Algorithm Concepts

Some concepts I think about when developping an algorithm:

|

Physics |

Biology |

Social |

Behavior |

Chemistry |

Finance |

|

Torque |

Evolution |

Semantic |

Crowd |

Shape Memory |

Volatility |

|

Elasticity |

Survival |

Simplicity |

Collective Wisdom |

Atoms |

Factors (Drivers) |

|

Momentum |

Biology |

Complexity |

Opinion Diversity |

Molecules |

Correlation |

|

Distance |

Genetic |

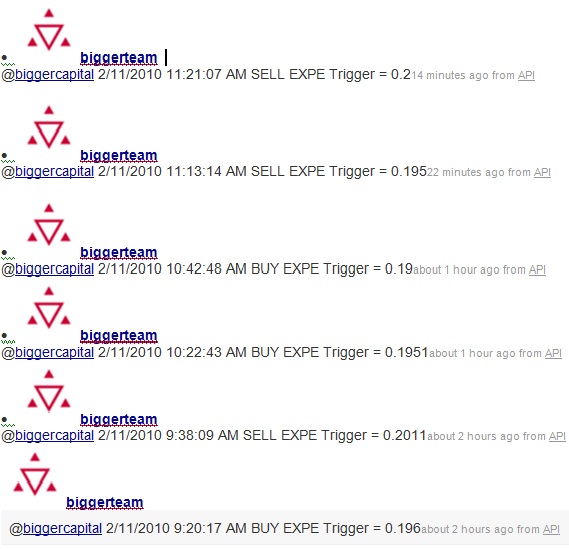

Social Media |

|

|

Value |

|

Acceleration |

Chromosomes |

Intelligence Augmentation |

|

|

Technicals |

|

Amplification |

Pheromones |

Network |

|

|

Assumptions |

|

System Instability |

Insects Behaviors |

|

|

|

|

|

Stochastic, Random |

|

|

|

|

|

|

Potential |

|

|

|

|

|

|

Kinetic |

|

|

|

|

|

Sounds a little bit crazy but it works for me. Am I missing anything worth exploring?

Written by Michael Bigger. Follow me on Twitter.

Friday, March 5, 2010 at 11:35AM

Friday, March 5, 2010 at 11:35AM