Question: Does American Apparel Cheapens its Brand by Selling Clothing at Wal-Mart?

Another way to ask the question is: Does Apple cheapens its brand by selling Iphones and Ipads at Wal-Mart? I don't think so.

Another way to ask the question is: Does Apple cheapens its brand by selling Iphones and Ipads at Wal-Mart? I don't think so.

History

Throughout its brief history, American Apparel ($APP) has been spewing negative catalysts. First, it started with the hiring of thousands of illegal immigrants which had to be fired after the company got caught by the INS. The company paid a dear price for this value destroying action.

The company’s balance sheet got decimated as it tried to recover from this situation by firing thousands of employees and having to interview 12,000 candidates to replenish the lost stock. In addition, the financial crisis created a great recession for retailers and APP sales collapsed in the process.

All of this brought the company down the precipice. The stock traded down from $17 in 2008 (13% EBITDA margin) to $.55 in 2011.

Back in 2011 when we first started writing about American Apparel ($APP), the stock was trading just below $1. The company had just received rescue financing of $15mm to avoid bankruptcy. The company could not re-negotiate its debt agreements, sales were stagnant, and the situation was highly distressed. We believed that the chance for the company to refinance was high because we thought sales were about to start expanding and there were enough inefficiencies in the operations for meaningful EBITDA improvements even without major sales growth. We also expected the company to reduce inventory and henceforth decreasing the amount of working capital needed. At the time we hypothesized that over a 2 to 4 years period these improvements could allow them to pay down a good chunk of their debt, reducing interest expense substantially.

In addition, we saw the potential of EBITDA margin expanding to a 15 to 20% boundary condition (Source: Management) as it benefits from harvesting its lighter capital sales channels and with sales increasing to $800 million or higher, it allows the company to leverage its fixed cost asset (manufacturing) on a larger number of units.

In 2012 sales improved to $616mm and adjusted EBITDA reached $36.6mm for a 6% EBITDA Margin. In early 2013 the company refinanced its high cost debt. The stock took off and traded as high as $2.40.

Then came 2013 when the company implemented two important strategic initiatives:

In addition, the company completed its roll-out of the RFID system and its implementation of the Oracle ATG Web Commerce Customer Service application for its e-commerce platform in 2013.

These initiatives show the strategic resolve by management to build a first class vertically integrated global apparel platform.

The implementation of these strategic initiatives has had a depressing effect on the 2013 baseline EBITDA forecast. At the end of Q2 2013, management’s EBITDA forecast was reduced to $46 to $51mm from $47 to $54 million because of a $4.3mm cost impact from the transition to the new DC. We can’t quantify the impact of the RFID implementation nor the backroom elimination. Therefore a normal adjusted EBITDA for 2013 baseline remains at $47 to $54 million on sales of $655mm for an EBITDA Margin of 7.8%.

In late 2013, the company was hit on four fronts. First, the distribution center going live proved to be harder than expected for the company. It just did not work as planned and as a result the company could not deliver merchandise to the stores on time. The result was lost sales and a negative delta impact of $13 million on EBITDA year-to-date 9/31/2013. The company cancelled its guidance for the rest of 2013 which stood at $46 million to $51 million as of Q2 2013.

In addition, the youth retail segment has been challenged recently which has dragged sales further down. If that was not enough, management’s diverted attention away from merchandising to fixing the issues at the DC, and bad weather in the American Northeast in late 2013 and early 2014 forced the company to face catastrophe once again.

So for most of its public life, American Apparel stock has been driven down by the following negative catalysts:

All these factors contributed to the company needing to raise money to pay for an April debt payment. The company received about $30mm in equity funding in late March and paid its April 15th debt coupon.

American Apparel is as ugly as you can get.

Therefore, very few eyeballs are following the stock. No one cares, and we think this creates an amazing opportunity and here are the reasons why.

The Platform Attributes

First, throughout its history, American Apparel has built tremendous global brand equity. Whether you like or hate American Apparel for its polarizing actions, the fact remains that most people around the globe -especially in urban centers- know the company. In a world in which information is abundant, almost free and near perfect, gaining attention is expensive and difficult. American Apparel has attention and this is very valuable. The company is followed by millions of people on different social media platforms.

Second, throughout its history, Dov Charney has obsessed over creating a differentiated apparel business platform. This is evidenced by its irreverent marketing campaign, its vertically integrated platform, its ability to fulfill orders (Internet, retail, wholesale, flash sales) on a global basis from the newly minted distribution center, the elimination of inventory backroom at the store level which requires just in time inventory delivery, the implementation of its RFID system, and its focus to develop a strong global Internet platform (work in progress). This is an asset that is next to impossible to replicate.

Third, the company has developed a culture of experimentation as witnessed by its acquisition of Warriors of Radness and OAK NYC, and the development of a Made in the USA shoe business. American Apparel will leverage these brands using its global distribution platform. It could do the same with its in-house Cali Sun & Fun. In a few years from now, APP could have 4 to 6 customer facing brands supported by a global apparel logistic system.

