On Wednesday we had our first Spread Trading webinar. Michael gave an overview of the importance of spread trading as a trading tool, and I discussed fundamental concepts. We had a great turnout. If you attended, we hope you found it useful. If you missed it, you can find the recording at the end of this blog post.

Spread trading at its heart is a way to formalize something we all do anyway, which is to compare our profits (or losses) with our opportunity cost. If I bought a stock because I thought it was cheap and it went up but the rest of the market went up more, did I really make a good decision? In spread trading, you are trading this relative performance explicitly. It is easier to identify pockets of value because you limit the number of factors to just the relevant ones for your particular trading thesis. One security is cheap relative to another, or relative to the market, always relative to something.

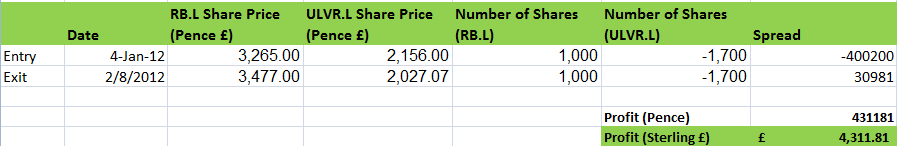

There are many different types of spread trades. There are options spreads (and within options spreads, there are vertical and calendar spreads). There are futures spreads, stock spreads, statistical arbitrage spreads, and merger arbitrage spreads. The list goes on and on. You can even push the spread concept to value investing being the difference between the stock price and its intrinsic value. The common theme is a view that one security will outperform the other. Once you have this view, you can create a spread by buying the cheap security and selling the expensive one.

During the webinar, we got a lot of questions about statistical arbitrage spreads. The next webinar will focus specifically on stat arb spreads and the related mathematical terms and concepts (such as cointegration, correlation, z-score, time frame, etc.). If you are a member of SpreadTraderPro, the “How to Trade Spreads” handbook that you received when you joined has a lot of information on this topic. In addition, your daily scan contains tons of cointegrated spreads every day. If you are not a member, you can sign up or wait for the March webinar to learn more about this topic. For details, sign up with our free Spread Analyzer to ensure you are on our mailing list. Details will be coming soon.

Thanks to everyone who participated in yesterday’s webinar. If I did not get to your question yesterday, I hope you found the answer in this blog post. If you have more questionss, please leave them as comments to this post or send me a tweet.

Written by Jennifer Galperin. Follow me on Twitter and StockTwits.

Tuesday, March 13, 2012 at 1:21PM

Tuesday, March 13, 2012 at 1:21PM