This post was amended on May 5th, 2015 to correct a mistake we made about the level of Hearthstone indebtness on the acquisition date. We increased the amount of debt by about $6 million.

Price: $2.72 (4/14/2015)

Enterprise Value: $107mm

Debt: $12.6mm

Cash: $29.3mm calculated as:

Shares Outstanding: 47.8mm

Summary

-

We project a goal of $14.5mm in annualized EBITDA in the medium term based on improved revenues and gross margins.

-

We believe COSI has medium-term upside to $4.30. The stock price could get to $6.27 using metrics closer to the Hearthstone metrics for the overall system.

Background

COSI Restaurants is a brand that resonates with many busy office workers in cities like New York and Boston. The food is good, the bread is fresh, and it smells fantastic. But management has struggled to grow the company profitably, and the stock has declined dramatically since its peak of about $45 in 2006. We have been following the company for quite a while, looking for an opportunity when a turnaround might be imminent.

We first started blogging about COSI in June of last year, shortly after RJ Dourney took over as CEO in March of 2014. It took no time to convince ourselves we were on to something and we started buying the stock at about $1.10 and have since increased our position at much higher prices.

RJ is a veteran of the restaurant industry with experience growing Applebees and Chili’s, and turning around Au Bon Pain. Dourney began his relationship with COSI in 2005 as a franchisee and quickly developed a formula for operating his restaurants successfully. His company, Hearthstone, grew from 5 to 13 profitable locations in and around Boston by 2014. This is quite an accomplishment since the parent company has accumulated more than $300mm in net negative earnings over its lifetime. So when Dourney took the reins at COSI, we knew we needed to meet him. After literally stumbling and breaking my leg, I finally organized the trip in August 2014, the day after Janus bought 20% of the company. We think RJ is the right leader to turnaround the fortunes of COSI at the corporate level and turn it into the next PNRA or CMG. With Janus on the shareholder list, our conviction got even stronger.

Market

Cosi operates in the fast casual dining market. This is a great space for two reasons. First, fast casual is a growing area filling the void between low-quality fast food and higher quality restaurants that require a full hour for lunch. At Cosi (and competitors Panera and Chipolte, to name a few), customers can get a delicious lunch in just a few minutes. Second, Americans are moving toward high-quality, healthy food. Cosi makes all its bread in-store, which means the bread contains simple ingredients and tastes fresh. Most people could eat at Cosi almost 5 days a week due to the large variety of healthy menu options. Check out this video to see what we mean: youtu.be/-A0eG0s2x9Q.

So, we establish that Cosi has a great brand with an experienced, motivated management team in place and a business model that is proven in Boston. The task ahead is to implement the model system-wide and, once the company is profitable, to gain operational leverage by expanding the number of restaurants.

Financials - Updated as of 12/29/2014 - 10K Filing

COSI has 64 company-owned locations (58%) and 47 franchises locations, for a total of 111 restaurants. Here is a breakdown of revenues and costs for the company-owned stores:

|

Cosi 2014

|

|

Cosi 2013

|

|

Cosi 2012

|

|

$mm

|

% of revenues

|

|

$mm

|

% of revenues

|

|

$mm

|

% of revenues

|

|

Revenue

|

75

|

|

|

83

|

|

|

95

|

|

|

Food Costs

|

20.1

|

26.80%

|

|

21

|

25.30%

|

|

22

|

23.16%

|

|

Labor

|

29

|

38.67%

|

|

32

|

38.55%

|

|

34

|

35.79%

|

|

Occupancy

|

27.7

|

36.93%

|

|

29

|

34.94%

|

|

30

|

31.58%

|

|

|

|

|

|

|

|

|

|

|

Gross Profit

|

-1.80

|

-2.40%

|

|

1

|

1.20%

|

|

9

|

9.47%

|

A few things are interesting about the numbers, and in particular the trends. To state the obvious, revenues have been declining. In our view, this is merely a statement of the problem. Poor management and limited capital investment have led to significant deterioration of the culture, physical stores and brand image.

In addition, COSI has steadily been closing stores. COSI began 2012 with 80 company-owned stores. By the beginning of 2013, that was 75 stores, and by the beginning of 2014 just 70 stores. At the end of 2014 there were only 64 company-owned stores, or 80% of the January 2012 store count. So a 21% decrease in company-owned store revenue is not surprising given the 20% decrease in store count. But we think there is a ton of potential to increase improve the culture at the employee level, refresh the stores, and restore what is truly a great brand.

