Cockroach Theory with a Positive Consequence. $scss $tpx

Written by Michael Bigger. Follow me on Twitter.

As the stock price of the Sherwin-Williams Company (SHW) reaches all-time highs, it is interesting to look back at how the stock reacted when Rhode Island dropped its lead paint lawsuit on the company in 2006 (see the chart below). We believe the "fallacy of vividness in a Levy flight news cluster" is the model that represents this situation.

A trader who has the ability to view similar situations in their proper contexts can create algorithms to take advantage of the deer caught in the headlights.

Written by Michael Bigger. Follow me on Twitter.

Yesterday, we said in this post that It might be of interest to short the large dealers if they rally.

So we set up our algorithm to lean short on Goldman Sachs (GS) and establish our short as a fade a quick move up type of trade. We were fortunate to get a strong upward move in $GS after it announced earnings. Our algorithm sold the stock short at $164.45 and covered this position a few dollars lower. We were very doubtful that shorting GS was a great thing to do. The beauty of algorithmic trading is that it takes the emotion out of the equation. If the mental model makes sense, follow it. We are just learning about how to trade in a Levy Flight news cluster. This is an experiment, and we could be completely off the mark. Our intuition tells us that until the truffle diggers are done digging, the move and fade strategy is the way to go. Our algorithm will trade GS from a long bias when the news frequency on the company decreases.

biggercapital Twitter stream:

Written by Michael Bigger. Follow me on Twitter.

It did not take long after I wrote the post Levy Flight Path in Algorithmic Trading to get a fraud scandal erupting that was worthy of a Levy analysis. The Goldman Sachs (GS) allegations have already attracted many truffle diggers (journalists and politicians) sending the frequency of Internet news messages to the moon.

It did not take long after I wrote the post Levy Flight Path in Algorithmic Trading to get a fraud scandal erupting that was worthy of a Levy analysis. The Goldman Sachs (GS) allegations have already attracted many truffle diggers (journalists and politicians) sending the frequency of Internet news messages to the moon.

Here is what two of the diggers are saying:

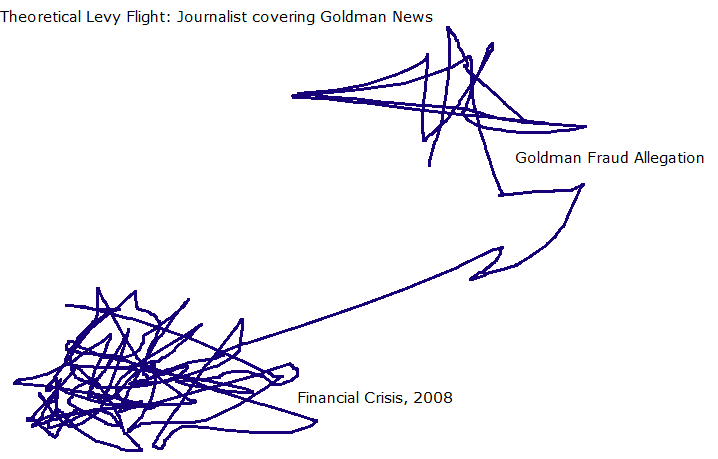

This is how we think things will play out using the Levy Flight model:

We have decided to add GS to one of our algorithmic trading strategies. We believe GS will be a great trading vehicle for agile traders. We can't wait to see how things play out and whether the Levy Flight model holds its own.

How do you think this will play out?

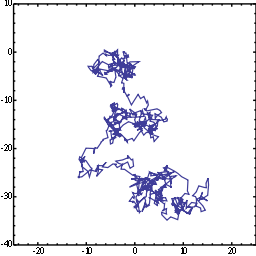

Source: Wikipedia about. For example, think about Merck's scandal involving the drug Vioxx. That was big business news, and it stirred up emotions. Many people took a stance on both sides of the issues related to this event. Writing about Vioxx generated good readership and sold advertising. Eventually, readers got bored with the story and moved on. Our journalist had to find other news. The journalist’s path follows a Levy Flight as depicted in the image, from one random walk to a cluster, followed by the same process over and over again.

Source: Wikipedia about. For example, think about Merck's scandal involving the drug Vioxx. That was big business news, and it stirred up emotions. Many people took a stance on both sides of the issues related to this event. Writing about Vioxx generated good readership and sold advertising. Eventually, readers got bored with the story and moved on. Our journalist had to find other news. The journalist’s path follows a Levy Flight as depicted in the image, from one random walk to a cluster, followed by the same process over and over again.