How Is American Apparel Performing Against Original 2012 Guidance?

Initial 2012 Outlook

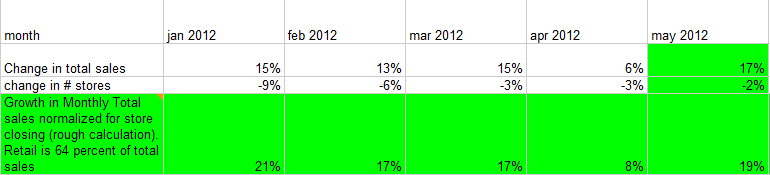

For 2012, the Company is initially projecting adjusted EBITDA to be in the range of $32 million to $40 million. The outlook assumes net sales between $552 million and $559 million and a gross profit rate between 54.5% and 55.8%. Raw material costs are estimated at current prices and foreign currency exchange rates are estimated to remain at current levels. Capital expenditures are estimated at $15.9 million for the year with a modest number of new store openings.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

P.S. Please do your research before you trade the stock. This is a highly risky situation and it is not suitable for the majority of investors. The purpose of the post is to write down how I think about this and share it with you. I am currently long APP.

Tuesday, June 19, 2012 at 2:07PM

Tuesday, June 19, 2012 at 2:07PM

Reader Comments