How my Imagination Turned into Trading Profits

This post was inspired by watching a two year old girl paint her cheeseburger, with ketchup, using a French fry.

I got into the trading business as a day trader and expanded into a swing trader. Along the way I never thought I would be trading spreads between two different securities. Play around. Make lots of mistakes. Color outside the lines. Be creative. These are some of the fundamentals that I learned from trading spreads and much like the kid and her ketchup, I knew that I was on to something really cool.

Michael Bigger introduced me to the concept of staying small and rotating your inventory over and over until your value compounds and compounds towards infinity. Value increasing along the money, knowledge, satisfaction, and doing great work vectors. Sounds great but it was only when I actually tried it that I realized it was possible. Spread trading allows you to see relative value between the two sides of the trade, and play with your food where you previously were taught not to. Looking at the market from this perspective reminded me that everything I've done well in my life I've done with my imagination. Imagination is limitless, and if your approach to the market requires your imagination, shouldn’t that make your profits limitless too? I liked where this was going.

So I went and played with my trading. Put on a trade, closed the trade. Learned and adjusted. Put on a trade, closed the trade. Learned and adjusted. I put on a stock vs. a stock trade. Then a stock vs. ETF trade. Then a ETF vs. ETF trade. I made directional trades like I always do and then I made statistical mean reverting trades where they made sense. All those trades were like inventory in a store and I moved them out when they hit my profit or loss level, replacing them with a new inventory of trades. I stayed small to keep rational and that rationality allowed me to stay creative. Trading became a process rather than a result.

If I knew the road to trading success began with sticking my fingers in food I probably would have done it a lot earlier in my career. Now that I've found a community of traders that share a creative outlook in trading, I have the confidence and support to make the adjustments that I always knew I could.

This is a guest post written by Eric Gong. Eric is a member of the SpreadTraderPro community. Follow Eric on Twitter and StockTwits.

Elevating my Trading Business

Jennifer's Trading Resolutions

2011 was a good year for me. I accomplished a lot, and learned a ton. Sure, I made some mistakes. But I definitely learned from them. Here are some of my resolutions to make 2012 another good year for me:

- If you find one good trade, look for more similar ones. Experiment to figure out what about the trade made it good. Was it the market momentum? The sector or industry of the stocks? Did earnings or dividends play in? Was there a liquidity gap or spike that you capitalized on?

- Share ideas. Social media and blogging are great ways to communicate with other smart traders, and get a new perspective on your trading.

- Don’t over-manage orders. Accept that you can’t always buy at the exact bottom tick or sell at the exact top tick. What matters is positive, consistent P&L.

- Give positions room. Once you have a position, accept that it might move against you a little. Set a stop-loss and stick to it. Again, positive and consistent P&L.

- Tweak your framework from time to time. Maybe you found a good trade that makes you look for others in new places. Maybe you notice a theme, such as missing some opportunities or falling short of target exits. Maybe a comment to a blog post makes you think about a new idea. Experiment with your parameters and you might find something interesting.

What are your resolutions?

Written by Jennifer Galperin. Follow me on Twitter and StockTwits.

You Asked

SpreadAnalyzer users have asked us: We want a daily scan run on U.S. ETFs. We understand you want to make money trading ETFs pairs. Here is the good news.

Starting today, the SpreadTraderPro members will receive a daily scan of US ETFs at no additional charge! That’s right. You now get a daily scan of spread trading opportunities from US equities and ETFs, and as always, you get unlimited access to daily trade ideas from our traders, to our forum, blog, and educational videos—all for just $49 per month or $350 per year! If you are not a subscriber already Sign up today and get our handbook, “How to Trade Spreads". If you are not completely satisfied, you can cancel anytime and keep the handbook for free.

Click SpreadTraderPro to find out more and get your free gift.

Happy trading and Happy New Year!

The SpreadTraderPro Team

P.S. Stay tuned for more spread trading innovations from SpreadTraderPro. See why Peter said, “If you keep adding products, I won’t need a programmer anymore!”. Don't miss out.

2011 is the Year I Started Over

- I have helped build the SpreadTraderPro community and Spread Analyzer through experimentation in a sandbox (Creative Space), innovation and iteration.

- I have educated myself about trading algorithms, APIs and other technologies that would help me build trading recipes. As Michael said it in his blog post How to Start an Algorithmic Trading Business in within a Week - "Let technology work for you by leveraging your trading knowledge".

- I am constantly improving my technical skills. I was neither the best programmer nor the brightest person in the room. I took it one step at a time to learn new technologies and acquire new skills. Practice and repetition until it is automatic.

- I wanted to absorb “things” that can add value to me and to my business. In return I will pass on these things in the form of “value” (it could be new API, algorithm, technology, new blog post or just a piece of advice etc.) to my stakeholders.