Fourth, the stock is darn cheap and it does not reflect the intrinsic value of the platform as you will learn below.

In a nutshell these are the reasons why we decided to participate in the last round of funding led by Roth Capital. We think the worst is over for the company which will allow the platform to shine in the next few years.

Financials

The funding should allow the company to end 2014 with close to $50 million of cash on its balance sheet (B/S). This is how we derive this amount (caveat: We don’t have the 2014 1st quarter numbers yet).

Assuming $5mm of cash on the (B/S) as of 3/26/2014

Equity Raise assuming over allotment options is exercised= +$30 million (about)

2014 EBITDA guidance = +$45 million

2 times bond cash interest payments of $13.7 million (Source Here) = -$27.4 million

Cash interest payment on ABL = -$3 million

Capital Expenditures (Source: Preliminary 2013 annual results) = -$12 million

Decrease in Inventory (Source: Management) = +$12 million

Total Cash as of 12/31/2014 = +$50 million (Very rough estimate)

This financial position will allow the company to fine tune the business and reduce cost in 2014 and start expanding in 2015. As investors gain confidence these numbers will be met, we believe the news flow is about to turn from negative to positive and the following catalysts are about to drive the stock much higher and investors will pay attention:

A better environment will allow Charney to implement his vision. He said:

Our 247 stores could be 20% more productive with the right tweaks, the online business could double, wholesale could grow by 20% to 30%. We could even develop a $100 million third-party retail business, selling items like American Apparel nail polish at drugstores or having hooded sweatshirt blowout sales at Costco.

Current Valuation

American Apparel major strategic initiatives, which were highly disruptive in 2013, have been completed. While the operational risks still exist, we think a lot of the challenges of these integrations are now behind the company, yet the benefits of these initiatives and the reduced operational risk are not reflected in the current stock price. So if you look beyond the fog and include the benefits of these initiatives into your assessment of the business, the thesis becomes much more compelling now than it was in April 2011.

Here is why in detail:

Our baseline 2014 EBITDA Forecast stands at $57 million to $71 million for an EBITDA margin of 8.9%. Annual Interest Expense should come in at around $33 Million in cash. We believe Capex will come in at $12 million. This forecast assumes little sales growth over initial 2013 sales forecast and no benefit from increased sales resulting from the additional selling space at the store level.

The enterprise value of American Apparel is about $330mm. It trades at near 5 times normalized EBITDA and it is operating way below capacity. That is just too cheap for this type of strategic asset. Here is an interesting read on the topic.

The Current Ownership Structure

The latest round of funding reduced Dov Charney percentage ownership in the company from 44% to 28%. We believe that Charney remains manic about realizing APP’s potential. That being said, we welcome the possibility of activism if management does not improve the performance of the company. I believe that the company has the whole of 2014 to convince investors of its ability of turning the ship around. If it does not, it wouldn’t surprise me to see a retail enterprise come in to acquire this strategic asset.

The Future: How will American Apparel look in 2015 and beyond?

Recall the quote of Charney:

“Our 247 stores could be 20% more productive with the right tweaks, the online business could double, wholesale could grow by 20% to 30%. We could even develop a $100 million third-party retail business, selling items like American Apparel nail polish at drugstores or having hooded sweatshirt blowout sales at Costco.”

Using this delta over the 2012 sales baseline, American Apparel could generate between $800 million to $900 million in sales in 2018. There seems to be quite a bit of confidence from some senior executives that annual sales could reach $1 billion within 4 years (Milestone could be reached in 2018). That is about $350 million of incremental revenues over 2013 sales. This represents 12% of annual growth until 2018. That is a big number and given the recent management execution issues, one should be very skeptical about the ability of management to deliver on this.

What could explain this optimism, and should we share this optimism?

In order to answer this question, I think it is important to look at the American Apparel line of business that has performed quite well recently. That line is wholesale. There is no way to move the needle to $1 billion in sales by opening 60 to 70 stores (plan) over the next 4 years.

The only way to get there is to expand wholesale from a U.S.A. centric business to a global wholesale business.