When Dourney took over Au Bon pain in 2000 the AUV was $1.1mm and 5 years later it reached $1.7million. In our previous post, we discussed how each of RJ’s Boston franchise stores are generating about $1.75mm in AUV. Currently the company-owned stores are generating about $1.2mm in AUV. If he and his team can successfully implement the Hearthstone formula system-wide, even at $1.6mm AUV * 64 company-owned restaurants = $102mm in top-line revenues. We don’t expect this to happen overnight, but with patience we expect current Cosi restaurants to reach this goal. Add to that the 15 Hearthstone restaurants, of which 13 are standalone locations (2 are kiosks) at current $1.75mm AUV per standalone location for a contribution of $23mm to top-line. So total potential of $125mm revenue from company stores system-wide. Moving over to the costs, we see an increase in all 3 cost categories as a percentage of sales from 2012 to 2014. Food Costs, Labor Costs, and Occupancy cost (in %) all increased during the time period. In order to be profitable, these costs will need to decrease as a percent of revenues. Now, 2014 really was a transitional year for COSI. RJ Dourney made a lot of changes to the team, culture, and systems. Change is never without friction, so we expect costs to go up temporarily as part of the transition. Based on RJ’s comments in presentations and earnings calls, it seems he feels much better positioned in early 2015 for success. So we will be very focused on the cost components to see if we start to see an inflection point where they start to move down.

In our previous post, we discussed our medium- to long-term targets for each of these cost categories in percentage terms and our reasoning behind those targets. We think food costs should come down slightly to 25% of revenues, labor costs can come down significantly to 30%, and occupancy costs can also come down significantly to 25%.

So the goal is set at $125mm in revenue from company-owned stores on current store count with the following cost breakdown:

|

$mm

|

% of revenues

|

|

Revenue

|

125

|

|

|

Food Costs

|

31.25

|

25.00%

|

|

Labor

|

37.5

|

30.00%

|

|

Occupancy

|

31.25

|

25.00%

|

|

|

|

|

Gross Profit

|

25

|

20.00%

|

|

G&A

|

12.5

|

10.00%

|

|

EBITDA

|

12.5

|

10.00%

|

For comparison, Hearthstone generated 16% of economic EBITDA margin (grossed up for the franchise fee) in 2014, making our 10% EBITDA margins quite conservative. Even our most aggressive best-case margin assumption of 12% is conservative relative to the Hearthstone TTM numbers.

Cash and Capitalization

One of the biggest issues facing turnaround candidate companies is cash flow. Change costs money, and companies with negative cash flow are typically tight on cash. While management has implemented many changes, there is still substantial work to be done in terms of improving and updating the look of the restaurants. These improvements will cost money. In 2014, the team successfully raised over $25mm in debt and equity capital. As a result, the company had over $21mm in cash on the balance sheet as of year end.

-

On May 20, the company placed a $2.5mm note with AB Opportunity Fund and AB Value Partners.

-

On August 19, COSI issued equity in a $4.5mm private placement transaction to Janus and an existing shareholder.

-

On December 12, the company completed a rights offering that raised $19.7mm from existing shareholders.

When we wrote our original thesis back last June, we believed that additional capital was needed for COSI to clean up its act outside Boston. Clearly management agreed.

Hearthstone Acquisition

On April 1, 2015, COSI announced completion of the acquisition of RJ Dourney’s company, Hearthstone Associates. The merger was originally discussed as part of his sign-on package. The owners of Hearthstone (RJ, his wife, and CFO Richard Bagge) get a total of 1.79mm shares of COSI in exchange for Hearthstone, plus COSI assumes $10.7mm in Hearthstone debt.

On April 10, the company raised $15.5mm of cash via an equity private placement. The company used $4.7mm of the proceeds to pay down debt acquired in connection with the acquisition, for a net raise $10.8mm. We participated in this round.

We believe the acquisition serves to align RJ’s interests with shareholders, as RJ is trading his interest in a cashflow positive private company with a smaller share in a much riskier cashflow negative COSI corporate entity. With 10 years experience with COSI as a franchisee and a long career in the chain / franchise restaurant industry, he is in a good position to evaluate the risks. His decision was to take the opportunity. This gives us comfort with our long position.