- I always strive to improve my writing. Here I am writing this blog. I have written blogs in the past for Bigger Capital. Example - http://goo.gl/eWBBZ .

- I have surrounded myself with the most amazing Entrepreneurs, Traders, dream-builders, bloggers using social networking sites such as Twitter, StockTwits, LinkedIn, Kindle page, Google+ etc.

- I am obsessed about compounding everything – Knowledge, money, relationships!

- I invest my money in the market and I build a long term pension portfolio.

- I trade my money and my family’s portfolio part time.

- I have adopted a minimalist lifestyle. I have simplified my living.

- I spend below my means. I strive to minimise my liabilities.

- I read books and blogs that can help me in my entrepreneurial journey and self-discovery.

The Fifth Habit of Creative Traders: Experimenting with Your Ideas

Don’t you love it when kids go wild in a sandbox? They build bridges, rivers, castles, and moats, their imaginations going wild with what they can imagine. For kids playing in a sandbox, anything is possible. They twist their minds, try all sorts of things, learn a ton, and exit much smarter little people.

I want to encourage you to become a kid once again. Experiment, tweak, and tinker in the sandbox and on the Internet, and find what works for you.

Recently, I read Something Incredibly Wonderful Happens: Frank Oppenheimer and the World He Made Up. This is a fabulous book about the life of the famous physicist. It is a book every trader should read. K. C. Cole, the author, delves deeply into Oppenheimer’s views on experimentation and play, which were the cornerstones of his brilliance in physics:

“So much time is spent just playing around with no particular end in mind,” [Oppenheimer] wrote. “One sort of mindlessly observes how something works or doesn't work or what its features are, much as I did when, as a child, I used to go around the house with an empty milk bottle pouring a little bit of every chemical, every drug, every spice into the bottle to see what would happen. Of course, nothing happened. I ended up with a sticky grey-brown mess, which I threw out in disgust. Much research ends up with the same amorphous mess and is or should be thrown out only to then start playing around in some other way. But a research physicist gets paid for this ‘waste of time’ and so do the people who develop exhibits in the Exploratorium. Occasionally though, something incredibly wonderful happens.”

. . . He asked his friend Bob Karplus, a physicist at the University of California at Berkeley, if he thought there was anything a young person must learn before it is too late, and Karplus' answer was “play.”[1]

The physics laboratory and the Exploratorium were Frank Oppenheimer’s playgrounds. Emulate Frank and build your own trading laboratory. For you as a trader, “occasionally though, something incredibly wonderful happens” means:

- I have finally discovered a great trading recipe.

- I have improved my trading plan.

- I have learned a new way to harness the Internet’s energy.

- I have discovered a new one-good-trade setup.

- And so on.

Be creative, experiment, observe how nature works and how humans behave, and apply your findings to the market. In your search for your trading recipe, you should heed Frank Oppenheimer’s philosophy: “Oppenheimer stressed the importance of play, courage, and guesswork Science.”[2]

At Bigger Capital, our laboratory consists of a sandbox account (paper trading) connected to our experimental software and quote functionality via a set of APIs. The software might or might not be connected to the Twitter API depending on whether we are importing financial ecosphere data.

We have derived our trading algorithm from our body of financial knowledge, the insights we have gained from practicing our craft and interacting with like-minded individuals, and all the experience we have acquired during all the days we have been trading. We are open to trying all sorts of trading experiments. We concoct recipes. We mash up trading stuff until “something wonderful happens”—until we have a trading framework for monetizing our newly discovered insights.

As an example, we have developed many one-good-trade frameworks that are statistically profitable using statistical analysis and other methods. When you have developed such a framework, you execute another good trade, then trade another one, and then continue this process. We create trading recipes, and we use technology to multiply the do-another-good-trade-and-another-one-etc. model.

Don’t limit your experiment to your trading processes. Leave no stone unturned. Everything is fair game, including how you interact on the Internet, for generating better information. Experiment with your blog posts, your operational processes, and every single component of your business model.

The idea is to take your hunches and insights and create your one-good-trade framework. The process is similar to a sculptor starting with raw material and working his or her way to a beautiful finished product. It is creative and messy, and it requires patience and tenacity. You are an artist. Shape that framework until it works in awesome ways for you.

If you get stuck, break down the task into small chunks and iterate until you get to the desired outcome. I wrote “Break Down Your Algorithm Plan into Smaller Parts” to show you how this is done with a trading algorithm. You can apply this strategy every time you get stuck with a challenge.

Since you must stay ahead of the game and maintain your edge, always work on developing new one-good-trade frameworks. You only need a few to become rich. If you develop a few great recipes and have a vision for their proper execution, you will succeed.

