The other day, I had an exchange about the difficulty of trading options straddles with Twitter user @chicagosean. The Twitter thread is listed below. Sean's issue is that he seems to lose money on the call leg of the options when the stocks move up. Sean is not the only one in this camp. Many experienced options traders have the same problem. Who wants to own bleeding calls on a stock that gently marches upward? Most of us don't. Call buying is appropriate for market makers; value investors with a big, bullish view on a stock; and the traders who think a company might be taken over.

If you want to short the stock via the puts or own volatility on a stock, buy cheap 10 to 30 delta puts. These are your best bet. The trick with these is to be right on your view and not pay much for the options. The best scenario for this bet is a big gap down in stock price with the cheap options exploding on the move, making you richer. If the stock moves up in the short run, you will lose money on the delta of the options, but the options will slide up the skew and they should trade at a higher implied volatility.

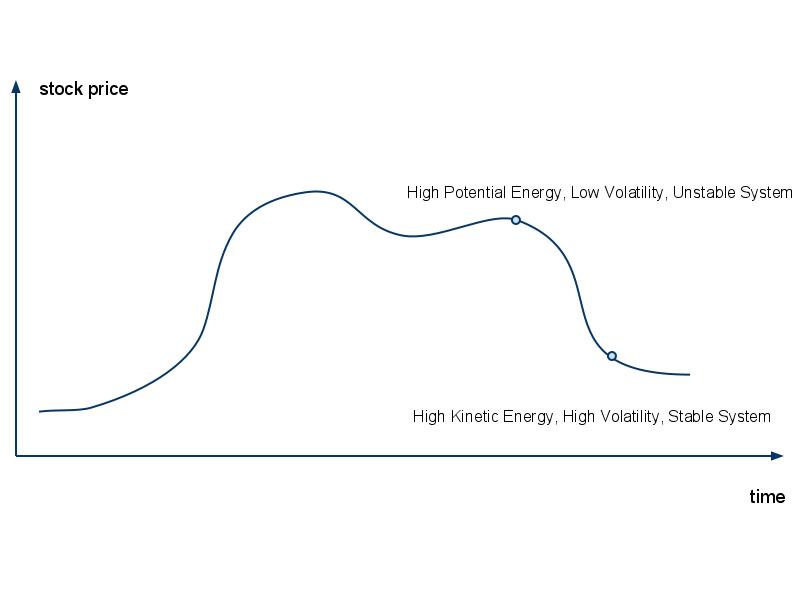

That being said, the current environment is not very favorable for options buyers. Think about it this way: over the last century, the S&P 500 has traded at an average P/E of 13, and the standard deviation of market returns is about 20 percent. Today, the S&P is trading at about a P/E of 13, but VIX is at 35.32. That is paying a big price for volatility for a market that is trading at its average valuation. Just before the financial crisis started, the S&P was trading at 18 P/E and VIX was at 10. It was a better environment for options buyers then.

Twitter Discussion:

chicagosean: Its starting to think its pointless to be a long holder of call

chicagosean: long straddles, even if bot at low vol, up moves are rarely rewarding - or in my case, never. Might as well just buy puts. Thoughts? 8:49 AM May 18th

biggercapital: @chicagosean If you trade the gamma then it is a pure vol trade and if you pay low and it moves alot you make $ 8:53 AM May 18th

biggercapital: @chicagosean yeah implieds usually go down when price goes up but that is the beauty as you want buy cheap vol on expensive stocks ;-) $8:54 AM May 18th

chicagosean: biggercapital if it moves alot to the downside, yeah. Great trade. But if it moves alot to the upside, it never seems worth it. For me.9:00 AM May 18th

biggercapital: @chicagosean what kind of vol r u buying? 10 ish 20 ish 30 ish 40ish higher than that?9:23 AM May 18th

biggercapital: @chicagosean what deltas of the puts and calls r u buying?9:24 AM May 18th

chicagosean: biggercapital I'm a buyer when vol is coming in, seller when its going out. And I've been maintaining neutral delta.9:25 AM May 18th

chicagosean: biggercapital when I enter the straddles or strangles, I'm always entering at or near the money.9:28 AM May 18th

biggercapital: @chicagosean IMO atm will decay vol fast on a move up and vol is not cheap right now9:50 AM May 18th

chicagosean: So, in your opinion, if I wanted to go short 50 deltas, would it be best to purchase 2 OTM puts with -25 deltas each rather than 1 ATM put?9:56 AM May 18th

chicagosean:..is that only in this environment? or would this be a smarter move in most (assuming I wanted to be short deltas)?9:56 AM May 18th

biggercapital: my preference for short deltas are the 10 to 30 delta puts9:58 AM May 18th

chicagosean: bang for the buck? less vol and theta hit? all of the above?10:00 AM May 18th

chicagosean: ....I appreciate your insight. Feel free to tell me to stop bothering you at any time :)10:00 AM May 18th

biggercapital: yes, especially on a gap down. Then the options explode10:01 AM May 18th

biggercapital: is good, if I don't answer on the spot that means busy but will come back to ur question10:02 AM May 18th

biggercapital: feeling though is overall options are very expensive now, hard bet10:02 AM May 18th

chicagosean: thesis I'm working with is that I'm trying to always be positioned long vol (more when its cheap, less when its expensive)...10:05 AM May 18th

chicagosean:..and just playing with different ways to best take advantage of this stance. Been doing straddles, but I haven't liked the overall results10:06 AM May 18th

chicagosean: seems the best way to play it is to simply be long puts, while managing risk properly. (only commiting x% of capital)10:08 AM May 18th

biggercapital: that makes sense 10:16 AM May 18th

Friday, June 25, 2010 at 7:22AM

Friday, June 25, 2010 at 7:22AM