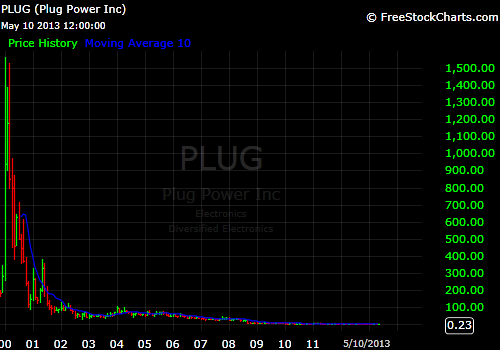

Plug Power a Free Option?

We all know that Plug Power ($PLUG) is a highly distressed situation. What is little known though is that $PLUG at current level might be as closed to a free options as I have ever seen in my life. A free options on the adjacent possible of hydrogen that is now becoming reality.

A month ago, Air Liquide, an hydrogen supplier, invested in $PLUG at about $.25 via a convertible preferred. Air Liquide's motivation is quite simple after you read this article.

The conversion of just 10% of the worldwide fleet of forklift trucks would represent

a potential hydrogen market of €7 billion.

1. The Adjacent Possible Market

That is correct....a €7 billion market. At 20% conversion rate it is a €14 billion market right? So the hydrogen suppliers such as Linde (Germany) and Praxair (USA) have a big vested interest in seing $PLUG thrive.

Check this video out to understand why the technology resonates and focus on the name of the hydrogen supplier on the hydrogen tank.

2. The Free Option

It is pretty obvious to us that PLUG will get the capital infusion of $10 million that it needs to reach EBITDA breakeven (we have been wrong before on our assumptions). Air Liquide, Linde and Praxair have too much at stake to let $PLUG disappear. Remember the €7+ billion market? Remember the Linde H tank at the BMW facility in South Carolina? Other investors could be interested in such an important strategic asset. I know I am, but you gotta discount the fact that I am a bit crazy. I wish management would do a better job of communicating the importance of PLUG to the investors community. I guess after 15 years of meandering, no one cares about the company.

If you only focus on the financials of PLUG you are missing the whole story. In our opinion, this economic asset will get funded and it will thrive.

To the man with a hammer, the world looks like a nail -Charlie Munger

We believe it would cost more than $200 million to build another PLUG from scratch. Even if you assume we are wrong and you use a $100 million figure, the situation is grossly misunderstood.

In my opinion, our biggest risk here is to be taken out of our position at a ridiculously low price.

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family hold about 3% of Plug Power. We intend to increase our position if the company's results confirm our thesis through time.

Plug Power is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal. We have been wrong on many of our thesis before.

Written by Michael Bigger. Follow me on Twitter and StockTwits.

Saturday, June 8, 2013 at 11:40AM

Saturday, June 8, 2013 at 11:40AM