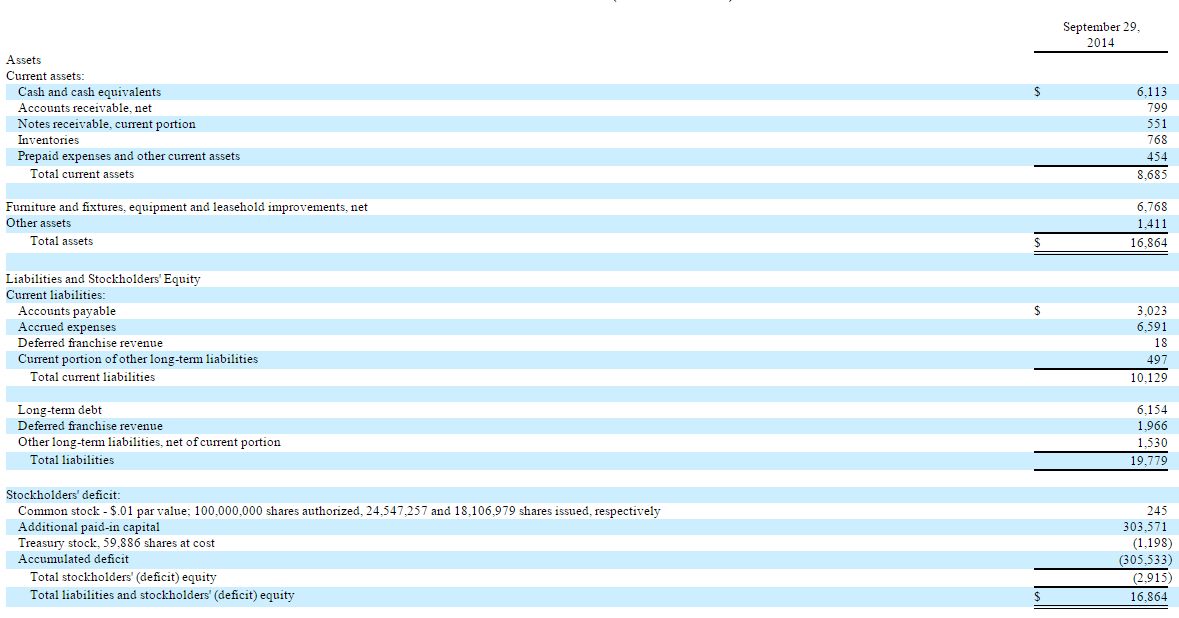

Chanticleer Holdings (HOTR): Market Cap $40mm.

Chanticleer is best described as a publicly traded private equity company in the restaurant operations business. The company primarily focuses on the fast casual arena. Their flagship holding is the corporate parent company Hooters, although there are discussions around selling this parent company to pay off the debt associated with it. Chanticleer also owns 14 international Hooters franchises (mostly in South Africa and Australia). They also own several local high-end burger franchises and chains, including American Burger, BGR, and are under LOI to buy BT’s Burger Joint. They bought a significant share in Just Fresh out of a distressed situation. In January Chanticleer raised about $8mm, mostly through friends and family. The growth strategy involves buying existing restaurants for about 5x or less multiple of EBITDA. Chanticleer continues to operate portfolio chains under their heritage name, but consolidates some operational line items such as beverage contracts and insurance. One thing to note is that there are significant warrants outstanding. We are monitoring the situation.

Spiral Toys (STOY): Market Cap $20mm, almost no debt.

Spiral Toys uses consumer products as a bridge to digital content. Their first area of focus is CloudPets, which is a stuffed animal that connects using bluetooth to phones to provide digital content. On this product, they are partnering with Disney, Wal-Mart, NickJr, and Google. This product launches this fall. The company only went public in March of this year. We are monitoring the product launches to see if they gain traction with the consumer.

Quest Solutions (QUES): Market Cap $10mm.

Quest provides hardware and software solutions for logistics management. They add value to small and medium-sized businesses by designing and implementing systems to improve efficiency. An example would be a bakery that provides buns for fast-food chains. Their hardware and software can allow the bakery to track the usage of the buns to deliver new, fresh product when supply is getting low. Quest provides hardware (tracking RF chips) and software, so there is upfront revenue as well as ongoing. The sales cycle is relatively long (6 months or so) but it is very collaborative and the revenue is sticky. In the last 3 years, only 3 of 90 customers have failed to renew service contracts. There are about 5 competitors that offer a full suite of products, but all (including QUES) are resellers of hardware. For example, they may purchase tablets from Dell or Apple and upgrade the case for durability, add a swivel arm or forklift mounting device, or make other modifications. QUES uses their relationships with hardware manufacturers to improve the economics for both QUES and their customers. They recently acquired two companies, one in November and another closing soon. 2014 Pro-Forma revenue for both acquisitions was $60mm with $2.2mm EBITDA. We are monitoring growth as well as integration of the acquisitions.