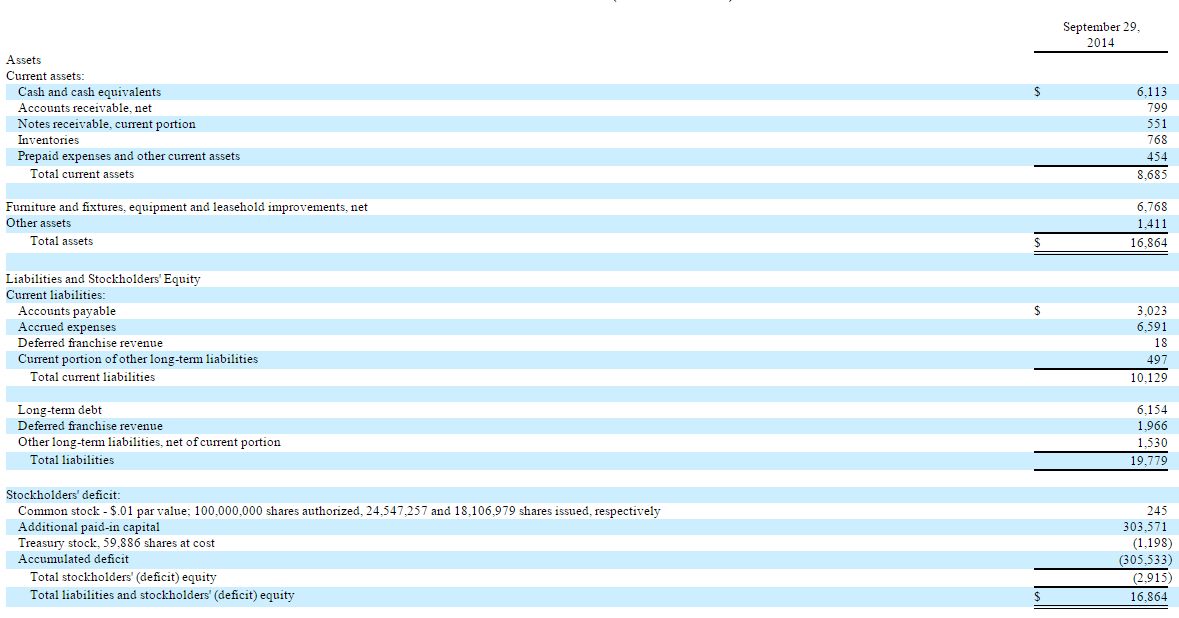

Balance Sheet

As of the 12/29/14 B/S, the company had $21.6mm in cash on the balance sheet and $6.6mm in debt. In early April 2015, the acquisition of Hearthstone closed and the company raised over $15mm in new capital. Here is how we believe the balance sheet will look:

|

Balance Sheet, $ in thousands

|

12/31/2013

|

9/29/2014

|

12/29/2014

|

Projected 3/31/15

|

Pro-Forma for Hearthstone & Equity Issuance

|

|

Cash

|

$6,021

|

$6,113

|

$21,560

|

$18,560

|

$29,327

|

|

A/R

|

$594

|

$799

|

$581

|

$581

|

$717

|

|

Inventories

|

$779

|

$768

|

$825

|

$825

|

$1,018

|

|

Other Current

|

$1,899

|

$1,005

|

$1,830

|

$1,830

|

$1,635

|

|

Total CA

|

$9,293

|

$8,685

|

$24,796

|

$21,796

|

$32,698

|

|

|

|

|

|

|

|

FFE

|

$8,195

|

$6,768

|

$7,308

|

$7,308

|

$9,021

|

|

Other LA

|

$1,115

|

$1,411

|

$1,327

|

$1,327

|

$1,327

|

|

Total LA

|

$9,310

|

$8,179

|

$8,635

|

$8,635

|

$10,348

|

|

Total Assets

|

$18,603

|

$16,864

|

$33,431

|

$30,431

|

$43,046

|

|

|

|

|

|

|

|

A/P

|

$2,462

|

$3,023

|

$1,519

|

$1,519

|

$1,875

|

|

Accrued Exp

|

$9,088

|

$6,591

|

$9,336

|

$9,336

|

$9,336

|

|

Current Portion

|

$214

|

$515

|

$195

|

$195

|

$0

|

|

Total SL

|

$11,764

|

$10,129

|

$11,050

|

$11,050

|

$11,211

|

|

|

|

|

|

|

|

Long-term Debt

|

$0

|

$6,154

|

$6,623

|

$6,623

|

$12,623

|

|

Deferred Franchise Revenue

|

$1,931

|

$1,966

|

$1,724

|

$1,724

|

$1,724

|

|

Other LL

|

$2,189

|

$1,530

|

$1,663

|

$1,663

|

$1,663

|

|

Total LL

|

$4,120

|

$9,650

|

$10,010

|

$10,010

|

$16,010

|

|

|

|

|

|

|

|

Common Stock

|

$181

|

$245

|

$383

|

$383

|

$383

|

|

APIC

|

$297,181

|

$303,571

|

$323,256

|

$323,256

|

$332,723

|

|

Treasury Stock

|

-$1,198

|

-$1,198

|

-$1,198

|

-$1,198

|

-$1,198

|

|

Retained Earnings

|

-$293,445

|

-$305,533

|

-$310,070

|

-$313,070

|

-$316,084

|

|

Total E

|

$2,719

|

-$2,915

|

$12,371

|

$9,371

|

$15,824

|

|

Total L+E

|

$18,603

|

$16,864

|

$33,431

|

$30,431

|

$43,045

|

|

|

|

|

|

|

|

Shares Out (mm)

