Don't trade, code the trade. Focus on the platform, on the proces, on the algo. #trading

Exactly. See previous post.

Exactly. See previous post.

You are a successful trader or an aspiring trader. You should consider expanding your horizons and increasing your profits. Leverage your trading strategy into a trading algorithm and a trading platform.

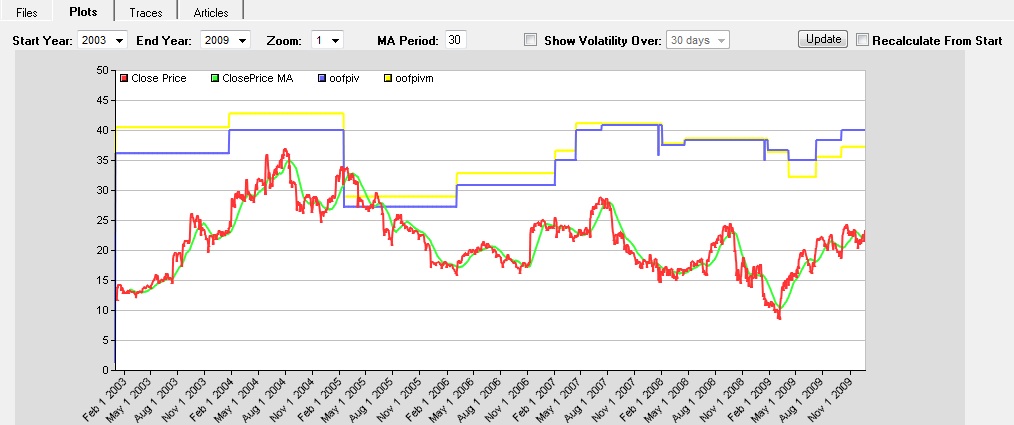

In 2008, my business partner had a terrific year trading S&P 500 futures against Nasdaq 100 futures. I decided to implement some of his techniques to the single-stock world. The result was a low-volatility strategy ("Strategy 2"). After running Strategy 2 in a trading sandbox and some fine-tuning, Bigger Capital is now making money with it. Our intention now is to start running Strategy 2 in a different trading entity with institutional money in a managed account, accumulate more of a track record, and then launch Strategy 2 in its own partnership vehicle.

The best way to start tinkering with your algorithm is to experiment in a sandbox. See more about this subject right here: http://bit.ly/2dN2C6.

If your broker does not offer a complete suite with application programming interface (API) tools, you might want to open a brokerage account with a different broker. I wrote the following post on how to choose the right online broker for your algorithmic trading business: http://bit.ly/8Qli9Y. Check it out and let me know what you think!

Great Post from John Dalt: "The Fed's MBS Shell Game" http://bit.ly/70QPsf

1. My good friend Eric G. led me from a task force composed of major financial institutions to the Treasury Borrowing Advisory Committee. The graph on page 34 shows the Federal Reserve (Fed) buying all the U.S. Net Fixed Income Supply in 2009. The table on page 35 shows that the Fed is supporting the fixed income market with its action in the mortgage-backed security (MBS) market. Printed money is supporting the U.S. fixed income market. As soon as the Fed stops its action, the Treasury market will gap down. Page 35 begs the question: Who is Households? See bullet #3 below.

2. China can’t fund our current addiction. Here is what Zhu Min, deputy governor of the People's Bank of China, has to say about the U.S. current account deficit according to the Shanghai Daily: "The US current account deficit is falling as residents' savings increase, so its trade turnover is falling, which means the US is supplying fewer dollars to the rest of the world," he added. "The world does not have so much money to buy more US Treasuries."

3. Eric Sprott asks:“Is it all a just a Ponzi scheme?” In this article, he is trying to explain “Households” from bullet #1 above.

4. Fannie and Freddie: "Treasury removes cap for Fannie and Freddie aid." U.S.A. goes from cocaine junkie to heroin junkie. The addiction continues.