IronClad (ICPW): Market Cap $20mm

IronClad designs and sells performance gloves. Their primary market is workers on oil & gas rigs, although they have lines of gloves for many professional and recreational markets (think everything from home repairs and gardening to snowboarding and motocross). They sell through distributors like Grainger. In February 2014 they got a new management team, after the old management team tried and failed at selling the company. At that time, they moved from CA to TX to be closer to their major customers. They took 6 of 20 people from that location, and they are building their sales team. The new CEO ran a $100mm company and wants to grow the business substantially. They have signed over 300 retail doors such as Dicks Sporting Goods, Ace and True Value and Bunnings Australia. Revenues are about $24mm with gross margins about 30% to 35%. The market cap is quite low for the relationships they have, but need to see some catalysts shaping up for us to get interested.

SMTP (SMTP): Market Cap $35mm

SMTP is in the marketing automation business. The company began as an email delivery company. In the last six months or so they made 2 significant acquisitions, GraphicMail and SharpSpring. GraphicMail is basically a competitor to MailChimp, for graphic newsletters and other email campaigns, but with a global sales team (based in 14 countries) that speaks multiple languages. GraphicMail is relatively stable, cash flow positive business. SharpSpring is the real growth potential because it is in Marketing Automation, a $3Bn and growing market segment. Marketing automation is highly competitive, with major competitors Marketo and Hubspot each valued at over $1Bn in market cap and spending about $100mm / year in sales & marketing. Sharpspring has some unique features such as call tracking and CRM integration which appeal to customers. In addition, SMTP is employing a unique marketing strategy. They target marketing agencies (rather than end users directly) to quickly expand its reach to end-users. In addition, SMTP believes SharpSpring will benefit from the huge marketing spend of competition to drive awareness of the sector. Marketing Automation is “sticky” with only about 2% attrition so far on average, since customers get comfortable with the interface and can access historical information. Competition has higher attrition rates, but SMTP believes most users leave for a lower-cost solution (such as SharpSpring). SharpSpring sits in a unique place within marketing automation since it is priced at significantly less than major competitors while including additional features such as CRM and call tracking. For this reason, it can appeal to a larger number of companies who can’t afford the standalone solutions or the salaries of employees to manage these solutions. SMTP has a clean balance sheet with no debt and about $13mm in revenue, $1.3mm EBITDA in fiscal 2014. Need to see significant traction with agencies with consistent low attrition rates for us to get involved.

LiquidMetal Technologies (LQMT): Market Cap $60mm

Liquidmetal manufactures small, complex injection-molded metal parts with 3D precision that resist corrosion and are extremely strong. These products are desirable for several industries including consumer electronics, watches, and medical devices. For several years, Apple paid upfront several years ago for a non-royalty license to use the technology in Consumer Electronics. In addition, Swatch has a royalty license to use it for watches. The company recently hired Paul Hauck as VP of Sales & Marketing with experience in injection-molded metals. Paul is building and training a commission-based sales team with extensive experience in medical devices. The sales cycle can be quite long (6-9 months). In addition, the company completed construction of a manufacturing facility in CA back in October 2014. LQMT has relationships with feedstock suppliers and manufacturers of the injection molding equipment necessary to manufacture parts using LQMT’s technology. The company has $8.2mm in cash with $3.9mm in liabilities. In addition, they have a $30mm undrawn equity line of credit with Aspire Capital with a floor of $0.10 on the stock. Need to see traction (sales) in medical devices for us to get involved.

Telenav (TNAV): Market Cap $350mm.

Telenav makes navigation software. They have been working with Ford since 2010, and just acquired GM as a customer. The 2017 requirement that all new cars have backup cameras will be a tailwind for them because the option to install navigation software will be partially offset by the mandatory presence of a color screen. In 2014 they did about $150mm in top-line at about 60% gross margins. It has almost doubled in the last year, and we think upside potential is 2x at most. At this market cap, this company is too rich for our blood.

Microvision (MVIS): Market Cap $150mm.

Microvision makes tiny laser projecting hardware components. They sell to consumer electronics companies who package the components into a product with a power supply, speakers, controls, etc. The projector doesn’t need to be focused and can project small to large format fairly easily. They have about $18mm in orders to date with SONY and are working with an OEM to fit their product into a smartphone. Currently manufacturing at negative margins, but if they can get sales from $4mm to $50mm they forecast break-even on a gross basis. Current cash position is $16.7mm with a burn of about $1mm / month.

S&W Seed Company (SANW): Market Cap $65mm.

S&W Seed Co is a breeder and grower of two main crops, Alfalfa and Stevia. Alfalfa is the 4th largest (by volume) crop in the world, primarily as a feed crop for animals. SANW has about 20% market share in this crop and this is the stable, slow-growth business. Stevia is somewhat new to the market and has a huge growth potential, although unclear which companies will benefit tremendously from its growth. In the Stevia market, SANW is focused on upstream breeding, and has 2 patents on stevia seeds.

Of interest: RMG Networks (RMGN) Investment Thesis

Jennifer Galperin. Follow me on Twitter and Stocktwits.

Michael Bigger. Follow me on Twitter and StockTwits.

Disclaimer: We have no position in any of the companies mentioned in this article as of 6/12/2015.

Friday, June 12, 2015 at 11:50AM

Friday, June 12, 2015 at 11:50AM