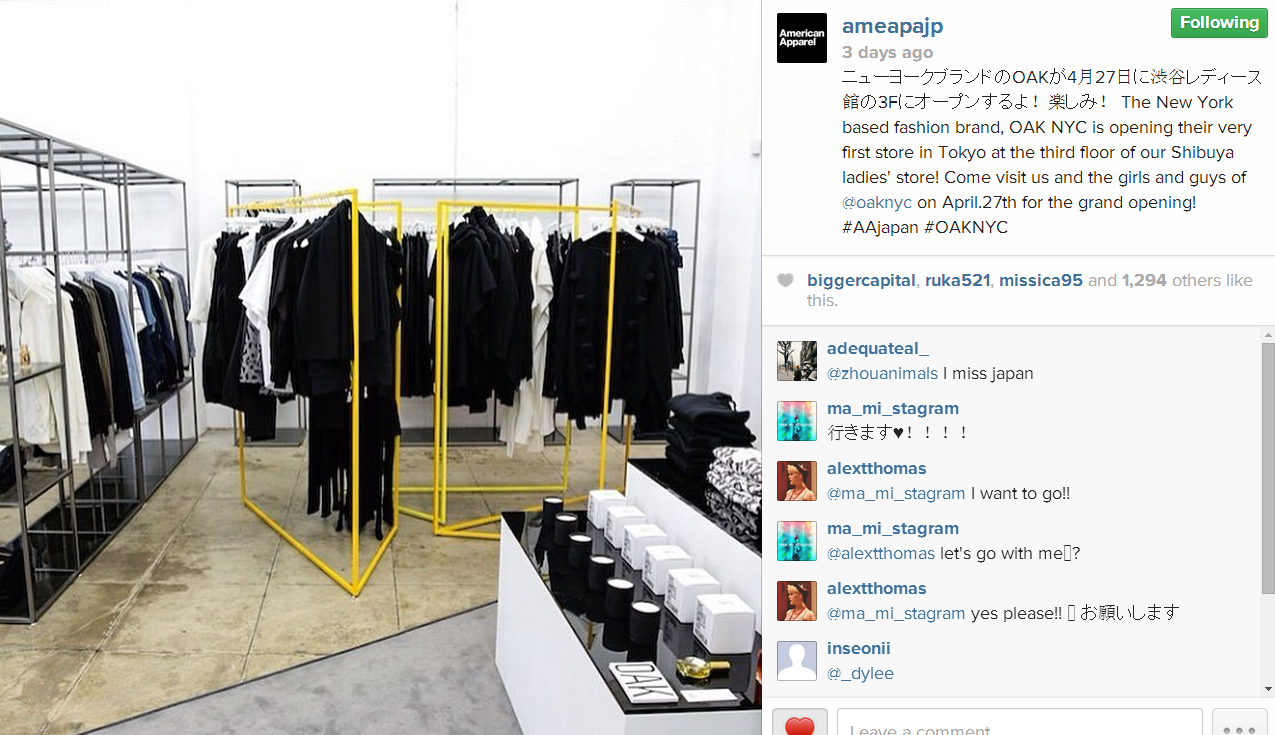

And we think that American Apparel is about to launch a massive wholesale push into Asia and other parts of the world. We are comfortable with this statement because of the activities we have uncovered on the American Apparel Japan Instagram page. We believe that APP will pursue OAK NYC and Warriors of Radness wholesale opportunities in the region after it establishes a retail foothold.

So let’s look at how the company intends to get there and determine if the expectation gap can be plugged in with a reasonable global (ex USA) wholesale. Using the information released by the company over the past year, let's see if the numbers jibes with this expectation.

Baseline Annual Sales (2012)