Exercise:

Try the following experiment: In a sandbox account, create a notional neutral (long notional-short notional=0) portfolio of stocks using the best methods you have developed to find long and short candidates. You can use our Spread Analyzer to include some pairs into this portfolio. Track the return of the portfolio and see how it performs over time. Push this exerise even further by making the portfolio beta neutral.

As you run the experiment, ask the following questions:

- Should you rebalance your portfolio at specific intervals of time to account for changes in your selection criteria or changes in the value of each position?

- Can you think of any ways to improve your results?

- Are you learning anything?

- Have you observed anything unusual in how the portfolio is performing?

- Are you generating alpha? If not, why not?

Are you ready to experiment?

Written by Michael Bigger. Follow me on Twitter and StockTwits.

P.S. You can learn more about the other habits of creative traders in my book titled How Traders Achieve Creative Flow.

[1] K. C. Cole, Something Incredibly Wonderful Happens: Frank Oppenheimer and the World He Made Up, (Boston: Houghton Mifflin Harcourt, 2009), 18.

[2] Ibid., 224.

Kraft and Heinz Day Trading Idea

I wanted to share Steve Cole's amazing idea: 10 * KFT - 7 * HNZ. The spread (pair) worked well for both of us. Sold it in the encircled area and covered for a nice gain. Steve is a member of our SpreadTraderPro community and he is learning fast.

The spread is "oscillating" nicely within the 2 year timeframe. I'm looking to sell this spread again if it retraces to above -3.00.

Written by Aris David. Follow me on Twitter and StockTwits.

Warning: Augmented Traders Invading our Town

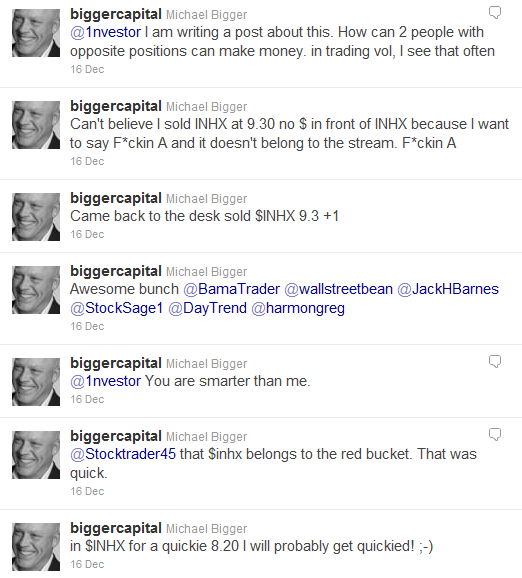

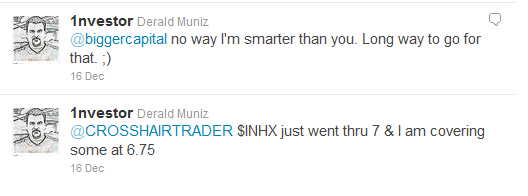

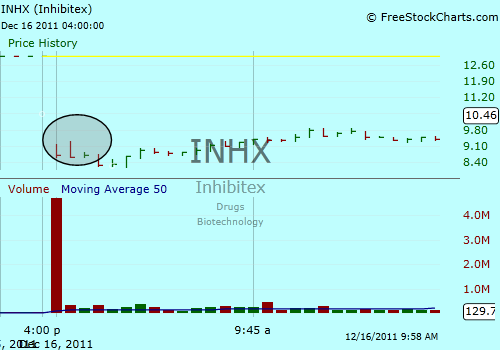

I had quite a cyber trading experience last Friday with Inhibitex ($INHX). The stock dropped 37 percent during in the pre-open market session on fear over the Pharmasset news. Having traded this beast before, I decided to buy a good size trading position for a quick turnaround at about $8.20 (see tweets below). The stock proceeded to drop into the $6 territory a few minutes after I made my purchase making me look foolish. I was thinking hard about closing the position when I noticed from the corner of my eye Derald Muniz (@1investor)’s tweet about covering his short position at $6.75.

This quick thought came to my mind: if Derald is covering, we might get a bounce from here. Anyway I had a meeting to attend so I put an order to sell the position at $9.30.

When I came back to the desk right after the market had open I noticed the fill on my station for a $1.10 profit per share. I was happy and I have @1investor to thank for his tweet nudging me into the patience territory.

I have followed Derald for quite some times and it is amazing how often we cross path trading the same names especially the great companies getting clobbered on some kind of news.

I gain lots of value using the Twitter API to augment myself as a trader and synchronize my brain with the bests. This experience is a clear example of what I mean by growing a second brain on Twitter.

Thank you Derald.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Wednesday, February 1, 2012 at 8:53AM

Wednesday, February 1, 2012 at 8:53AM