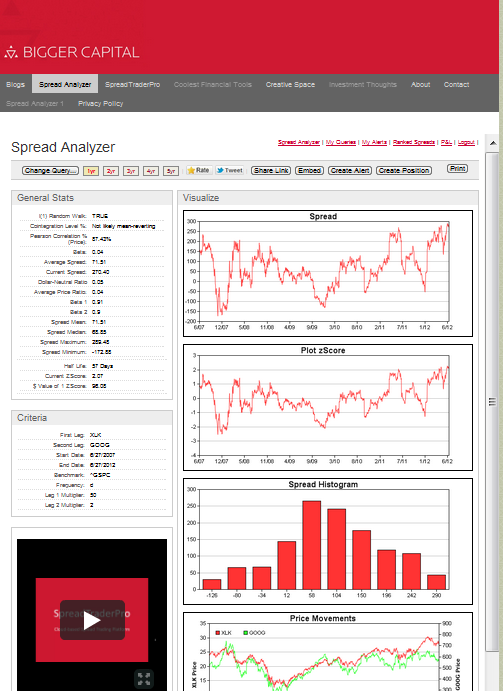

VMware Versus the Technology Select Spider Spread

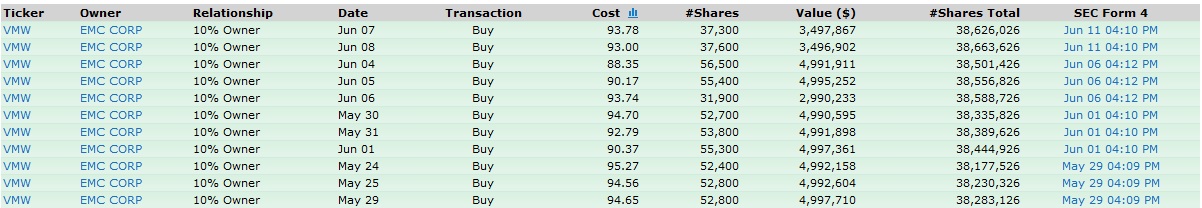

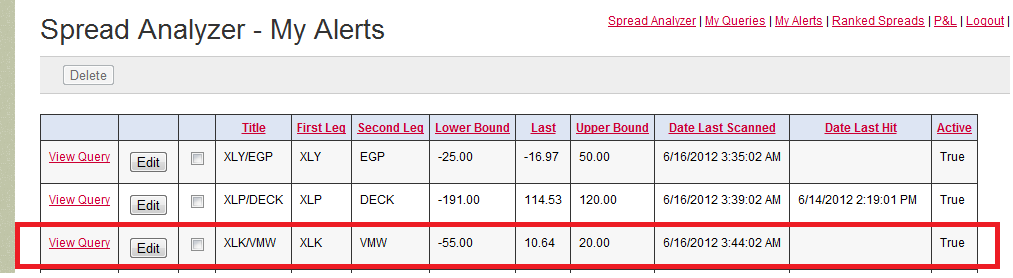

We are monitoring the $XLK $VMW $spread based on recent insider activities. We are hoping that we can get a spike in the 10 * $XLK - 3 * $VMW to the 20 level. We have used the My Alerts feature of our Spread Analyzer to monitor this $spread for us. Located below, are all the documents supporting our thesis, as the insider buying we think is bullish for VMW (bearish for the spread). If the $spread reaches the $20 level, we will be happy sellers.

Written by Aris David. Follow me on Twitter and StockTwits.

Kroger Versus S&P Spread

Some of my favorite scans we provide to our SpreadTraderPro members are statistical runs on ETFs vs stocks. On May 2, Kroger caught my attention as it was cheap statistically versus $SPY. The spread SPY-KR was trading near the high of the range, with a zscore of +1.6:

The momentum though was clearly favoring $KR to weaken further against the major index so I decided to wait to sell the spread. I set an alert at a level of +$5 using the "My Alerts" tab. On June 13, the alert triggered when the spread traded above 5 and I sold a small quantity at $5.04.

On June 14, the company increased its earning forecast for fiscal year 2012. The spread dropped to -2 on the news and then rebounded to $1 and I sold more at that level.

This is a spread I will sell more of at any opportunity as it moves back toward its average with the current catalyst.

The trick here is to combine value and a catalyst that will propel the spread to a more normal level. The catalyst is critical to put an end to the momentum that pushed the spread in the overvalued category in the first place.

Where do you see pockets of value on a relative basis? Have you thought about running a statistical test on your stocks versus major indices using our Spread Analyzer?

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Canon Value Play

Yesterday, we sold the 2 * SPY - 5 * CAJ at 66.78. Here is a short video explaining why we did it.

How to Rate Spreads

Written by Jennifer Galperin. Follow me on Twitter and on StockTwits

Parameters of Statistical Arbitrage Spread Trading Webinar

This past Wednesday we held a webinar about the parameters for statistical arbitrage spread trading. We had a great audience, and many people have written me separately to ask about a replay. You can find the replay at the bottom of this blog post.