Retail $389mm

Wholesale $173mm

Internet $55mm

Total Sales 2012 $617mm

Retail

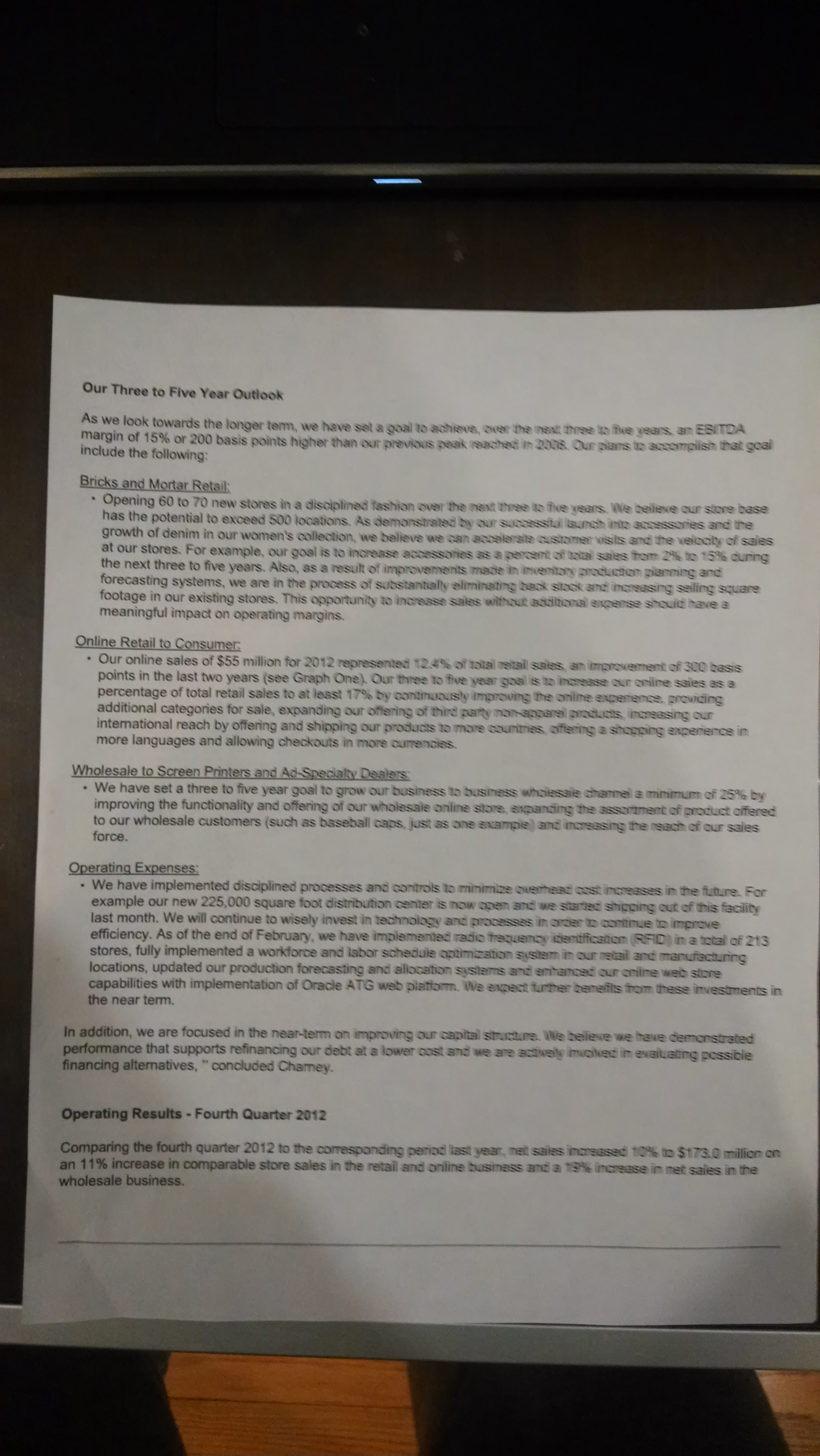

Management indicated in early 2013 that they could open 65 new stores over the next 3 to 5 yrs. The store base is expected to grow 26.31%. In addition, management has said current stores could improve productivity by 25%.

So in total, retail sales could increase by 58% by the end of 2018. We are assuming no comp sales growth to counterbalance the fact that new stores are not fully productive right from the get-go.

2018 Retail Sales = $588mm

Wholesale

Current wholesale sales growing by 25% over that period.

2018 Wholesale Sales = $207mm

Internet

Internet to double.

2018 Internet Sales = $110mm

Total 2018 Sales excluding new businesses = $905mm

New Businesses

To build a $100mm third party business (Example: Selling hoodies at Costco).The company has already started this effort via Wal-Mart and Ross Stores (Source: twitter).

2018 Sales = $100mm

To build a global wholesale business

2018 Sales = $100 mm (our reasonable and conservative scenario)

Total 2018 Sales including new businesses = $1105 mm

The company's goal is to increase EBITDA margin to 15% over that period which we think is reasonable since APP EBITDA margin was 13% in 2008 on a much lower sales figure. Using a 200 million shares count, the company could generate $.80 per share in 2018. Using a 10% EBITDA margin, the company could generate $.55 of EBITDA per share in 2018. Even if we assume the worst of both that the company generates $800 million of revenues in 2018 at a 10% EBITDA margin we calculate at $.4 of EBITDA per share.

On the debt side, currently APP has approximately $205mm in debt outstanding at 15% interest (We are excluding ABL), total annual interest payments of about $31mm. If they reach their goal of $1Bn Revenues in 2018 and 15% EBITDA margin, that means $120 in pre-tax earnings ($0.60 / share). Even at $800mm Revenues and 10% margin, there is still $50mm in pre-tax earnings or $0.25 / share. That is without repaying a dime of debt. We think it is likely they will start to pay down debt gradually beginning as early as 2015 and refinance as early as 2017 (The bonds are callable in 2017). (Rough Calculation)

Conclusion

We believe that the 1st quarter of 2014 was the nadir for American Apparel and that its results will improve dramatically for the rest of the year. We think that the American Apparel platform will start delivering impressive growth starting in 2015 with very little investment required. This is very hard to imagine when looking at the current American Apparel wart, but if you look at the platform the company has built and the clues you can gain by following the company more closely via different information channels, it becomes more obvious that the company is on a path to generate more than $1 billion in sales and 15% to 20% EBITDA margin. Everything is in place for the company to run a strong marathon.

Written by Michael Bigger

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family own more than 3.27 million shares of American Apparel. American Apparel is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal. In other words, the probability of losing all your investment in this situation is very high. We have been purchasing American Apparel since May of 2011 and we have nothing to show for it. Take our opinions with a grain of salt and do your homework.

Yesterday PLUG announced an acquisition of a PEM stack manufacturer, ReliOn, for $4mm in stock. We are excited about this acquisition for a number of reasons:

Written by Michael Bigger

There seems to be quite a bit of confidence from some senior executives at American Apparel, that annual sales could reach $1 billion within 4 years (Milestone could be reached in 2018). That is about $350 million of incremental revenues over 2013 sales. That is a big number and given the recent management execution issues, one should be very skeptical about the ability of management to deliver on this.