|

|

|

38.4

|

38.4

|

47.8

|

Notably, there is cash available for the capital improvements we know are necessary.

Valuation

Pulling it all together, we take our medium-term target numbers:

Restaurant Net Sales: $125mm

Gross profit margin: 20%

Gross Profit from Company-Owned Stores: $25mm

Franchise Revenue: $2.0mm ($2.8mm less $0.8mm from Hearthstone)

Total Gross Profit: $27mm

General & Administrative Expenses: $12.5mm

Projected EBITDA: $14.5mm

Competition’s EV/EBITDA multiples are at 11x for PNRA and 28x for CMG. If we use a conservative EV/EBITDA multiple of 10x, you get an EV of $145mm for the combined entity. Total debt: $12.6mm

Total Cash: $29.3mm

Market cap = EV - Debt + Cash: $161.7mm.

NOL’s of $225mm: $44mm (Assuming 50% haircut to valuation)

Total Value: $206mm

Shares Outstanding 47.8mm

Stock price of $4.30 with reasonable / conservative assumptions. And that is without expanding store count at all.

Boundary Condition Valuation:

We have made some conservative assumptions. Let’s now push it to the limit and see what the valuation looks like if RJ can get the rest of COSI to look exactly like Hearthstone in terms of AUV and EBITDA margin:

Restaurant Net Sales @ $1.75mm AUV: $135mm

EBITDA Margin: 12%

EBITDA from Company-Owned Stores: $16.2mm

Franchise Revenue @ $1.75mm AUV: $3.4mm

Total EBITDA: $19.5mm

EV @ 10x EV/EBITDA Ratio: $195mm

Total Debt: $12.6mm

Total Cash: $29.3mm

Market cap = EV - Debt + Cash: $212mm

NOL’s of $225mm (no haircut): $88mm

Total Value: $300mm

Shares Outstanding 47.8mm

Stock Price (incl. NOL’s): $6.27

So it is theoretically possible for the stock to get to $6.27 without any expansion of store count.

How Big Can Cosi Become?

Now let’s talk about growing store count. This is the fun part of the analysis because we get a glimpse into the long-term potential for the company.

Now, the first priority for RJ and team is to get the current store base in order, and get to both the revenue and EBITDA margins goals we discuss above. But in the long-term, there is huge potential for growth. Cosi has 111 stores currently with a mix of 70% company-owned / 30% franchise post-Hearthstone acquisition. Panera has 1810 locations with a mix of 50% company-owned stores and 50% franchise locations as of July 2014. RJ believes there are about 2000 potential locations nationwide. So long-term, with a profitable operating model at the store level, there is significant room for expansion in terms of store count.

Even with 10x = 1110 total stores and the current 70/30 split between company-owned and franchise, the company could be worth a multiple of our projected numbers. It is going to take time and capital to get there, but the team is already laying the groundwork for this type of success.

We think the Cosi team will focus on implementing the Boston processes throughout the organization over the next year. Once all of Cosi is ready to serve up an amazing experience, we believe RJ will press the pedal to the metal from a public relations and marketing standpoint.

Conclusion

As you can see, we believe there is tremendous opportunity in COSI if RJ and team can right the ship and get it headed in the correct direction. Based on our meetings and discussions with management, we feel confident in their ability to do so.

We exercised our rights to purchase shares in the December rights offering, and we participated in the April 2015 deal.

Of interest: New CEO Lights a Fire in the Ovens at Cosi

Jennifer Galperin. Follow me on Twitter and Stocktwits.

Michael Bigger. Follow me on Twitter and StockTwits.

Disclaimer: Bigger Capital and related entities are long a sizable position in COSI. COSI is in a turnaround mode and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal. Take our opinions with a grain of salt. If you find yourself relying on our views to make an investment decision it means you definitely did not do your homework about this situation.

Friday, May 15, 2015 at 11:38AM

Friday, May 15, 2015 at 11:38AM