One thing that always surprises me about spread trading is how many different ways there are to look at it. Even within statistical arbitrage, you might think that computers can choose the spreads and trade the strategy without human input. But the old saying "garbage in, garbage out" holds true here too. The trader has to design a strategy to select spreads based on the parameters. There can be as many different strategies as there are traders, because each trader takes a slightly different view on the input parameters.

In the webinar, we talked about the significance of cointegration, half-life, zscore, and term. I talked a little bit about how my strategy views these parameters, and I am interested to hear how your strategy is designed. Please feel free to comment about that, or leave feedback about the webinar.

Here is the webinar replay:

We hope you will join us next month for the next webinar in the series.

Written by Jennifer Galperin. Follow me on Twitter and on StockTwits

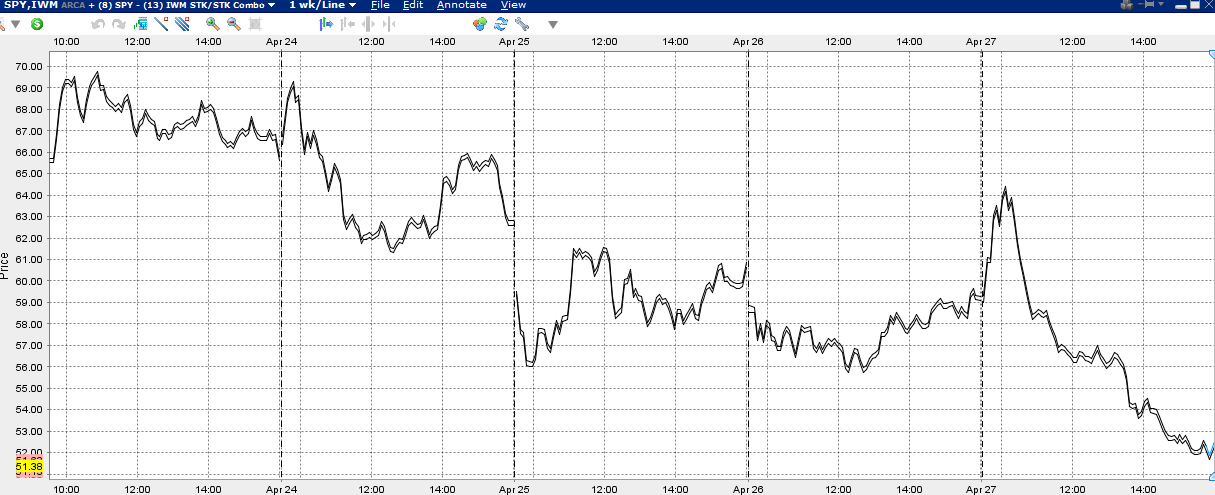

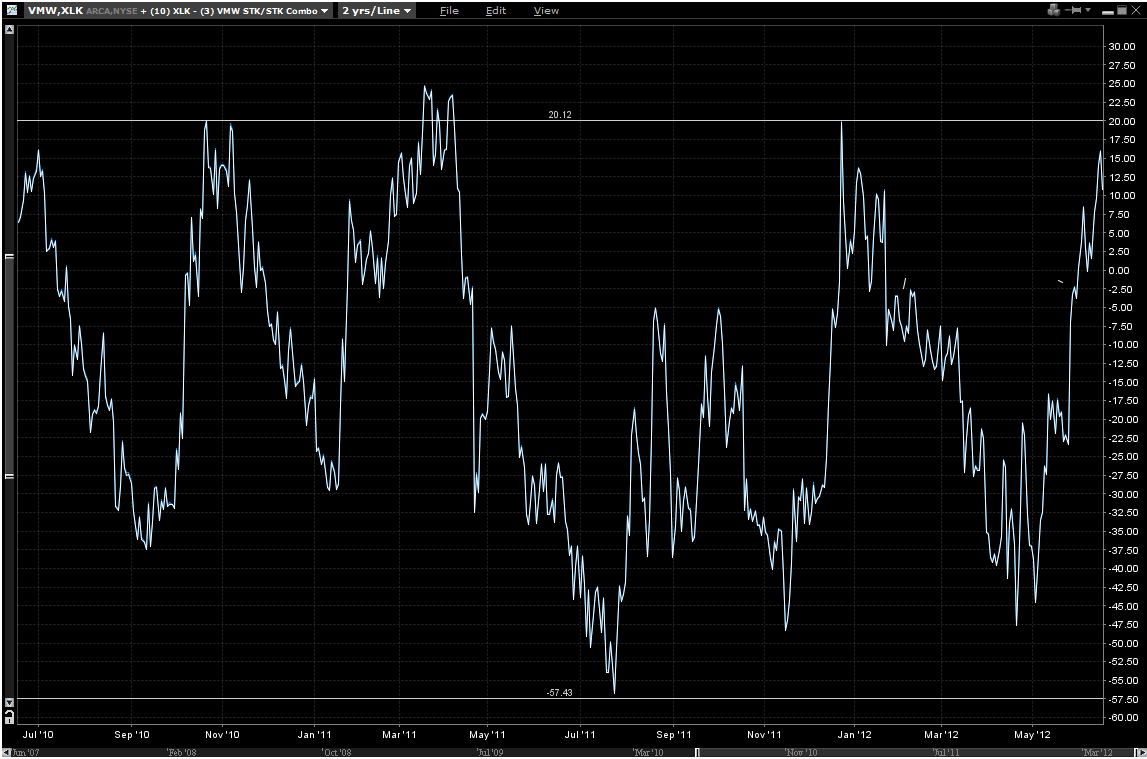

I Wish I Had Learned to Trade This First

A while ago I wrote a blog post about Starting Over. There are a lot of things I wish I had known when I started my trading career. One thing I wish I had done was to learn how to trade 8*$SPY - 13*$IWM. This is my favorite trading vehicle. I think most traders should keep this spread on their screens. The trading apprentice should play with it in a sandbox. Here is the statistical run-down on it:

For a larger image, click here.

Here is a graph of this spreads at a shorter time scale:

If you want to become a professional trader, there is a lot to learn. When you are first starting out, SPY-IWM is a great product because it is liquid, easy to understand, can be traded on a short (but not instant) time-frame, and provides lots of opportunities to make money. It will help you learn some of the subtle yet important aspects of trading, such as:

- Setting probabilistic and symmetrical stop losses

- Emotion and it's impact on the market

- Liquidity gaps and spikes

- Pricing lags in one security versus another

- Changes in the market environment, and how to adapt your strategy

- Intraday time windows

What is your favorite trading vehicle?

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Darwin the Trader

Charles Darwin is widely known as the man behind the Theory of Evolution. He theorized that through evolution a species could adapt to different environmental conditions. Those individuals who did not adapt would not survive to pass along their genes.

A friend said to me the other day, “It is the market’s fault I lost money trading last month.”

I could have agreed with my friend's opinion since I have spent the last two years building my quantitative strategy and I have had plenty of setbacks along the way. Now in the current low-volatility enviromnent I am making money trading my strategy at a very short time scale, choosing my entry points very wisely, and capitalizing on many small gains.