Nonetheless, it is a good exercise to figure out how the company intends to get there. Using the information released by the company over the past year, let's see if the numbers jibes with this expectation.

Baseline Anuual Sales (2012)

Retail $389mm

Wholesale $173mm

Internet $55mm

Total Sales 2012 $617mm

Retail

Management indicated in early 2013 that they could open 65 new stores over the next 3 to 5 yrs. The store base is expeted to grow 26.31%. In addition, management has said current stores could improve productivity by 25%.

So in total, retail sales could increase by 58% by the end of 2018. We are assuming no comp sales growth to counterbalance the fact that new stores are not fully productive right from the get-go.

2018 Retail Sales = $588mm

Wholesale

Growing wholesale sales by 25% over that period.

2018 Wholesale Sales = $207mm

Internet

Internet to double.

2018 Internet Sales = $110mm

New Business

To build a $100mm third party business (Example: Selling hoodies at Costco)

2018 Sales = $100mm

Total 2018 Sales = $1005mm

The company's goal is to increase EBITDA margin to 15% over that period. Using a 200 million shares count, the company could generate $.75 per share in 2018. Using a 10% EBITDA margin, the company could generate $.50 of EBITDA per share in 2018. Even if we assume that the company generates $800 million of revenues in 2018 at a 10% EBITDA margin ($.4 of EBITDA per share).

On the debt side, currently APP has approximately $200mm in debt outstanding at 15% interest (We are excluding ABL), total annual interest payments of about $30mm. If they reach their goal of $1Bn Revenues in 2018 and 15% EBITDA margin, that means $120 in pre-tax earnings ($0.60 / share). Even at $800mm Revenues and 10% margin, there is still $50mm in pre-tax earnings or $0.25 / share. That is without repaying a dime of debt. We think it is likely they will start to pay down debt gradually beginning as early as 2015 and refinance as early as 2017. (Rough Calculation)

Written by Michael Bigger

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family own more than 3.17 million shares of American Apparel. American Apparel is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal. In other words, the probability of losing all your investment in this situation is very high. We have been purchasing American Apparel since May of 2011 and we have nothing to show for it. Take our opinions with a grain of salt and do your homework.

It is the big ideas that drives me. This is an image of American Apparel growth strategy early 2013. Trying to do the right thing, but failing temporarily executing the idea. But the big idea has not vanished especially at a long time scale. That is the constant I must manage to.

Written by me and for me Michael Bigger

Throughout its brief history, American Apparel ($APP) has been spewing negative catalysts. First, it started with the hiring of thousands of illegal immigrants which had to be fired after the company got caught by the INS. The company paid a dear price for this value destroying action.

The company’s balance sheet got decimated has it tried to recover from this situation by firing thousands of employees and having to interview 12,000 candidates to replenish the lost stock. In addition, the financial crisis created a great recession for retailers and APP sales collapsed in the process.

All of this brought the company down the precipice. The stock traded down from $17 in 2008 to $.55 in 2011.

Despite getting rescue financing in 2011 (We wrote about it here) and getting back on track in 2012 and early 2013, the company faltered again in late 2013 because of execution issues at its newly minted Distribution Center (DC) located in LaMirada, management’s diverted attention away from merchandising to fixing the issues at the DC, a less vigorous youth market, and bad weather in the American Northeast. The company is now facing catastrophe once again.

So for most of its public life, American Apparel stock has been driven down by the following negative catalysts:

At this juncture the company is facing delisting, it has raised money to pay an April debt payment, and the company is late filing its 2013 10-K. APP is as ugly as you can get.

But despite all these issues, we decided to participate in the last round of funding lead by Roth Capital. We think the worst is over for the company as we explain in this post titled American Apparel: This Wart Looks So Perfect.

The funding should allow the company to end 2014 with close to $50 million of cash on its balance sheet (B/S). This is how we derive this amount (caveat: We don’t have the 2014 1st quarter numbers yet).

Assuming $0 of cash on the (B/S) as of 3/26/2014

Equity Raise assuming over allotment options is exercised= +$32 million (about)

2014 EBITDA guidance = +$45 million

2 times cash interest payments of $13.7 million (Source Here) = -$27.4 million

Capital Expenditures (Source: Preliminary 2013 annual results) = -$12 million

Decrease in Inventory (Source: Management) = +$12 million

Total Cash as of 12/31/2014 = +$50 million (Very rough estimate)

As investors gain confidence these numbers will be met, we believe the news flow is about to turn from negative to positive and the following catalysts are about to drive the stock much higher and investors will pay attention:

A better environment will allow Charney to implement his vision. He said:

Our 247 stores could be 20% more productive with the right tweaks, the online business could double, wholesale could grow by 20% to 30%. We could even develop a $100 million third-party retail business, selling items like American Apparel nail polish at drugstores or having hooded sweatshirt blowout sales at Costco.

Using this delta over the 2012 sales baseline, American Apparel could generate between $800 million to $900 million in sales in 2017.