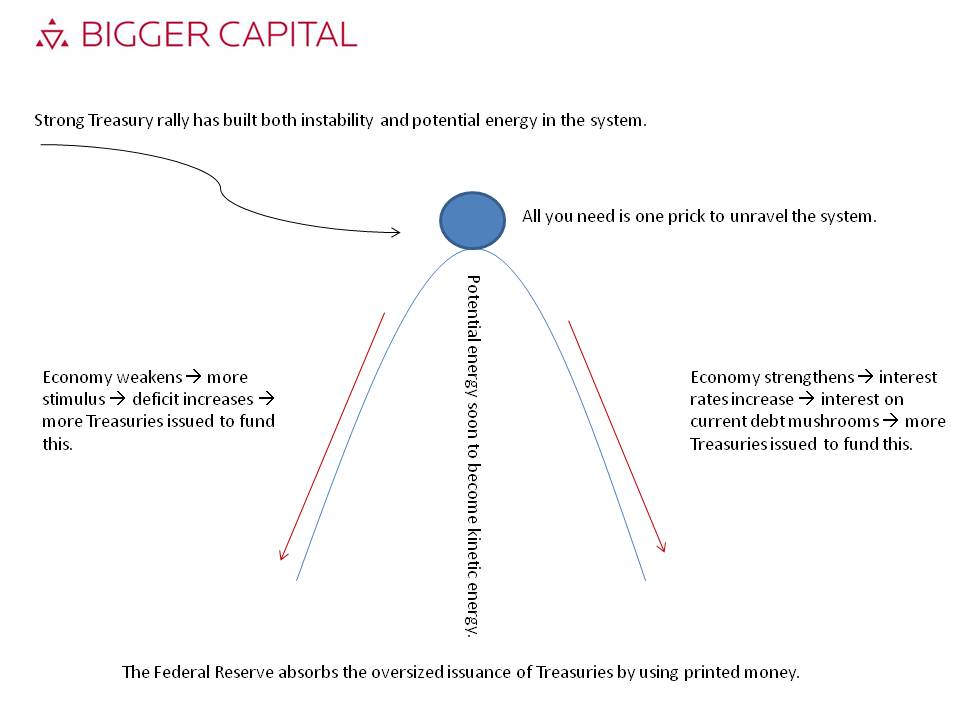

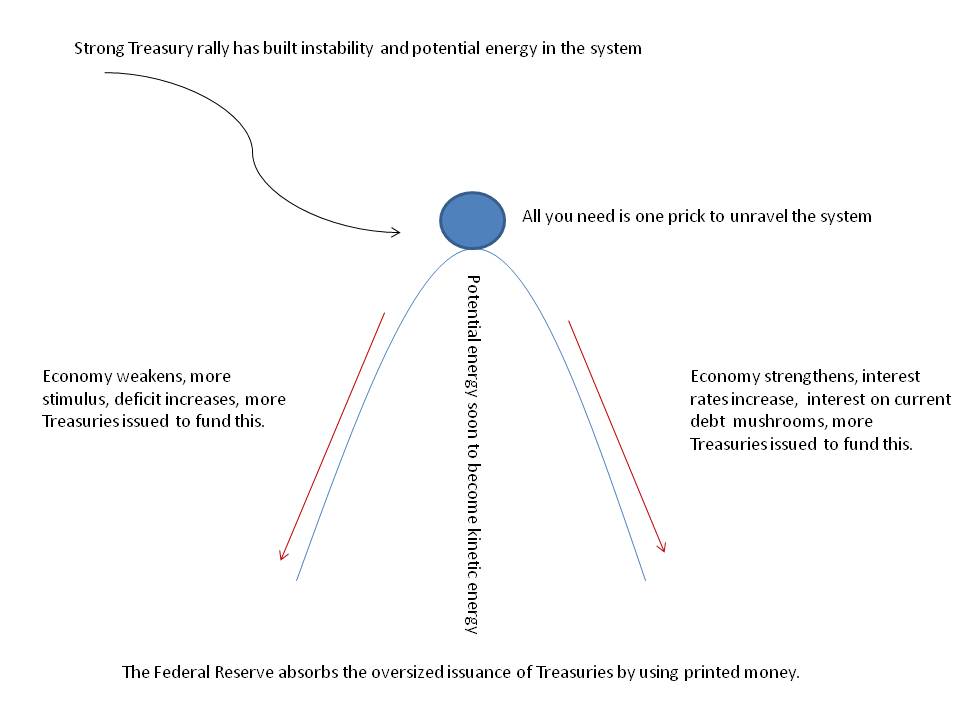

5. This leads us to my own chart: we have a very unstable system.

My career as a trader dates back to the mid-1980s. In the 1990s, I ran the single-stock derivatives trading business at Citibank N.A. At that time, Citibank’s single-stock derivatives portfolio was one of the largest in the world. In 1998, I moved to D.E. Shaw and ran an identical business.

In 2004, I started Bigger Capital, a hedge fund that uses advanced trading technologies to make money from market discrepancies.

I have been trading extensively on Trader Workstation (TWS) from Interactive Brokers (IB) since the late 1990s. As a testimonial to the superior IB trading experience, Bigger Capital runs entirely on IB’s Hedge Fund Platform.

When choosing an online broker for your algorithmic trading business, you might want to use the guidelines listed below. After you have chosen a broker, it becomes very hard to switch—especially after you have developed software running on a broker's platform. Save yourself some headaches by making the right decision up front.

Here are the attributes you should look for in an online broker:

1. Low trading cost.

2. Powerful and reliable technology.

3. Comprehensive sandbox for experimenting with your strategy. See more about this subject right here: http://bit.ly/2dN2C6.

4. Extensive and cutting-edge Application Programming Interface (API) technologies. For traders with little or no programming experience, we recommend going with a broker that offers a simple DDE for Excel platform, as Excel offers a familiar and user-friendly interface.

5. Breadth of products in both type (stocks, bonds, futures, commodities, currencies, options, etc.) and geography (global).