At various points in my journey so far, I have had to cut limbs to survive. I had to admit I did not know much about quant strategies when I started. I made mistakes, took steps back to think, I iterated, re-tested, and moved forward. I had to adapt to market conditions all the time.

What has worked for me is to adapt to different market conditions all the time. Like a football team, I started by building a book of plays that will work at diffeSave & Closerent times and against different opponents, in different market environments. I learned that what worked last week may not work this week or next. I need to understand my opponent by recognizing trends, inflection points, and themes in the market, all of which can change on a dime. I use my growing playbook to exploit this situation. If you build a good playbook you will have the trades set to make money in any market conditions by adapting and evolving.

A playbook is the tool I have built in order to adapt.

So how do we adapt? For quantitative traders, this can be one of the hardest things to do. Computers don’t learn and adapt, they just crunch numbers. Humans need to think very carefully about the inputs. Maybe that means we ask the computer to look at performance of the strategy in bull and in bear markets, or in low and high volatility environments, or in times when oil prices are low and high. Whatever we think might impact our strategy. Maybe we find that when certain market conditions are in effect, we need to tweak our strategy (or radically change it). Then, experiment with the change. Try one or two small trades to see how they perform. But don’t get too comfortable, because the next change in the market is just around the corner.

Later this month, I will host a webinar discussing how I have built my playbook with detailed trades. Stay tuned ... details to come shortly.

Written by Jennifer Galperin. Follow me on Twitter and StockTwits.

Learn to Trade Like a Math Geek

On Wednesday we held a webinar "Learn to Trade Like a Math Geek". We had great turnout, and I want to thank everyone who joined us. I've received a lot of emails asking about the recording, which you can find at the bottom of this blog post. We discussed some of the key math terms involved in statistical arbitrage spread trading. Many of the questions were specifically about calculations and how they are done. It is important not to get too bogged down with the math. Cointegration tells you that the two stocks have a history of reverting to a mean level like a spring. When you design your statistical arbitrage trading framework, you want to build a portfolio of these spreads. You should see that most of them behave nicely, while a few continue on their trend away from the mean. You'll develop your own recipes for determining when spreads will behave well and when they will not. You may even develop some recipes for trading spreads that are very different, like the earnings strategy we discussed at the end. The beauty of statistical arbitrage spread trading is that you can design your own strategy however you find it works best. Here is the replay.

Written by Jennifer Galperin. Follow me on Twitter and StockTwits.

Thursday, June 28, 2012 at 7:37AM

Thursday, June 28, 2012 at 7:37AM