At $800mm in sales and EBITDA margins reaching 10%, the company could generate $.5 of EBITDA per share and see its stock reach $4 (8 * EBITDA). We are assuming a 160 million shares count (Could be higher than that). We are also assuming Charney’s anti-dilution provision will expire worthless. If they don’t, this will be the best possible scenario but we are not counting on it.

Since the company raised the necessary amount under the shelf according to our thesis, we believe the fog will lift rapidly and investors will start focusing on the bright future ahead.

Written by Michael Bigger

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family own more than 3.17 million shares of American Apparel. American Apparel is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal. In other words, the probability of losing all your investment in this situation is very high. We have been purchasing American Apparel since May of 2011 and we have nothing to show for it. Take our opinions with a grain of salt and do your homework.

On February 26, Plug Power ($PLUG) confirmed that the order it received on January 10 was from Wal-Mart ($WMT). To understand the importance of Wal-Mart’s role in the hydrogen market we wrote Plug Power Cracks the Hydrogen Code.

It took about fifteen years and close to $1.0 Billion of investment for PLUG to crack the code. Throughout its life as a public company you can think of PLUG as a long-term venture investment experimenting in search of a kick-ass business model suited for a very large market opportunity. The experiment has been completed. Now in order to fully realize a venture type of return on investment, $PLUG must push the pedal to the metal on two fronts. First, they need to leverage their position as a market leader in the hydrogen-powered material handling space to go after the established lead acid battery technology. Second, and simultaneously as much as possible, PLUG needs to use its customer base to aggressively exploit the opportunities in adjacent markets such as airport Tuggers, Transportation Refrigeration Units (TRUs), Range Extenders (REs) and so forth.

PLUG’s GenKey offering is miles away from any hydrogen fuel cell competition. From a strategic point of view, the validation its clients (for example, Wal-Mart) provide reduces its sales cycle. PLUG has now great relationships with industry leaders, which makes GenKey a much easier decision for prospective new customers and existing customers alike. Also, these relationships should insulate it from competitors for years to come. We believe the latest Wal-Mart deal confirms the solution-market thesis. This became clear to us when Wal-Mart chief of distribution logistic presented via a video webcast at the analyst day in Albany, NY in December. I don’t remember the bearish bloggers attending this conference…

When we first bought stock in this company at $0.23, we knew it had potential. When it hit an intraday high of $11.72 on March 11, the market cap soared to $1.2Bn. Of course the bearish bloggers had a field day with this, but we feel this raises the key question: How Big Can Plug Become? To answer this question, one must assess the size of the current opportunity and its position in the competitive landscape. Its leadership position in hydrogen power can’t be denied.

Let’s see if we can figure out how big this opportunity can be on a global basis. The latest management presentations give us some important metrics that we can use to assess the total global opportunity.

Material Handling Market (GenKey offering: Batteries, Molecule, Service, Infrastructure: Source internal calculation): 6,000,000 global units at $6000 of revenues per year per unit over the lifetime of battery = $36 Billion per annum = maximum boundary condition (Total potential US market for GenKey product).

Tuggers (Source: management): Could be a $60 million business for $PLUG. This is by far the smallest opportunity.

Transportation Refrigeration Units (TRU’s) (Source: management): $15 billion+

Range Extenders (RE’s) for battery-operated vehicles (Source: management): $10 billion +

Other Adjacent Markets: Unknown, but there is potential. As an example, range extenders could eventually make electric vehicles more practical for longer distance travel.

The total market opportunity for $PLUG is $61 billion +.

Now let’s calculate how big the annual Wal-Mart opportunity is:

Wal-Mart has 117 Distribution Center (DCs) in The US (Source: Internet). 100 of the DCs can be converted using the GenKey solution. We know that over a period of 6 years each DC represents a $9 million revenue opportunity for PLUG (Source: Management). Therefore the total US Wal-Mart opportunity is $150 million a year. That is 1 client and we know PLUG has now more than 24 clients, most of them located in the US.

At a market valuation of $700 million, Plug is valued 4.7 times its WMT annual potential revenue opportunity. WMT owns less than 0.5% of the global number of forklift (6,000,000 units: Source Management)

Let’s look at the total potential just with existing customers. As of December, existing PLUG customers (including WMT, SYY, and KR) owned about 250,000 total forklift trucks, of which only 4000 were PLUG powered trucks The remaining 246,000 trucks could all present the “low hanging fruit” opportunity for PLUG. Assuming a lifespan of 6 years (PLUG’s management says about 6-10 years depending on usage), the revenue opportunity is $1.6bn / year … and that is without acquiring a single new customer.

Some investors will start focusing on P/E, EV to EBITDA, and all sorts of metrics to value PLUG. We think that for the time being these methods will blind investors. PLUG should be priced more like a venture capital investment in relation to its potential market and its leading position.

Short-term or momentum traders have gotten involved in the stock given the run-up since December. While this has certainly brought attention to the company, the volatility is unsettling for some investors.