6. Powerful algorithms you can use to make money right out of the box.

7. Continuing education via webinars.

8. Strong credit and very well capitalized.

9. Reliable and fast mobile platform.

Am I missing anything else? Let me know.

PDF version of this image: http://bit.ly/7JyJCq

In a few paragraphs this article explains the coming collapse of Treasury securities. http://bit.ly/8sIez4

Learn to love bear markets like David Tepper does. Way to go! Very few were standing on their feet during the dark days. http://bit.ly/6Xvnx8

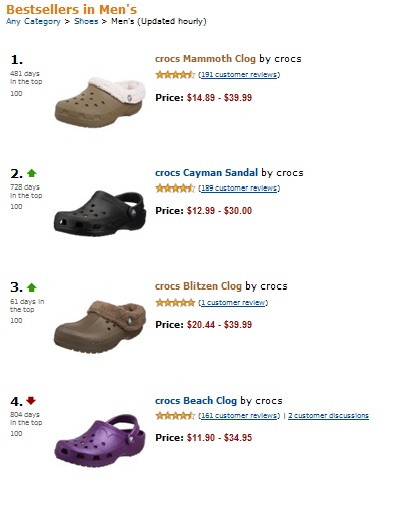

Interested in knowing which company's products resonate with customers? Go to Amazon.com and monitor which products are the bestsellers on the site. If you are interested in investing in companies making winning products such as the iPod, Crocs, Uggs, OXO, Tempur-Pedic, and others, you can take the pulse of your favorite brands on Amazon.com.

On the site, you will find out how products rank with customers, and you will also discover emerging products. By listening to Amazon.com's consumers through reviews, comments, and forums, you will learn what makes a product a winner and it could lead you to a very profitable investment. You can also initiate discussions with a product's users by asking questions directly to the reviewers or to the product's forum community.

For example, take a look at the star ratings below to see what people think of Crocs. At the time of writing this post, Bigger Capital had an investment in Crocs (CROX).

How do OXO products score with reviewers on Amazon.com? At the time of writing this post, Bigger Capital had an investment in Helen of Troy (HELE) owner of the OXO brand.