The company will look expensive for probably this decade and its rate of growth should explode very soon. This could be a $10 billion company in 10 to 15 years.

Written by Michael Bigger.

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family hold a very large stake in Plug Power. We have a very long term horizon that differs from the majority of investors. These high growth situation are often not suitable for most investors since they are extremely volatile and can realize their full potential over decades.

This post should be complemented by all the research we have performed on the company since April 2011.

Back in 2011 when we first started writing about American Apparel ($APP), the stock was trading just below $1. The company had just received rescue financing of $15mm to avoid bankruptcy. The company could not re-negotiate its debt agreements, sales were stagnant, and the situation was highly distressed. We believed that the chance for the company to refinance was high because we thought sales were about to start expanding and there were enough inefficiencies in the operations for meaningful EBITDA improvements even without major sales growth. We also expected the company to reduce inventory decreasing the amount of working capital needed. At the time we hypothesized that over a 2 to 4 years period these improvements could allow them to pay down a good chunk of their debt, reducing interest expense substantially.

In addition, we saw the potential of EBITDA margin expanding to a 15 to 20% boundary condition (Source: Charney TV interviews) as it benefits from harvesting its lighter capital sales channels and with sales increasing to $800 million or higher, it allows the company to leverage its fixed cost asset (manufacturing) on a larger number of units.

In 2012 sales improved to $616mm and adjusted EBITDA reached $36.6mm for a 6% EBITDA Margin. In early 2013 the company refinanced its high cost debt. The stock took off and traded as high as $2.40.

The company implemented two important strategic initiatives in 2013:

In addition, the company completed its roll-out of the RFID system and its implementation of the Oracle ATG Web Commerce Customer Service application for its e-commerce platform in 2013.

The implementation of these strategic initiatives has had a depressing effect on the 2013 baseline EBITDA forecast. At the end of Q2 2013, management’s EBITDA forecast was reduced to $46 to $51mm from $47 to $54 million because of a $4.3mm cost impact from the transition to the new DC. We can’t quantify the impact of the RFID implementation nor the backroom elimination. Therefore a normal adjusted EBITDA for 2013 baseline remains at $47 to $54 million on sales of $655mm for an EBITDA Margin of 7.8%.

In late 2013, the company was hit on two fronts. First, the distribution center going live proved to be harder than expected for the company. It just did not work as planned and as a result the company could not deliver merchandise to the stores on time. The result was lost sales and a negative delta impact of $13 million on EBITDA year-to-date 9/31/2013. The company cancelled its guidance for the rest of 2013 which stood at $46 million to $51 million as of Q2 2013.

In addition, the youth retail segment has been challenged recently which has dragged sales further down.

On December 13, the company filed a shelf for 50,000,000 common shares. To this date the company has not issued shares. On February 10, Sapna Maheswari published this interview of Charney that led us to lower our probability of a meaningful (>= $25 million) equity raise taking place.

On February 4, 2014 the stock plunged to $.85.

On February 20, some news outlets reported that some American Apparel’s creditors hired legal counsel to represent them in a restructuring of the company. It was also reported that American Apparel hired Skadden, Arps, Slate, Meagher & Flom LLP to represent them in such negotiation. Charney denied that report, saying in an interview that Skadden has been the company’s outside counsel for years and it’s a “mischaracterization that they have been engaged as a restructuring firm.” The firm is currently in a quiet period and it can’t say more than this. Skadden has been American Apparel legal firm for a long time. The 2012 shareholder meeting was held at Skadden offices in New York city.

On this news the stock plummeted to $.55. At this level, the stock was currently trading at two time normalized EBITDA. The market is according a high probability that the company will seek bankruptcy soon. We believe that the maximum leverage ratio (Adjusted EBITDA as denominator) of the credit line covenant is problematic at the moment. The company will be reporting 4th quarter 2013 results within a few weeks. We are therefore in the dark as to what the numbers look like for basically a five month period. As of 9/30/13, the leverage ratio was between 5.75x and 6.0x, and it is likely it will shake out in that range for the quarter ended 12/31/13. Unless EBITDA grows significantly in the current quarter ending 3/31/14, the leverage trigger will be a problem at the end of this quarter but we believe the company will get a waiver.

|

Period |

|

Ratio |

|

Closing Date through March 31, 2013 |

7.35 to 1.00 |

|

|

April 1, 2013 through June 30, 2013 |

6.50 to 1.00 |

|

|

July 1, 2013 through September 30, 2013 |

6.25 to 1.00 |

|

|

October 1, 2013 through December 31, 2013 |

6.00 to 1.00 |

|

|

January 1, 2014 through March 31, 2014 |

5.75 to 1.00 |

|

|

April 1, 2014 through June 30, 2014 |

5.50 to 1.00 |

|

|

July 1, 2014 through December 31, 2014 |

5.25 to 1.00 |

|

|

January 1, 2015 through March 31, 2015 |

5.00 to 1.00 |

|

|

April 1, 2015 through June 30, 2015 |

4.75 to 1.00 |

|

|

July 1, 2015 and thereafter |

4.50 to 1.00 |

The bond's covenant calls for no more than 4.5x leverage (debt - cash) / EBITDA. We believe the company failed to meet the covenant as of 12/31/13, the interest increased by 2% PIK. It goes without saying that there is much upside to reduce this burden once the business stabilizes.

Putting aside the credit issue for a moment…

American Apparel major strategic initiatives, which were highly disruptive in 2013, have been completed. While the operational risks still exist, we think a lot of the challenges of these integrations are now behind the company, yet the benefits of these initiatives and the reduced operational risk are not reflected in the current stock price. So if you look beyond the fog and include the benefits of these initiatives into your assessment of the business, the thesis becomes much more compelling now than it was in April 2011.

Here is why in detail:

Our baseline 2014 EBITDA Forecast stands at $57 million to $71 million for an EBITDA margin of 8.9%. Annual Interest Expense should come in at around $36 Million in cash. We believe Capex will come in at $17 million. This forecast assumes little sales growth over initial 2013 sales forecast and no benefit from increased sales resulting from the additional selling space at the store level.

How will American Apparel look in 2014 and beyond?

During this interview Dov Charney admits that the company is in a retrenching mode after experiencing the issues in 2013. Charney plans on polishing and fine tuning its operations in 2014. He does not expect as much growth for the next 1 to 2 years. We appreciate the fact that Charney admitted that he is his worst own enemy. We welcome the candor and we are convinced Charney remains a manic about engineering a differentiated apparel business model that will carry this brand forward for years to come. Most of the pieces are coming together.

Here we are in 2014 with American Apparel stock trading at $0.70 – basically a level 30% lower than our cost basis which we have accumulated since April 2011. But so much has been accomplished by the company in these last 2 years. If the company can manage its debt issue, we believe management would be in a great position to focus on fine tuning the model, connecting with its customers, experimenting and paying down debt.

Assuming a fully diluted share count of 160 million, the company could generate 38 cents of EBITDA per share in 2014. The stock is currently trading at 2 times this level. We believe this stock could trade at up to 10 times (boundary condition) this level in two to 3 years as investors gain conviction that the worst is over for the company. A while back I wrote a blog post about distressed apparel companies. In that post, I observed that when a recovery is realized, top brand apparel companies can trade up to 10x to 15x EBITDA.

We believe American Apparel is a top of the mind brand in its youth target market. This video provides a clue as to why we believe so.

During Sapna Maheshwari interview of Charney, he said:

Our 247 stores could be 20% more productive with the right tweaks, the online business could double, wholesale could grow by 20% to 30%. We could even develop a $100 million third-party retail business, selling items like American Apparel nail polish at drugstores or having hooded sweatshirt blowout sales at Costco.

Using this delta over the 2013 sales baseline, American Apparel could generate between $800 million to $900 million in sales in 2017.

At $800mm in sales and EBITDA margins reaching 15% to 20%, we could see the stock price reach $7.

We think that if the company raises a token amount under the shelf to help it through the seasonally slower first half of 2014, the fog will lift rapidly and investors will start focusing on the bright future ahead.

We also believe that given all the cash management can squeeze out of operation, the company will get a waiver on its credit line if it needs to.

Written by Michael Bigger with the help of Jennifer Galperin.

Many thanks to my friends who have provided feedback on this post.

Disclaimer: Bigger Capital, LLC, Bigger Capital Fund, LP, Bachelier, LLC and the Bigger family own more than 1 million shares in American Apparel. We intend to increase our position opportunistically.

American Apparel is a highly distressed situation and it is not suitable for the majority of investors. The likely outcome of an investment is a loss of principal. In other words, the probability of losing all your investment in this situation is very high.

We have been purchasing American Apparel since May of 2011 and we have nothing to show for it. Take our opinions with a grain of salt and do your homework.

Ocean Power Technologies, $OPTT, is a company that makes equipment to harness the power of the ocean's waves and turn them into electricity. Sounds like a great idea, because what I do know is that ocean waves are free and abundant.

What I don't know is how well $OPTT's devices work, their cost efficiency, durability, and the economics of the power generation on a $/kWh basis if you include the manufacture and installation. I have no clue about that. Sure, I have a degree in Engineering from MIT. I could spend the next 6 months learning about their technology, reading patents, talking to engineers, and get up to my elbows in calculus.

But why should I do that when a group of smart people at Lockeed Martin ($LMT) have already done the hard work for me? The fact is, I don't need to do any of that detailed research. I see that $LMT today announced a $200mm deal with $OPTT to build an ocean wave power generation station off the coast of Australia. $LMT is very familiar with $OPTT's technologies and capabilities; the two companies have been working together on smaller projects since 2004 and on this project specifically for about 18 months. If $LMT believes in the future of $OPTT's ocean power harnessing technology, then I know it is a good bet to jump on that ship.

What do you know?

Written by Jennifer Galperin. Follow me on Twitter and StockTwits.